🔮 Sunday #520: New AI models; Is China catching up? Funding challenges ; empires++

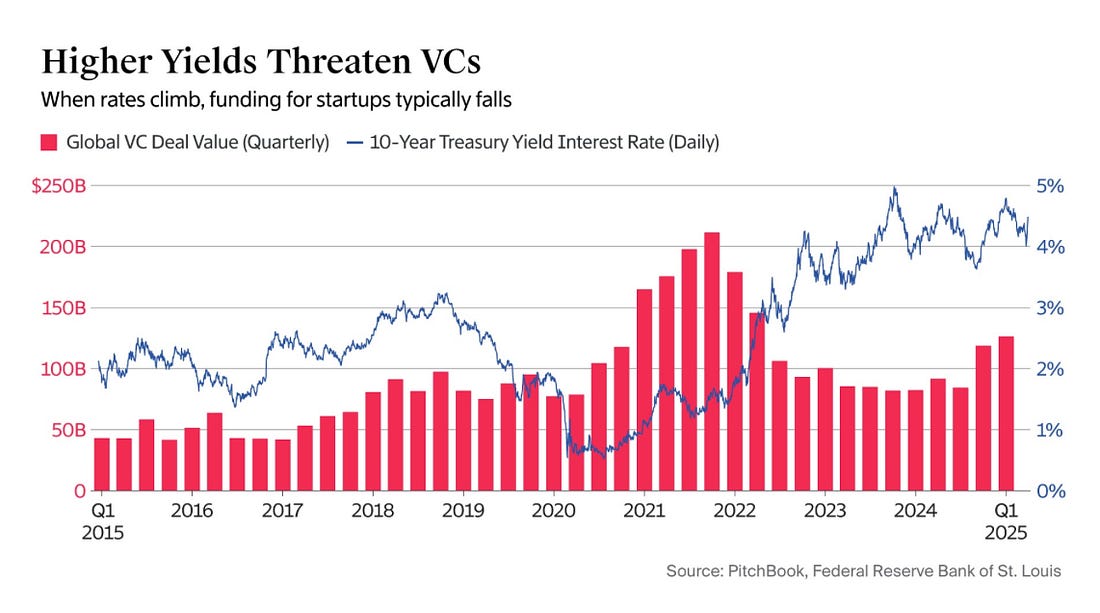

Hi, it’s Azeem with our weekend update this Easter weekend. Let’s dive in. AI accelerationMy thoughts on the array of AI model launches this week. Unintended consequencesThe US campaign to block China’s access to advanced silicon has yielded a paradox we’ve long discussed at Exponential View: the harder Washington pushes, the more resilient and ambitious Beijing becomes. In trying to freeze China out, the US is not just accelerating the development of a domestic Chinese chip ecosystem—it’s also pushing its own champions, like Nvidia, toward reluctant exits from critical growth markets. The latest turn: Washington is now blocking Nvidia’s “export‑compliant” H20 GPU, a move that could shave $5.5 billion off its quarterly revenue, and as much as $22 billion annually, according to analyst Ray Wang. Chinese firms are already rushing into the breach. Huawei’s new AI server, the CloudMatrix 384, is powered by the Huawei Ascend 910C chip. While Huawei’s chips lag those of Nvidia, the overall CloudMatrix system is competitive with Nvidia’s top tier GB200 system. The CloudMatrix is especially good with memory throughput, important for the inference workloads that will drive the AI economy. Where it lags Nvidia’s systems is in power efficiency, consuming roughly four times more. The Chinese electricity system, unlike America’s, has demonstrated it can scale with few constraints. As I argued back in December, “over time, this sheer capacity might help China close the A.I. gap or even overtake the United States.” The bedrock tremblesFor decades, US Treasuries were the safe haven of global finance, risk spiked, cash flowed in, yields fell. Last week, that broke. As tariff tensions rose, investors sold both stocks and Treasuries, driving the 10-year yield from 4% to 4.5% in days. When safe assets sell off with risk assets, the foundation of the capital stack starts to wobble. Startups feel it first. Cheap capital fuels innovation. When yields dropped to 0.65% during the pandemic, VC deals hit $211 billion. As yields climbed in 2022, that flow dried up. Q1’s $126 billion rebound looked promising, but another rate spike could stall it. Until Treasuries stabilize – or yields fall – investors will ration cash, favour quick returns and avoid moonshots. Echoes of empireWhen extraction goes too far, the state itself becomes unstable. At their peaks – Han China in 2 CE, Rome in 165 CE – inequality reached extreme levels. Income Gini coefficients hit 0.48 and 0.46 respectively. The top 1% took 26% and 19% of all income. But the most telling figure is the Inequality Extraction Ratio: ~69% in Rome, 80% in Han China. That’s dangerously close to the theoretical limit, where elites captured nearly all economic surplus and left systems brittle and exposed to shock. The researchers argue that Han’s extreme level of extraction likely fostered political instability and contributed to the crisis and reduced resilience observed shortly after 2 CE. In contrast, Rome’s comparatively lower (though still substantial) extraction coincided with a period of relative stability at 165 CE. Modern societies are wealthier and direct comparisons are complex. But warning signs are there. The 2023 US Gini stands at 0.485. Brazil’s 2022 figure hit 0.52. Yet the historical trigger wasn’t just inequality, but elites extracting nearly all available surplus — perhaps today’s massive ‘pie’ means even high extraction doesn’t automatically equal state crisis. Elsewhere:

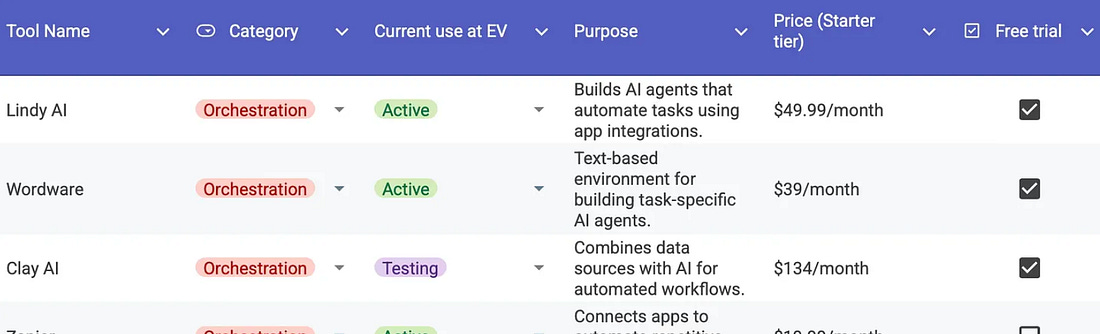

EV’s AI tool stackThis past week, we shared with you the seven key lessons we’ve learnt so far while building with AI. We also shared our internal tool stack—currently, 40+ systems we’re using, testing, or watching closely—which is available to members of Exponential View.

Thanks for reading! Azeem |

Similar newsletters

There are other similar shared emails that you might be interested in: