Play It Cool: Chasing Heat vs. Being Contrarian in Venture Capital

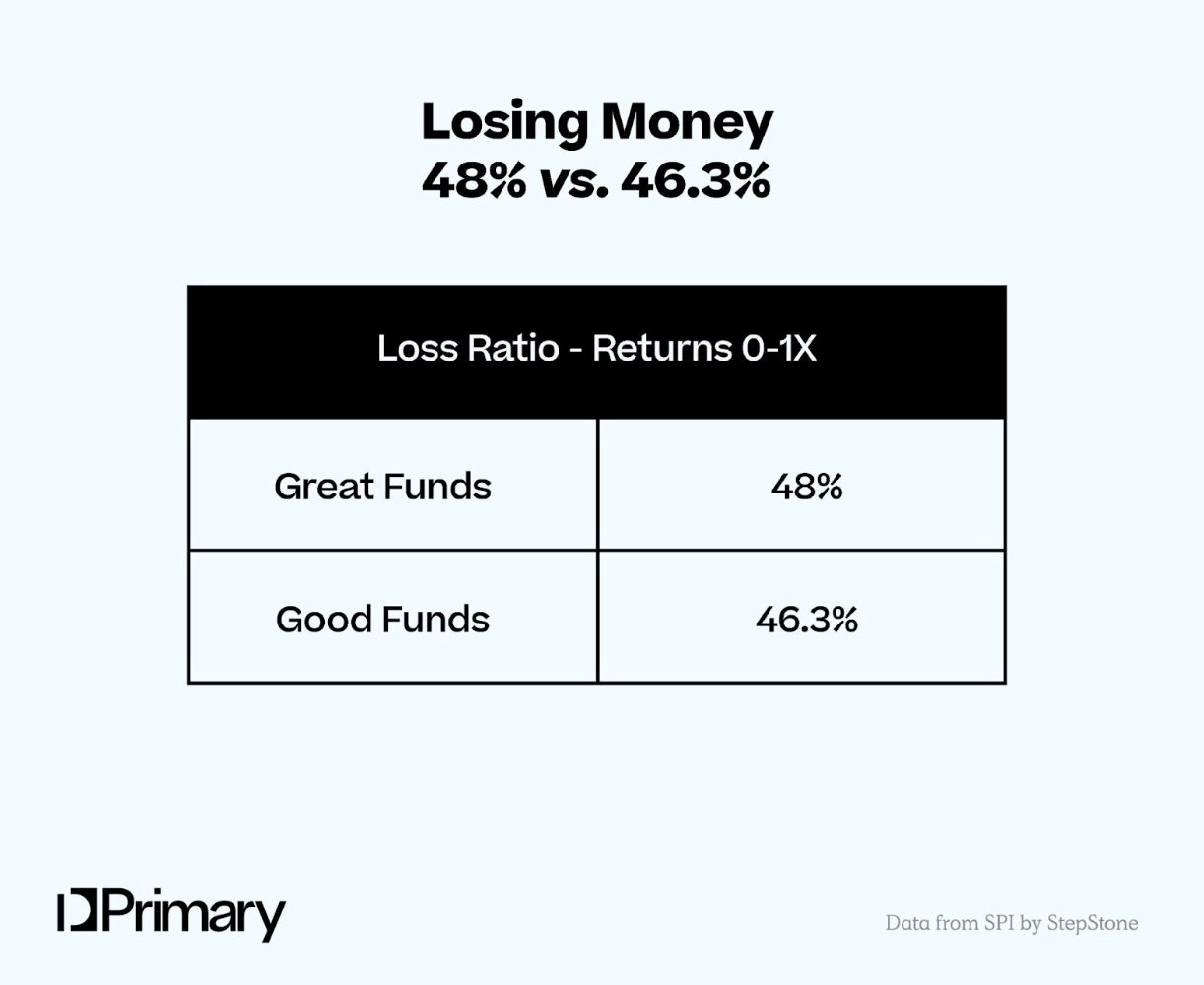

Play It Cool: Chasing Heat vs. Being Contrarian in Venture CapitalWhich categories aren't "hot" today, but are worth our time and investment?Weekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities. If you haven’t subscribed, join 65,000+ weekly readers by subscribing here: Play It Cool: Chasing Heat vs. Being Contrarian in Venture CapitalWe hear often that venture capital is built on being contrarian. After all, venture is predicated on the power law: a small number of investments will drive most of the returns. This is a business of outliers. StepStone and Primary crunched the numbers and found that both “good” and “great” performing funds have loss ratios around 50%. In other words, every 1 in 2 investments will return less than 1x.

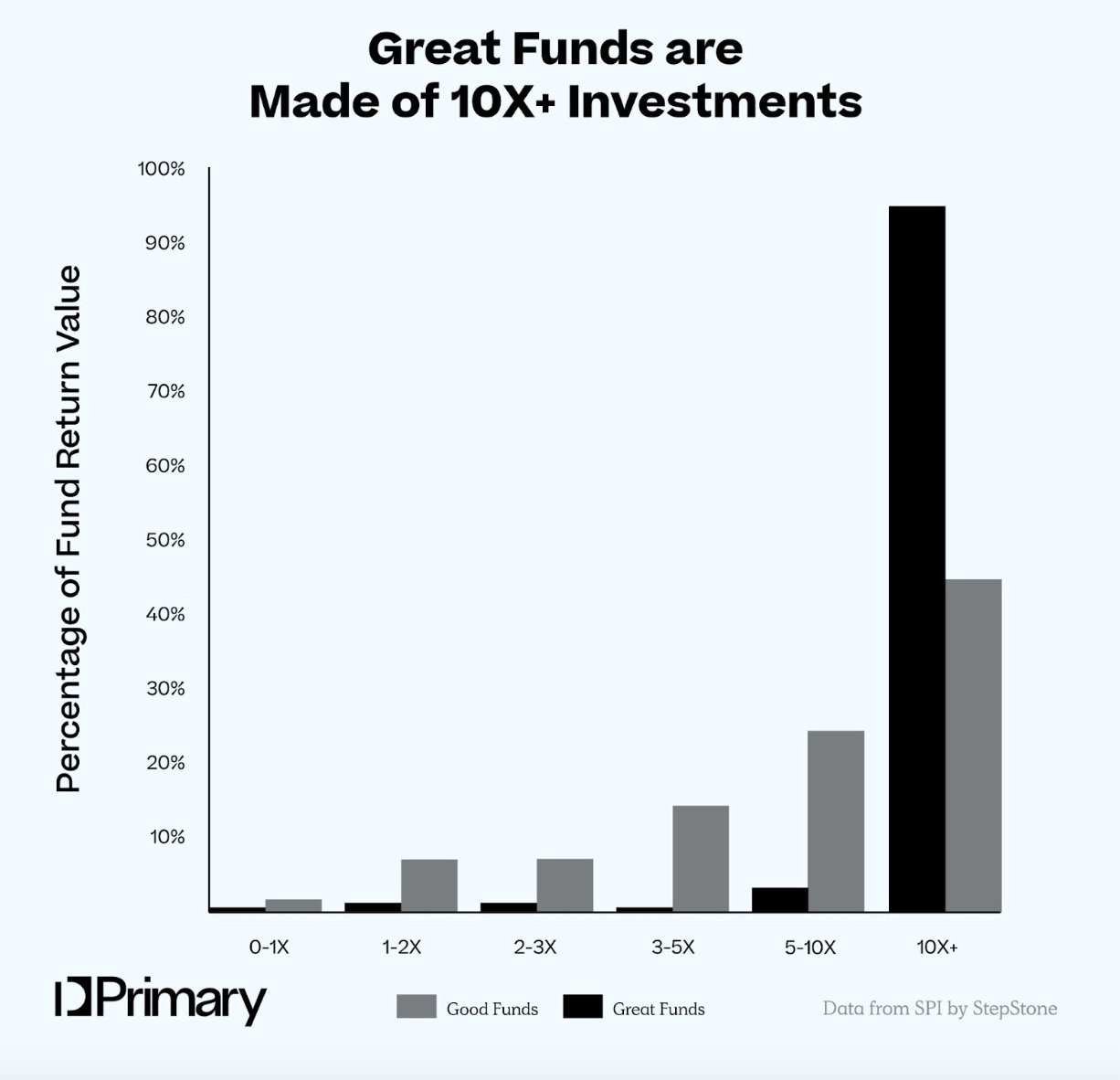

If you’re wrong half the time, you’d better be really right when you are right. And the data proves that out: “great” funds get 90%+ of their returns from 10x+ investments—big home runs.

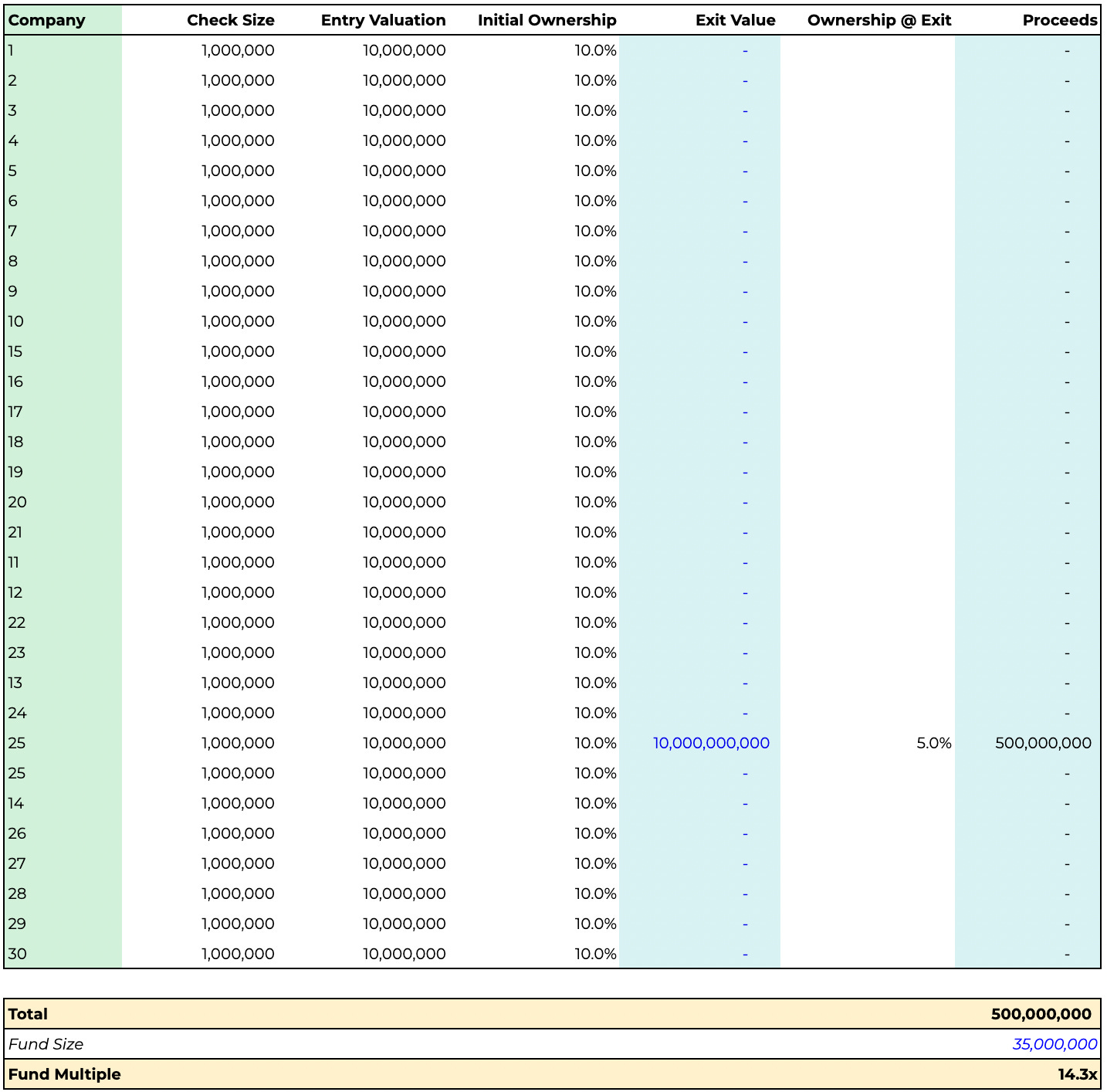

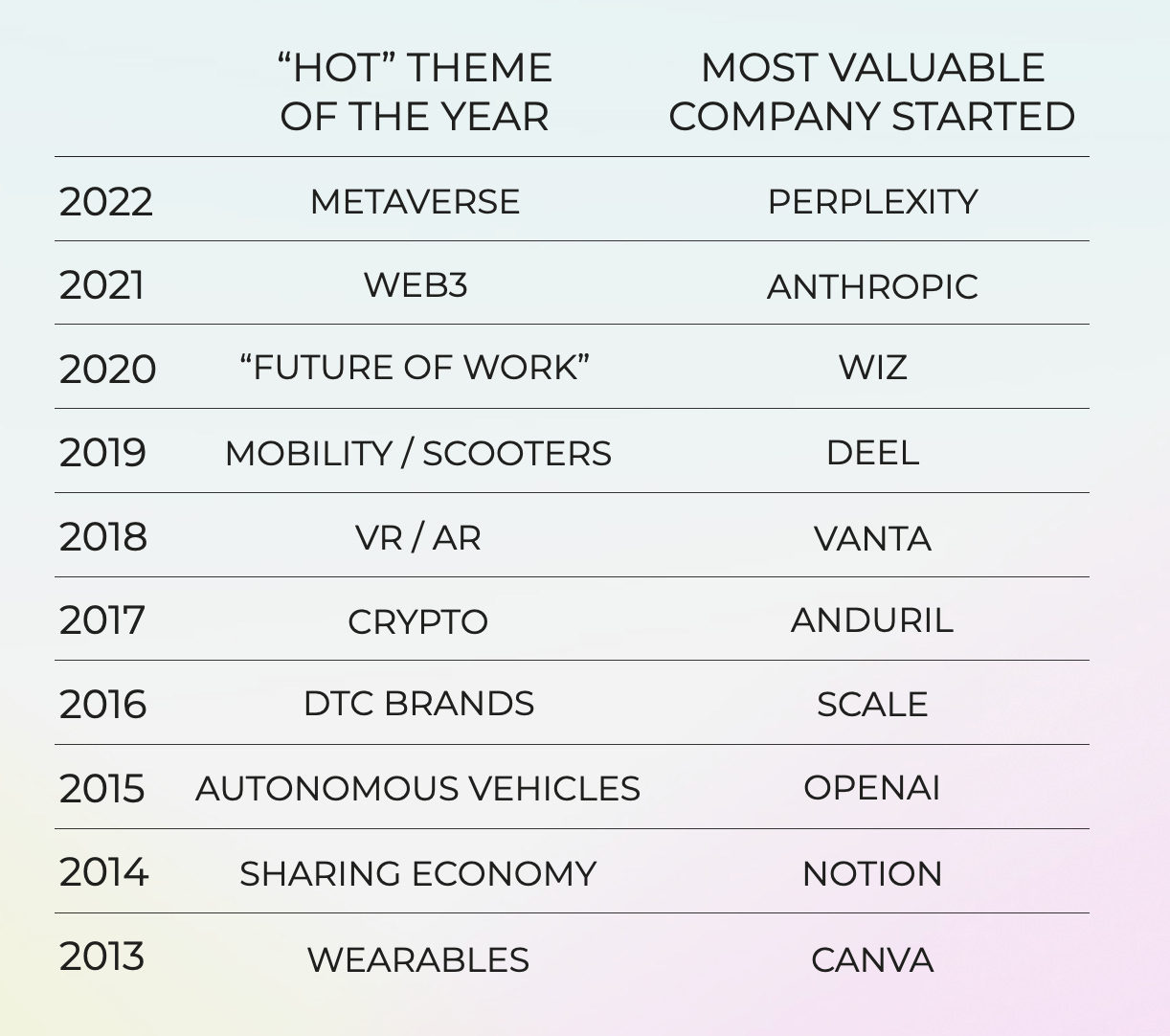

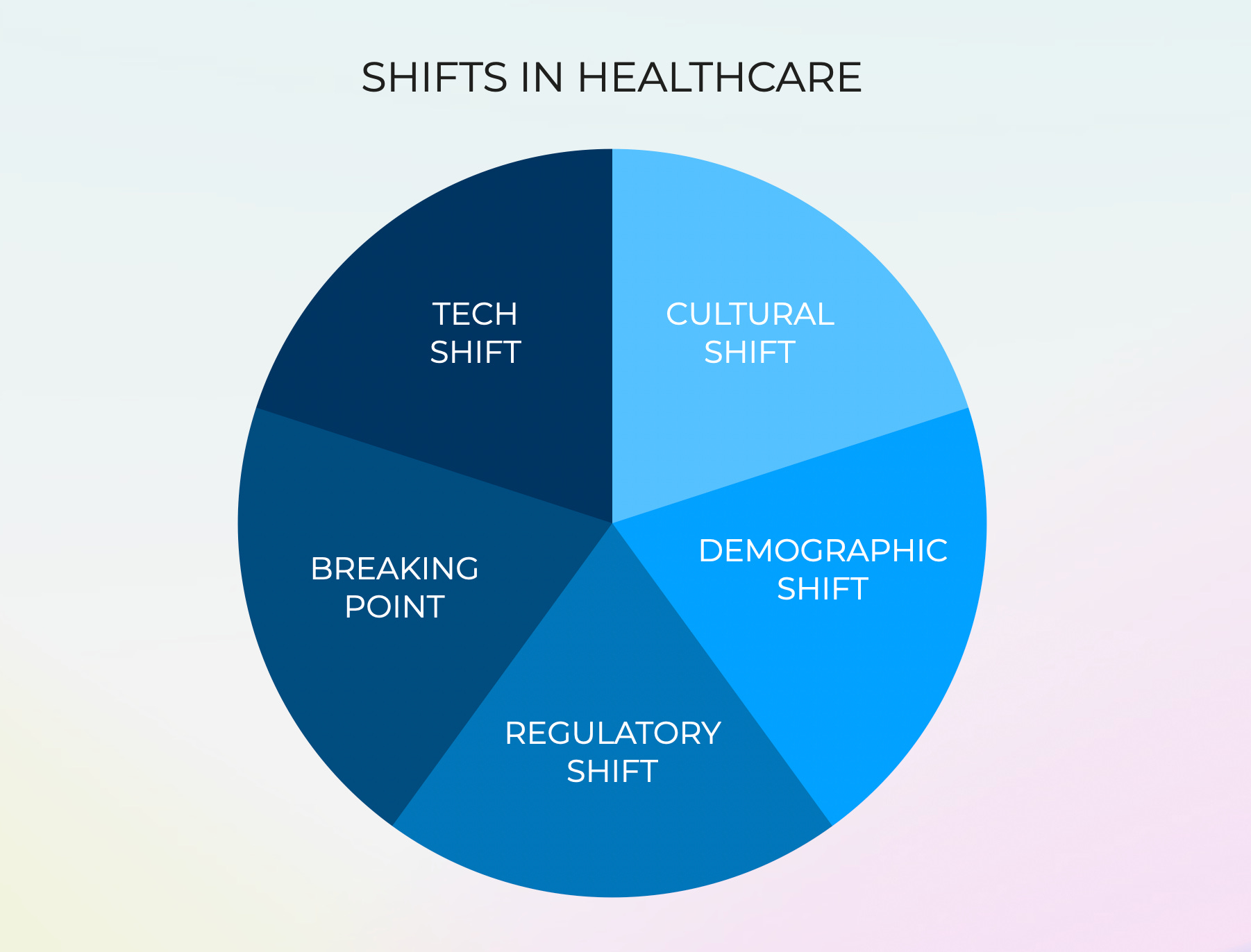

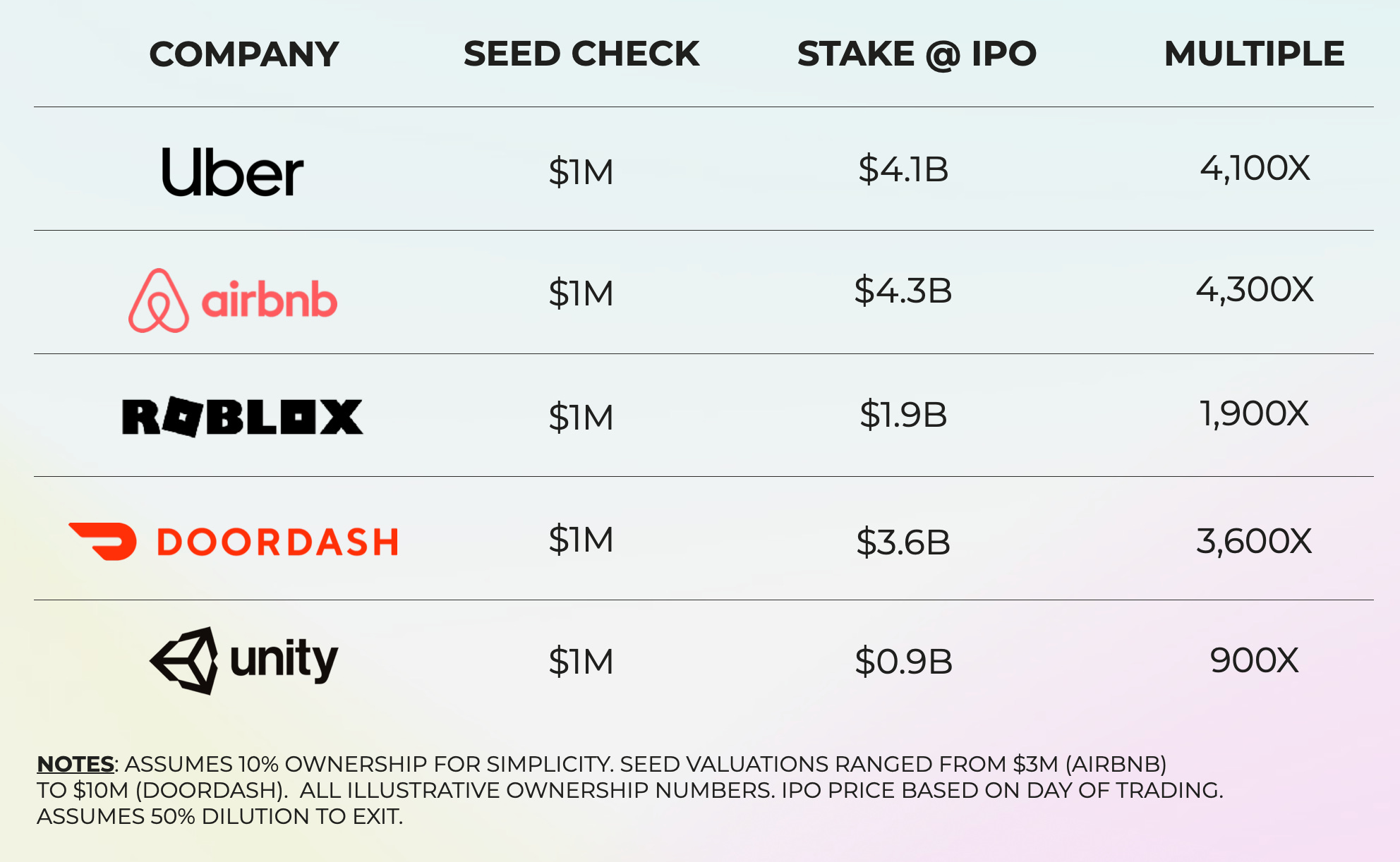

Spring’s Daybreak: Building a Venture Capital Firm went into more detail on sample portfolios. What if a Pre-Seed / Seed fund like Daybreak has a portfolio of, say, 30 companies? Of the 30 companies, 29 return zero, but one company becomes the next Figma or Snap or Roblox or Unity. In that case, this one winner powers a 14.3x fund. A $35M fund turns into $500M. This is oversimplified, of course, but it gets the point across. A good way to have a power law outcome: be contrarian and be right. Fund returning outcomes are often crazy, innovative, disruptive ideas. If you’re following the herd, it’s tough to find true outliers. Everything devolves into incrementalism. What’s more, when you’re chasing heat, companies are often over-priced and thus compress your ownership and returns. It’s easy to talk about being contrarian, but it helps to visualize it. At an event with my friends at Founder Collective earlier this month, we talked about venture’s constant hype cycles vs. which successful companies were actually started in each year. The two rarely match up. Here’s a rough visualization, created through my crude research and approximations: Not all of this is exact. The themes stem from my research and memory, and the companies stem from what I could find on PitchBook and Crunchbase. But it’s directionally right, and it gets the point across: the biggest companies were often not the hot Seed round or flavor of the month. A good time to be investing in AI would’ve been a few years back, when the foundation model and infra layers were taking shape. See: OpenAI, Scale, Anthropic above. (The application layer, though, has a lag effect, so now may be the right time.) When everyone was talking about “The Future of Work” in 2020, meanwhile, it would’ve helped to invest in Canva and Notion five years prior. And defense tech is all the rage now, but most people were focused on crypto and DTC brands when Anduril was being born back in 2017. And so on and so on. Keeping this in mind, where should we spend time today? A good question to ask is: what will be the hot theme in three, four, five, years—a theme that few people are looking at today? A few possibilities I see: HealthcareA lot of VCs have scar tissue in healthcare, and in consumer health especially. The outcomes haven’t been great. But past performance isn’t always predictive of future performance, and there’s reason to believe healthcare has a compelling “why now.” We outlined some of the reasons in last month’s aptly-named The “Why Now” for Healthcare, digging into five big shifts that are currently coinciding. I wouldn’t be surprised if health is the “hot theme of the year” in 2025, or 2026, or 2027. That means the time to be building and investing at Pre-Seed and Seed is probably right now. Consumer“Consumer” is also something of a bad word in some venture circles. We see this reflected in the early-stage markets: recent data from Carta showed that just 7.1% of Seed capital raised last year went to consumer startups. That’s less than half the share from 2019 (14.3%). But consumer’s fallow period doesn’t make much sense—we’re only a few years removed from blockbuster consumer IPOs. Here’s how much a $1M investment in the Seed round of five recent IPOs would yield: Not bad. Summer’s The Consumer Renaissance made the argument that VCs shouldn’t be overlooking consumer founders. Last month’s The Second $100B AI Company furthered that point, arguing that the next $100B outcome in AI (after OpenAI) is most likely to be a consumer application—probably one in commerce, online video, or gaming. In my opinion, consumer startups tend to be more “incrementalist” in the latter years of a technology wave—say, a decade into mobile or internet. But during the onset of a new era—hint: where we are today with AI—consumer is a very interesting place to spend time. EducationEducation has also historically been “okay,” not great for tech startups. Most edtech startups run into the buzzsaws of lethargic school systems and thin budgets. (Notable exceptions include companies like Duolingo, which now boasts $14.5B (!) market cap.) There’s reason to think now is different. In July’s How AI Will Change Education, we argued that AI is really good at the thing that’s most important in education—personalization. What’s more, AI is automating and augmenting expensive, human-centric services (this is the “service-as-a-software” theme discussed in AI Is a Services Revolution) and education is a prime example of such a service. Venture capital is often about taking fresh eyes to a stale category. Pattern recognition can actually be a bad thing: experienced VCs might have scar tissue in a space and thus miss out on new innovation or a new “why now.” Education seems like a contender for such a moment. What Else?If we look even more specifically, what areas are interesting?

I’m curious what I’m missing—what other areas might be “hot” in a few years but are under-the-radar today? One of my favorite quotes in startups is: “Being early and being wrong often feel the same.” A lot of the categories above are early, but I don’t think they’re wrong. Shoot me a note with which themes you think will be frothy in 2025, 2026, 2027, and beyond. Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: |

Similar newsletters

There are other similar shared emails that you might be interested in: