🔮 Exponential View #549: Volatile markets; infinite compute; Kimi K2’s frontier leap; orbital computing++

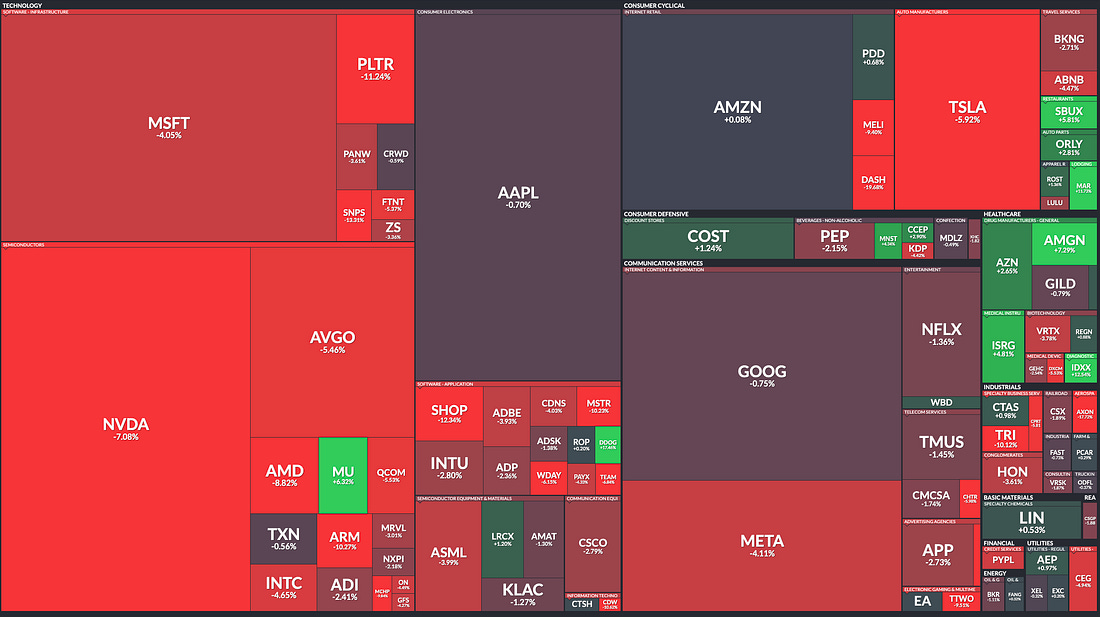

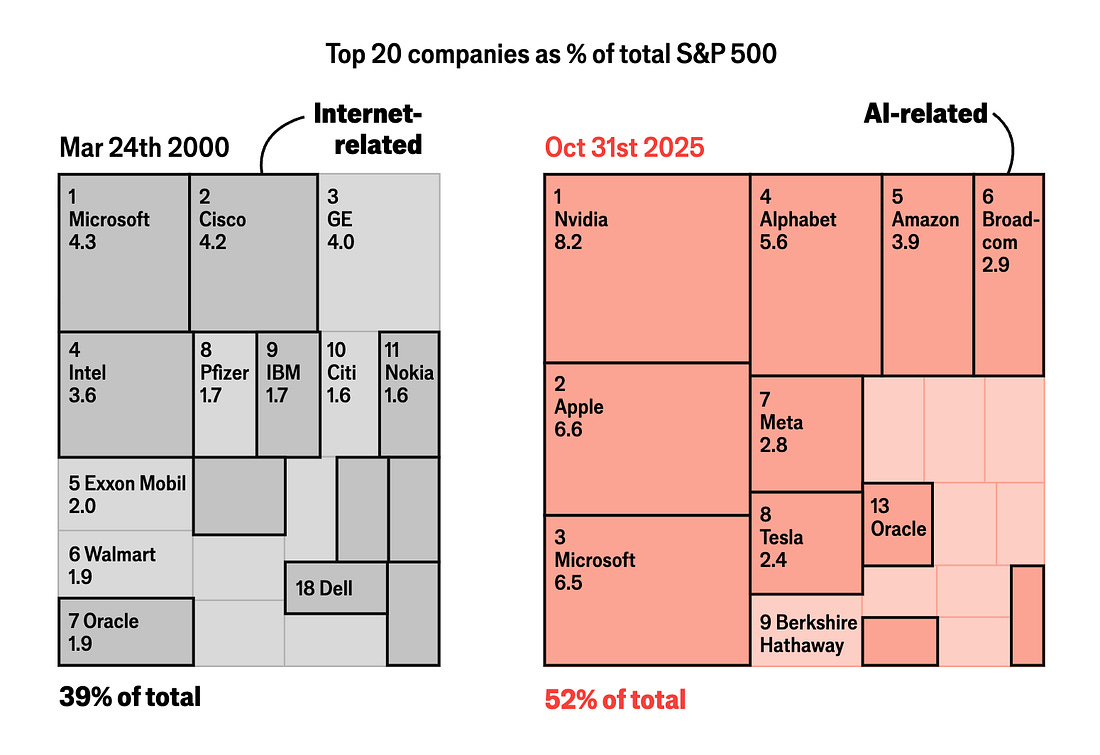

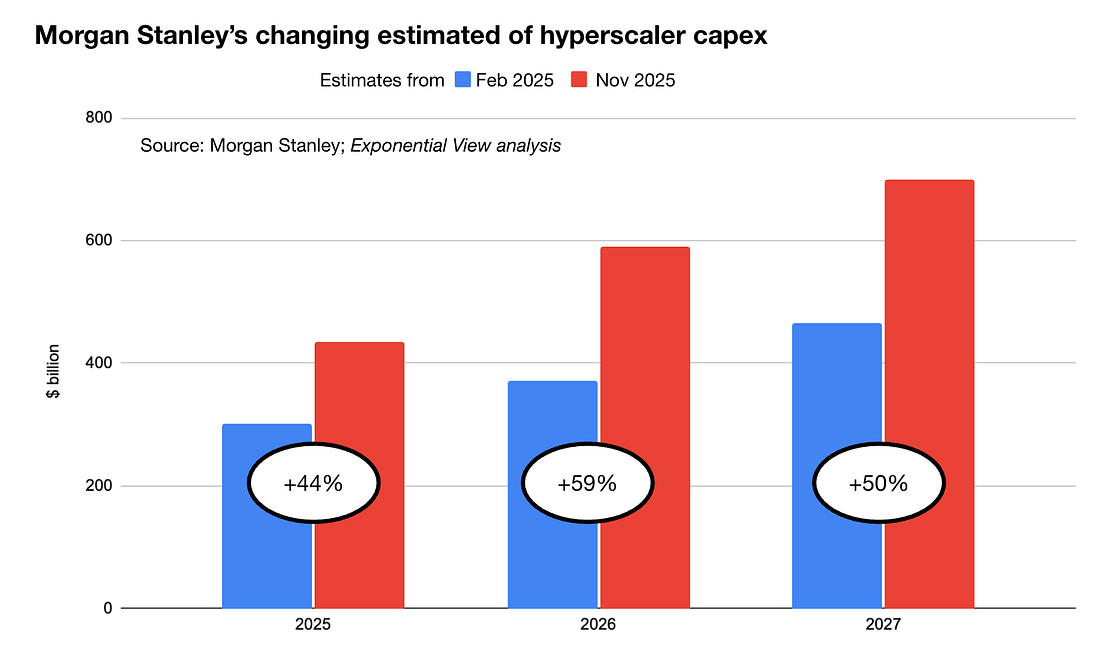

🔮 Exponential View #549: Volatile markets; infinite compute; Kimi K2’s frontier leap; orbital computing++A weekly briefing on AI and exponential technologiesGood morning from New York City! First, a couple of podcasts for your weekend. In my latest episode, I zoom out to explain why we’re not just in an “AI moment”, but at the start of an economy built on effectively infinite compute:  You can also catch me in conversation with a16z’s Ryan K. Rigney discussing the AI bubble question:  All-inBig Tech’s bond binge has topped $200 billion, the market is all-in. We have data center debt, private credit warehousing and AI-linked ETFs. OpenAI projects $100 billion in revenue by 2027—when we broke down the numbers, we were surprised to find out that this is not out of the question. The market remains on tenterhooks. When OpenAI’s Sarah Friar cackhandedly talked about government loan guarantees, it freaked the market out. Red was everywhere, and $800 billion knocked out tech stocks. It was the worst week since, wait for it, April 2025. It remains in line with typical volatility of growth stocks, or “move along” as Obi-Wan Kenobi instructed. Of course, how you read this depends on what you think AI is. If you believe that we are in the midst of a productivity boom, it’s a no-brainer. But if you think AI (specifically the LLM modality) is too unreliable to be useful, the risks simply shift to society and compound. The Financial Times’s Alphaville, generally sceptical commentators on AI, unwittingly points out that about a sixth of American firms are already seeing “material contribution to earnings from [AI] deployments.” It’s an absolutely remarkable achievement to reach this proportion within a couple of years into the cycle. If that 16% falls below 25% this time next year, AI is falling short of expectations. If it is much above 33%, it is more than proving its mettle.¹ Despite this, household equity exposure is at a record high and The Economist estimates that if AI tech valuations were to crack, there would be a 2.9% hit to GDP via consumption from wealth effects alone. The US economy leans heavily on AI. AI bubble watch – weekly update📈 Quick reading: A boom with some bubble flavoring. One of the five indicators is red, well within our boom range. What moved this week:

If you would like to receive our Boom or Bubble update emails separately, apply for early access here. If you prefer to sell on the news, don’t apply. Nothing in this or any other email I send should be considered financial or market advice. Kimi K2 is thinkingBack in July, we praised the release of the open-source Kimi K2 model from China as a milestone:

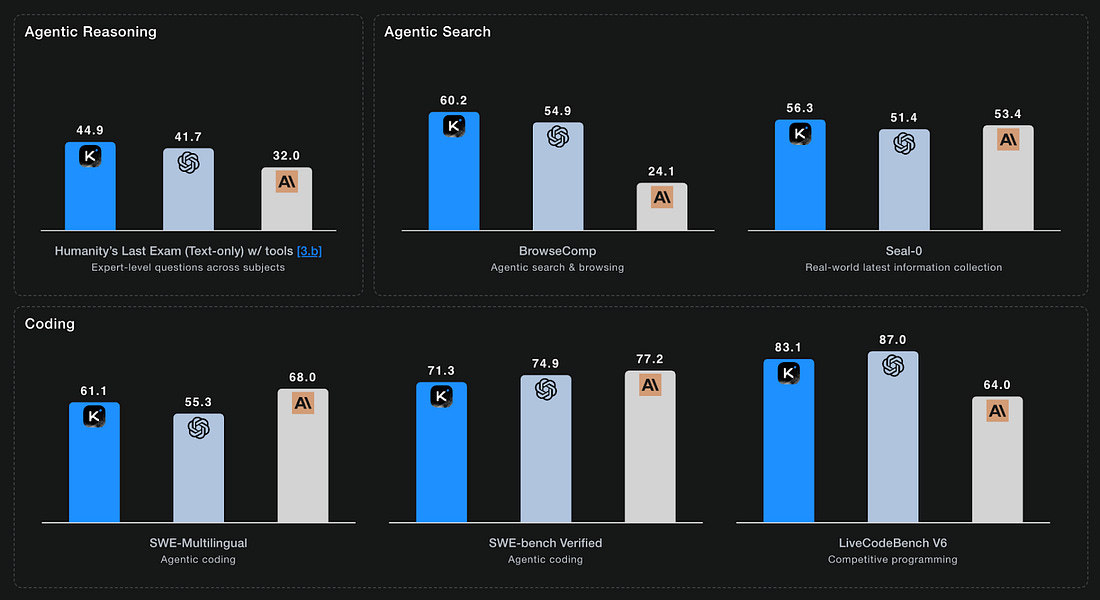

This week, Moonshot launched an open-source reasoning model Kimi K2 Thinking, which quickly showed as one of the best in the industry (with training costs estimated at around $4.6 million, a fraction of its rivals). Kimi K2 Thinking scored higher than GPT-5 and Claude Sonnet 4.5 on Humanity’s Last Exam benchmark. Its agentic search outperforms OpenAI and Anthropic’s best. Subscribe to Exponential View to unlock the rest.Become a paying subscriber of Exponential View to get access to this post and other subscriber-only content. A subscription gets you:

|

Similar newsletters

There are other similar shared emails that you might be interested in: