👀 Did OpenAI’s $100 billion path just get narrower?

👀 Did OpenAI’s $100 billion path just get narrower?Sam Altman’s internal pivot tells us something important about the AI market right nowIn February 2023, when ChatGPT had just hit 100 million users and launched its $20 premium tier, I ran the numbers on revenue potential. My napkin math pointed to monthly revenues of at least $60 million by year-end. Readers thought I was optimistic. OpenAI closed 2023 at $1.6 billion in annualized revenue and then tripled it the following year. A month ago, I asked whether they could reach $100 billion in full year revenues by 2027. The math showed a plausible route: layered subscription momentum, enterprise API growth, international expansion, advertising and agentic systems. I concluded:

Sam Altman’s declaration of a “code red” makes that ‘barely possible’ even more unlikely. OpenAI remains the fastest-growing technology company in history, with revenues approaching $13 billion this year and 800 million weekly active users. But now Google, Anthropic and DeepSeek are pressuring OpenAI to choose between defending its core product and pursuing new revenue streams. Altman seems to have chosen defense. That decision makes sense for product integrity. It also suggests the firm will delay several revenue streams underpinning our $100 billion scenario. In our previous work, we showed you a scenario. The latest news changes our assumptions – here is a live update. Retreating to defendThe Information reported that Altman declared a ‘code red,’ telling staff: “We are at a critical time for ChatGPT.” Google’s AI resurgence, he warned, could bring ‘temporary economic headwinds.’ Altman redirected engineering toward five priorities: personalization, image generation, model behavior, speed, and reliability. Advertising, AI agents and Pulse – automatic-feed experiment – now take a lower priority. The concern is that running ads while users doubt ChatGPT’s edge would push them toward good enough rivals (see my analysis of how Google came to own “good enough”). And “good enough” may understate the threat – on several benchmarks, Google and Anthropic’s models already outperform. Gemini 3 Pro and Claude 4.5 have started to eat more and more into my AI conversations. ChatGPT is still dominant, but less than it was just three weeks ago. ChatGPT does retrain those queries where years of conversational history have made its context indispensable, a narrowing niche built on accumulated exchanges I can’t yet abandon. I genuinely admired ChatGPT Pulse; its premise was exactly what I needed: telling ChatGPT my tracking priorities, receiving nightly intelligence briefs tailored to those domains, with offers to drill deeper. Yet execution stumbled on fundamentals and it didn’t hold me. After several weeks, the experience became monotonous and small friction points were a dealbreaker. But its fatal flaw was that Pulse has no sense of time. It recycled stale findings day after day, like a news feed for amnesiacs. I no longer open it regularly. Meanwhile, our API and programmatic workflows rarely relied on OpenAI’s offering anyway. Gemini 2.5 Flash handles bulk processing. Claude’s API powers judgment calls: editing passes, analysis and code, although Gemini’s 3 Pro model is coming increasingly handy. I doubt I’m an outlier. Last quarter’s numbers show my shift mirrors a broader migration across three competitive fronts:

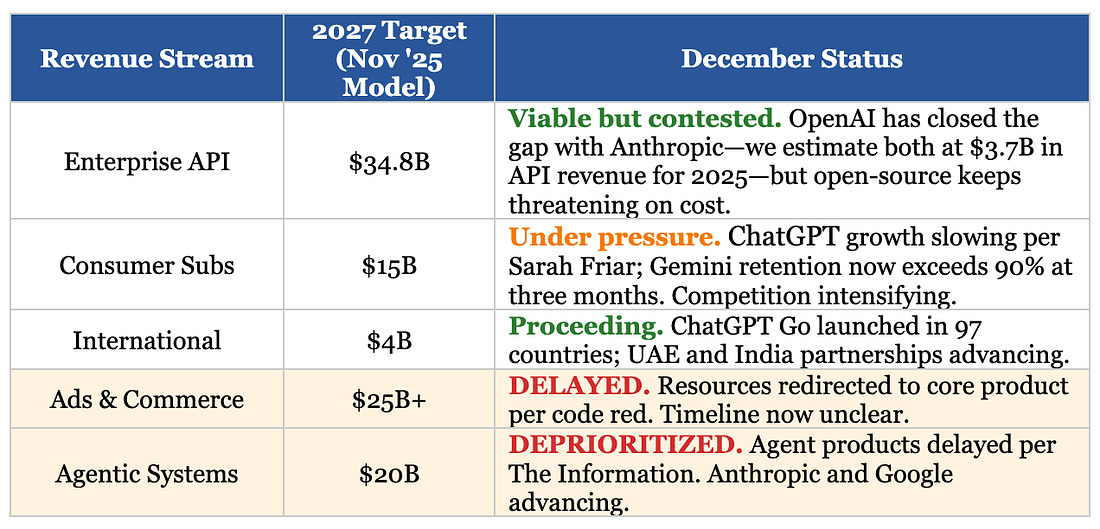

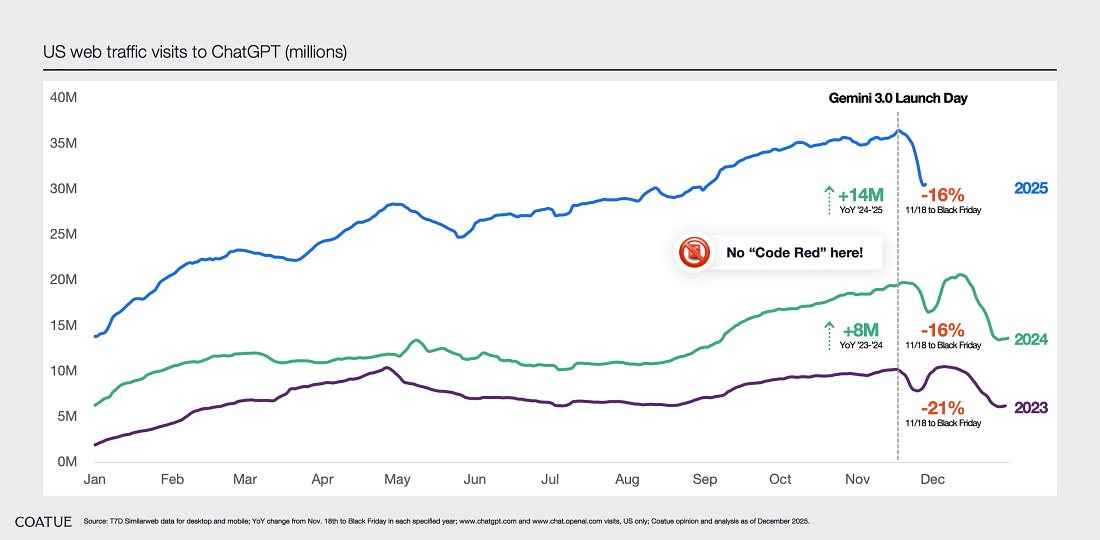

Facing stiffer competition on both enterprise and consumer sides, OpenAI has made a trade-off to delay expansion into ads and agentic systems to protect the core products under siege. Does $100 billion still hold?Last month, I projected five revenue streams that could combine to reach $100 billion by 2027. This month’s code red announcement forces us to reassess each one: Remove or halve the ad and agent revenue, and the math shifts. Our earlier scenario totaled $100 billion across five streams. Without ads and agents firing on schedule, what does that ceiling fall to? Perhaps $55-60 billion by 2027. That remains extraordinary growth by any historical standard. It is not, however, $100 billion. Of course, there is an astonishing paucity of information in this market right now. Is the “code red” just an internal kick in the pants to an already overworked AI team? Is the decline in ChatGPT’s usage actually linked to the launch of Gemini? Or are we just seeing a typical seasonality? ChatGPT’s traffic has traditionally dipped around Black Friday, according to Coatue, an investor in both Anthropic and OpenAI. If history is any guide, usage could pick up again in two to three weeks, and we’ll update our models once more. OpenAI has rallied beforeOpenAI has rallied before – after Claude 3, after Gemini 1.5’s million-token context window, after DeepSeek’s efficiency leap. Each time, it answered. But now all three forces are surging at once. OpenAI is already mounting its response. Chief research officer Mark Chen hinted at a model codenamed Garlic:

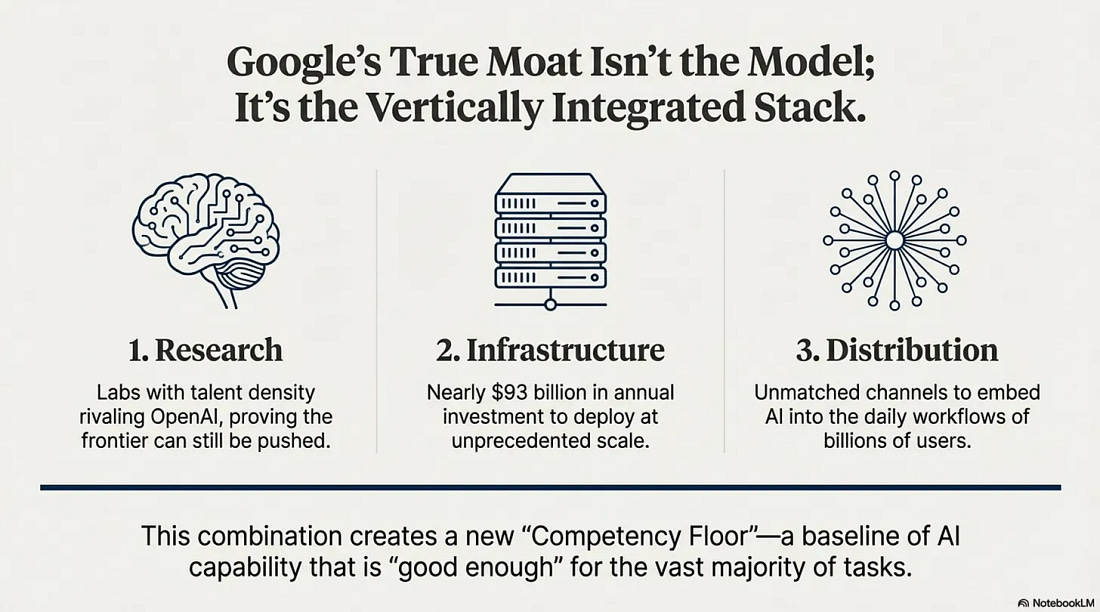

The upshot, he explained, was that OpenAI can now pack the same level of knowledge into a smaller model that previously required a much larger one. Smaller means faster to train, cheaper to serve and quicker to iterate, exactly the advantages you need when the incumbent is cutting prices and moving the goalposts. But it would take a lot to undercut Google. The incumbent has woken up and is pulling everything into its gravity well. Its vertical integration allows it to better control inference and training costs; its deep balance sheet is fed by the $300 billion cash spigot that is its ad business. The search giant could cut prices longer than most rivals can bear. When escaping an object as massive as Google, you need to find an angle, one that really distinguishes you from the competition, that is perhaps orthogonal to their gravitational field. Again, I go into detail on this in my analysis of Google. I’m wondering whether OpenAI’s broad approach still makes sense – or if it needs a sharper differentiation from Google. There are some signals emerging: the firm recently signed a deal with LSEG, a financial information group that includes the London Stock Exchange and Refinitiv’s market data business. This puts professional-level financial data directly into the ChatGPT workflow, particularly for LSEG’s existing customers. Deals with airlines like Emirates and Virgin Australia might presage deeper integration of ChatGPT into both inward-facing operations and, ultimately, the consumer-passenger experience. These tactics might yield the right kind of differentiation that would deepen user engagement and, with it, greater opportunities to monetize. Will this be enough to turn off the “code red” and put the company in a shouting chance of the $100 billion scenario for 2027? We’ll have a clear answer soon enough. I await Garlic with bad (bated) breath. |

Similar newsletters

There are other similar shared emails that you might be interested in: