Dealflow.es #459: Factorial gets $120M. Playtomic raised €65M. Adara's new fund.

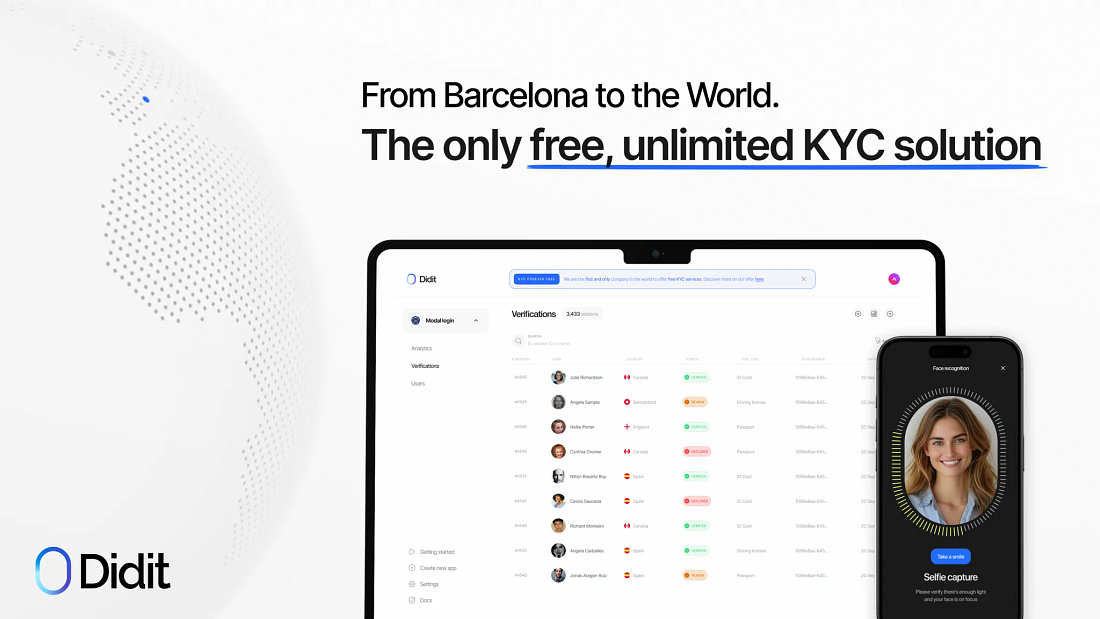

Dealflow.es #459: Factorial gets $120M. Playtomic raised €65M. Adara's new fund.A weekly summary of everything that happened in the Spanish startup and tech investing ecosystem.This week, we’d like to open the newsletter by sharing something close to home. At Kfund, we believe that investing in early-stage companies means more than analyzing financials or market trends — it’s about deeply understanding the technology that powers the companies we back. That’s why we’re proud to be one of the few funds in Spain with a dedicated CTO, Juanjo Mostazo, who plays a key role in our investment process. His latest blog post offers a behind-the-scenes look at how we approach technical due diligence (TDD) and why it’s such a critical part of our decision-making. Unlike many funds that treat technical assessment as a formality or outsource it altogether, we view TDD as a collaborative process between our team and the founding engineers. Our goal is not to act as auditors but as partners who can help technical founders navigate both the challenges and opportunities that come with scaling technology. We evaluate factors like code quality, team structure, product architecture, and technical debt, always with a founder-friendly approach that focuses on improvement rather than judgment. Juanjo’s post also touches on how we adapt the depth of our TDD to the stage of the startup — focusing on agility and adaptability at pre-seed and seed stages, while paying closer attention to aspects like security, scalability, and documentation in later rounds. Importantly, the way we approach TDD allows us to better understand product and technical risks early on, which in turn strengthens our conviction when we invest. We encourage you to check out the full article — and if you’re a technical founder building something ambitious, we’d love to hear from you. For Dealflow sponsorship opportunities, email me at jaime@dealflow.es. I only have 4 slots available for the rest of the year, the first one being December 1st We also have Dealflow France 🇫🇷 and Dealflow LatAm to follow startup and VC news in each ecosystem. Subscribe if you’re interested! This week’s newsletter is brought to you by Didit:

Startup funding news 💸€50M to €100M` financings:

€10M to €20M+:

€1M to €10M:

Other rounds of funding: Ovianta (€540k), Carina AI (€500k) M&A 🎉Deporvillage, owned by JD Sports, has seen stagnating sales and a 65% drop in net profit over the past three years. The company’s revenue peaked at €160M in 2021, but profitability has since eroded. Former CEO and co-founder Xavier Pladellorens published a rant about the difficult relationship between acquirers and acquired companies, focusing on what he believes is mismanagement from JD Sports that has led to the current status of Deporvillage Indra acquired Málaga-based Clue Tech for €39.8M to strengthen its defense and aerospace business. Clue Tech, specialized in electronic systems for aircraft, works on projects with Airbus, Navantia, and Indra itself Vocento sold Pisos.com to Italian group Immobiliare.it for €22.5M US cybersecurity firm Lumu acquired Maltiverse, a Spanish startup specialized in threat intelligence Luis Pareras, managing partner of Spanish fund Invivo Ventures, shared that only 16 months after their first investment in EsoBiotech, a French cancer therapy company, the company has been acquired by Astrazeneca for up to €1B Boopos, the Spanish fintech focused on providing acquisition financing to entrepreneurs, has been acquired by US-based Founderpath. Boopos is a Kfund portfolio company LTP, a major Asia-based institutional crypto broker, acquired Spanish crypto brokerage Turing Capital Brokerage (TCB) Investor & accelerator news 🚀Adara Ventures has completed the first close of its AV4 fund at €75M, reaching 75% of its €100M target. The fund will focus on seed-stage investments in cybersecurity, AI, healthtech, hardware, and space tech. Backers include BBVA, EIF, CDTI, Cofides, and several family offices Enzo Ventures is preparing a second fund targeting €30M-€40M to invest in early-stage startups in Southern Europe. The firm focuses on pre-seed deals Two analysis of investment activity from corporates:

Startup news 💡Company financials:

New startups and products/features:

Startup profiles:

Lists:

Other news: Urbanitae closed its first hotel financing deal, raising €5M for the Occidental Roca Negra hotel in Gran Canaria. The transaction marks Urbanitae’s debut in the hospitality sector The Bank of Spain authorized German neobank Trade Republic to operate as a local branch and offer Spanish IBAN current accounts Big company & policy news 🤓Santander is bolstering its leadership team with a wave of tech-focused hires from firms like PayPal, Amazon, BBVA, and Stripe to accelerate its digital transformation. The bank has recruited over 10 executives in a year, including Nitin Prabhu (ex-PayPal) to lead its global Digital Consumer Bank, Ricardo Martín Manjón (ex-BBVA) as Chief Data & AI Officer, and Swati Bhatia (ex-Marcus, Stripe) for its US retail banking Booking CEO Glenn Fogel reaffirmed the company’s commitment to Spain despite the CNMC’s €413M fine, which has been temporarily suspended by Spain’s Audiencia Nacional. Fogel criticized the ruling and called for clearer regulations that foster innovation Telefónica Brasil (Vivo) acquired i2GO, a leading Brazilian smartphone accessories brand, for up to BRL 80M (€13M) Interesting reads 🤓Oscar Martinez, who writes Built in Europe, published an analysis of “CitizenX: Citizenship By Investment” Ignacio Arriaga published “En el SaaS no siempre gana el que más puede invertir”. Thread with more info here Toni Perez, co-founder of Harmonix (previously Bloobirds), wrote about his experience raising funding and the pros and cons of having VCs in your cap table. More here and here Good thread from Eduardo Manchon about how treating entrepreneurs well can lead to bigger outcomes Jesús Monleón (4Founders Capital, GoTrendier) sharerd a reflection on a founder who delayed Social Security payments, sparking a debate about survival tactics in startups. Some, like Pablo Grueso (sold TecnoFor to Sngular), argue that using SS or tax deferrals is a valid short-term financing move that helped them survive and even exit successfully. Others, like David Bonilla (Petalo), warn of severe personal and legal risks if mishandled |

Similar newsletters

There are other similar shared emails that you might be interested in: