This Week in Turing Post: | Wednesday / AI 101 series: What is Mixture-of-Recursions? Friday / Interview with Lin Qiao, co-founder and CEO at Fireworks

| | ⭐️ We Recommend: Expert guide on AI evaluations | | How are you evaluating your AI outputs? Learn how the experts quickly and accurately evaluate AI using LLM judges! Enjoy 70 pages of content on: | How to automate evaluations to score, explain, and flag quality issues Advanced techniques like token-level scoring, Chain-of-Thought, and pairwise comparison Practical frameworks and code examples for building your own LLM judges

| | | Main topic: Without AI, US Capex Would Be in a Slump | Imagine standing at the edge of a prairie. You hear nothing at first, only wind in the grass. Then a low hum builds in the distance. It isn’t thunder or insects. It’s the sound of server farms rising from the soil – vast, windowless habitats for silicon creatures. And in the quiet language of GDP statistics, they are the ones keeping the American economy alive. bzzzzz…. | How so? The Counterfactual Economy | The U.S. economy staged a comeback in Q2: +3.0% growth after a dreary –0.5% in Q1, according to BEA. Headlines called it resilience, soft landing, proof of American dynamism. Except, of course, there is a nuance. | Because if you squint at the data – and then peel back the AI spending – you see an economy on a treadmill: walking with the help of AI, but not really getting very far. | Q1’s –0.5% growth is already a bad look. But Apollo’s Torsten Sløk points out that data-center construction alone added about a full percentage point. Remove it, and you’re staring at –1.5%. | Q2 looks so much healthier at +3.0%, or you would think so. Pantheon Macroeconomics sums up the first half of 2025 with some more sobriety: AI alone contributed about half a percentage point of GDP. Without it, the U.S. would be bumbling along at 1% growth. Still better than minus, but thin grass all the same. | One more stat for the better view: since 2019, investment in AI-sensitive sectors is up 53%, while everywhere else is basically flat – 0.3%. | | And look at this chart: | | That means the U.S. economy’s biggest driver right now isn’t households opening their wallets – it’s data centers. Since we live in the AI world here, it might sound like a validation. But it is not that good really. A healthy AI economy still needs consumers and businesses adopting the tools – not just building the infrastructure. | And the demand signal comes from the apex predators of this ecosystem: the labs. It is no exaggeration to say that a dozen training runs per year are now steering national investment. | | And on the ground, the buildout continues at breakneck speed at this moment → Foxconn and SoftBank are teaming up to produce data center equipment in Ohio, repurposing a former EV factory for the high-stakes Stargate project – a $500 billion AI mega-venture with OpenAI and Oracle. With Trump’s backing and urgency in the air, Ohio's steel mills might not be coming back, but AI racks sure are. If you are a human constructor, we recommend to move to Ohio. | Winners | Utilities – EIA says commercial electricity demand is climbing largely due to data centers. By 2026, ~6% of U.S. electricity could be eaten by server farms. Chipmakers & hardware suppliers – NVIDIA, AMD, Broadcom, TSMC, Micron: the supply chain feeding the AI boom. Their earnings reports read like a harvest season. Cloud landlords – Microsoft, Google, AWS, Oracle. All this infrastructure eventually funnels into their balance sheets through hosting and AI services. Investors tied to AI-sensitive sectors – since 2019, capital spending in AI-linked industries is up 53%, compared to flatlining everywhere else.

| Losers | Non-tech industries – capital investment outside AI-sensitive sectors is up only 0.3% since 2019, a flatline compared to the AI surge. Residential utility customers – higher wholesale demand raises the risk of pricier electricity bills for households, especially where grids are already strained. Water-stressed regions – data centers guzzle millions of gallons for cooling. Farmers and residents in arid states feel the pinch. Small & medium businesses (SMBs) – traditional sectors find credit and VC money harder to come by as capital chases AI infrastructure and startups. Environmental advocates – the boom locks in carbon-intensive steel, concrete, and energy footprints, even as regulators push net-zero targets.

| Conclusion: On paper, the US economy looks resilient. In reality, it’s narrow. Without AI, Q1 would have been a contraction, Q2 only a modest rebound, and the first half of 2025 little more than treading water. | That doesn’t make AI a mirage – the data centers, the electricity draw, the dollars are all very real. What’s unreal is the idea of a broad-based recovery. The question is whether the rest of the economy can catch up – or whether, if or when the treadmill stops humming, we find out just how dependent we’ve become on a single species of growth. | Topic # 2: Our Weekly WOWs and one Promise: The rivalry unfolding between Altman and Musk, Helix the Robot Laundry meditation, and the impressive Matrix-Game 2.0 from Skywork AI. Watch it here → |  | First eyeballs, now brains. Sam Altman is hungry | 3 Wow and 1 Promise |

|

| | | Our news digest is always free. Upgrade to receive our deep dives in full, directly into your inbox. Join Premium members from top companies like Hugging Face, Microsoft, Google, a16z, Datadog plus AI labs such as Ai2, MIT, Berkeley, .gov, and thousands of others to really understand what’s going on with AI → | |

|

| | We are reading/watching |  | jack morris @jxmnop |  |

| |

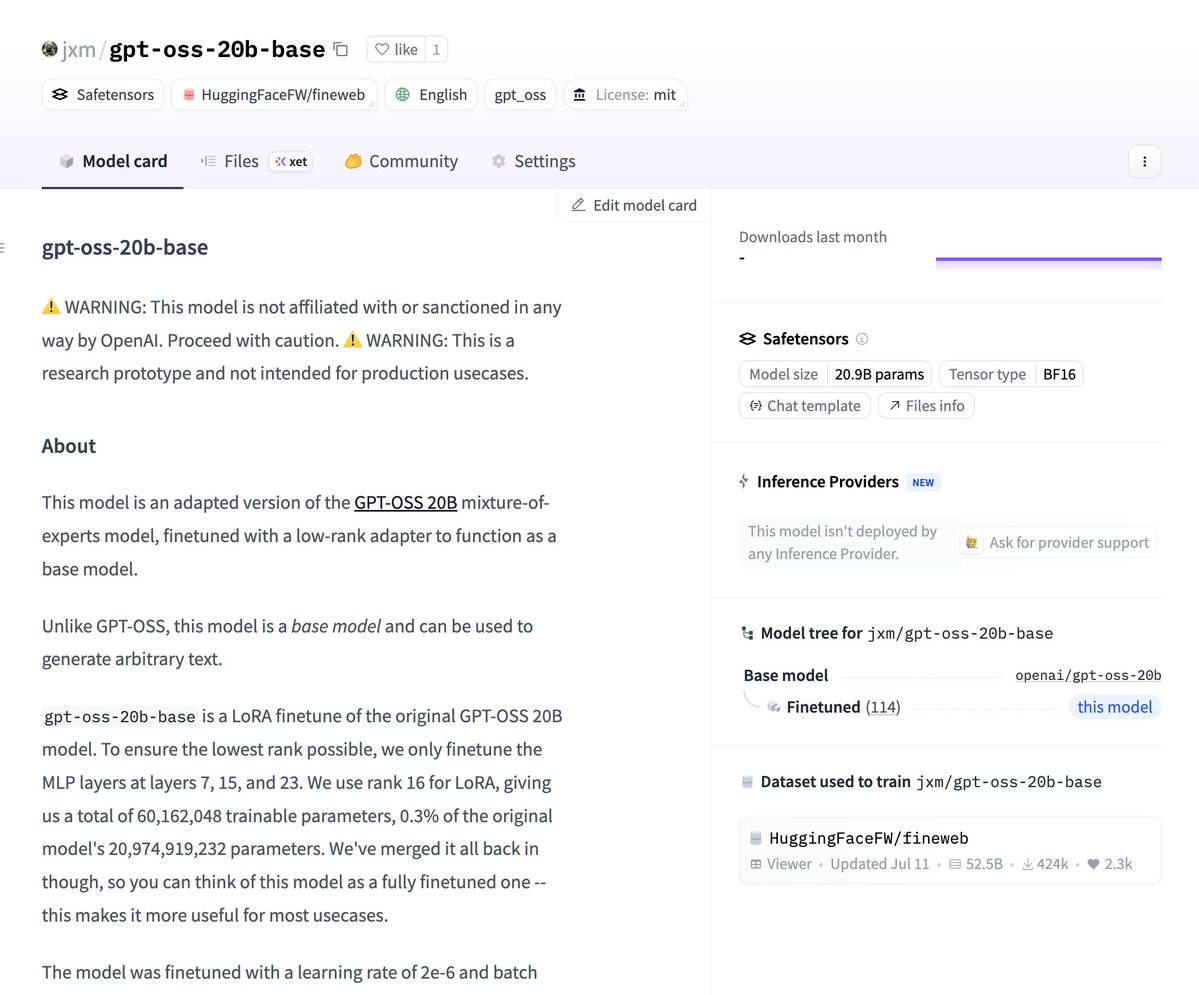

OpenAI hasn’t open-sourced a base model since GPT-2 in 2019. they recently released GPT-OSS, which is reasoning-only... or is it? turns out that underneath the surface, there is still a strong base model. so we extracted it. introducing gpt-oss-20b-base 🧵 | |   | | | 1:07 AM • Aug 13, 2025 | | | | | | 6.21K Likes 462 Retweets | 154 Replies |

|

| | The freshest research papers, categorized for your convenience | We organize research papers by goal-oriented or functional categories to make it easier to explore related developments and compare approaches. As always, papers we particularly recommend are marked with 🌟 | | Our research rating will be published tomorrow here → https://x.com/TheTuringPost | That’s all for today. Thank you for reading! Please send this newsletter to your colleagues if it can help them enhance their understanding of AI and stay ahead of the curve. | How was today's FOD?Please give us some constructive feedback | | |

|