How to succeed in the current financial context

- Sergio Visinoni from Sudo Make Me a CTO <makemeacto@substack.com>

- Hidden Recipient <hidden@emailshot.io>

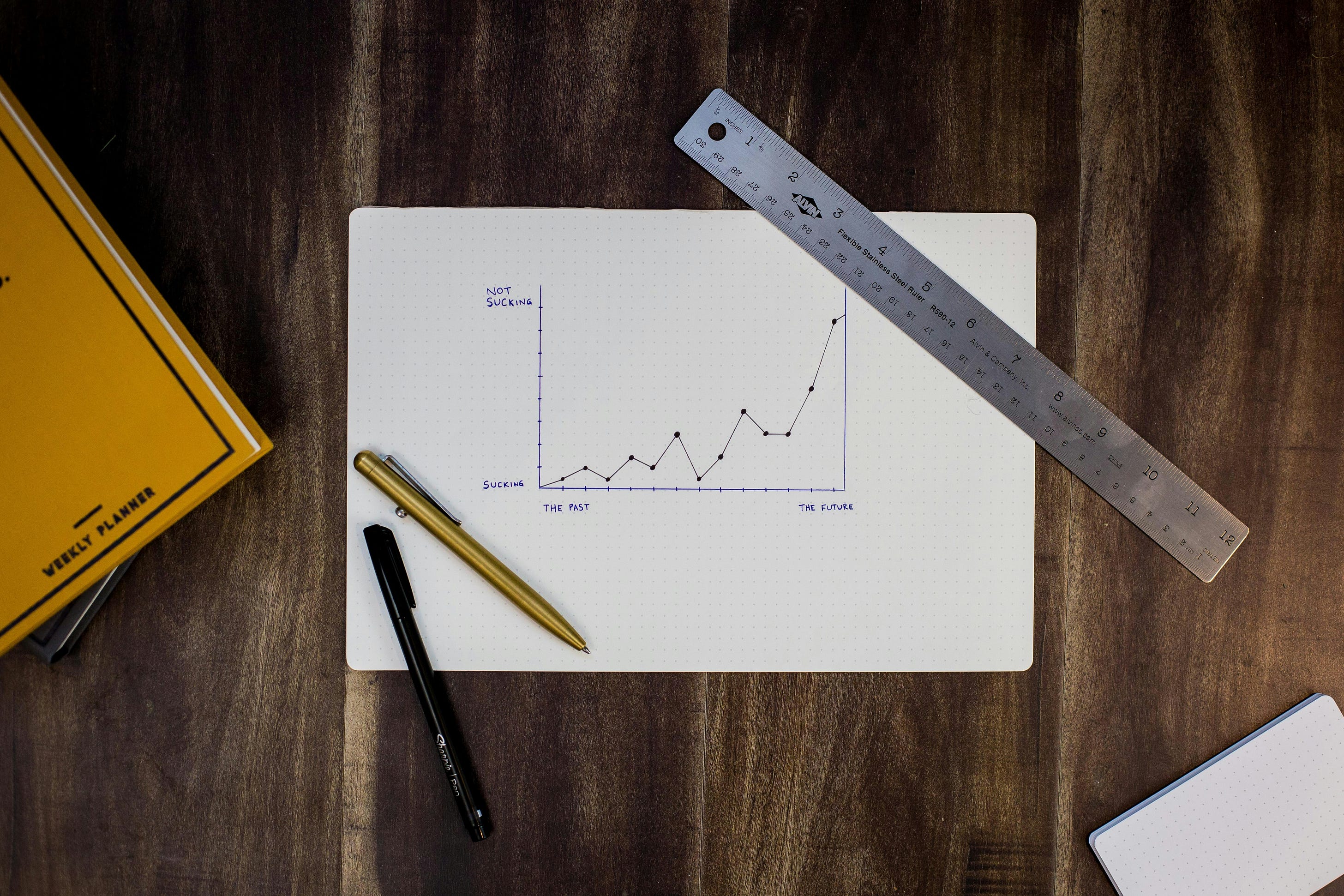

Hi, 👋 Sergio here! Welcome to another free post from the Sudo Make Me a CTO newsletter. If you prefer to read this post online, just click the article title. As this is a free newsletter, I do immensely appreciate likes, shares and comments. That's what helps other readers discover it! How to succeed in the current financial contextWhy I think the end of Zero Interest Rates is a good thing for the tech industry and for Engineering Leaders

This is what a client told me in a recent conversation. I initially thought they were being ironic, but it turned out they weren't. After the initial surprise, I realized that many people have joined the tech industry in the last decade or so. Even though they lived through the Covid pandemic, they might be led to believe that was just a bump in the road, and that the normality of zero interest rates and easy access to capital will continue indefinitely. I have been around for a bit longer. I joined the industry a few months before the first Internet Bubble exploded. I've seen the pendulum swinging back and forth a few times. I cannot say I predicted this last swing, but I was not surprised when it happened. I'm not here to tell you “I told you so” because that's always easy to do and doesn't really add value to the conversation. If you want a detailed analysis of the market dynamics over the past two decades, implications for tech valuations, and the job market I recommend you go through the excellent series of articles from Gergely Orosz on the topic. Today's article will focus instead on why I think this can be a good thing for the industry and engineering leaders. Let's dive into it! 🔀 Is this good or bad?

Let me get the controversial part out of the way immediately: people losing their jobs, companies having to shut down and rampant inflation is bad. They suck, especially when you're directly affected by them. This article does not intend to minimize how painful it is to have to face such situations in our personal lives. If you have been affected and are suffering its consequences, know that I empathize with your situation. It's estimated that about 50% of startups fail within the first 5 years in the US, and the percentage is much bigger when considered worldwide. Up to 90% according to some sources. Among the main reasons for failure, lack of financing and running out of cash take the lion's share. We can expect that in the current financial environment, these numbers will only get worse. From a VC perspective, many failed investments are acceptable, as a single win can generate returns that will more than compensate for those losses. When we look at the phenomenon more holistically, the implications for the tech industry culture are quite interesting:

Until the market changed and none of this is any longer the case. I argue that while in the past decade, most people in the tech industry have learned the skills of building very scalable systems that cost a fortune to operate, very few - in fact a minority - have mastered the skills of building solutions that will fuel a sustainable business for decades to come. One of the most notable companies in this space is 37 Signals, which for too long has been considered the odd voice while everybody else was busy worshipping VC poster children such as Adam Neumann and Sam Bankman Fried. This could be a perfect moment for founders, entrepreneurs, and individual actors in the tech industry to shift their mindset and efforts toward building businesses that will still be in business a few decades from now. One consequence I expect is that we will see a proliferation of so-called Companies of One. 🥇The rise of Companies of OneI've recently read Company of One by Paul Jarvis, a book that I found extremely timely. And that's because of 2 main reasons:

Though the book focuses primarily on the idea of individual or very small businesses, many of the principles it puts forward can be applied more broadly. The key thesis is that the conventional idea that business success equates to growing bigger is flawed. In my view, it's not only flawed, but it has led to many of the worst startup stories of the past decade - Wework, Theranos, FTX… More in detail, the book's key tenants are the following:

I think the last point is often dismissed too quickly as incompatible with the hustle culture that is considered a necessary ingredient for a successful startup life. With this, I'm not trying to tell you that you should necessarily reject the hustle culture and work less. I'm not entitled to tell you what you should do with your own life. And that's exactly the point. Don't let anyone else come up with a definition of success for you. What success will look like in your professional journey is something you should define based on your priorities and values. The definition of success that dominated the past decade is not being seriously reconsidered. That should serve as a word of warning against blindly adhering to whatever definition of success is being sold as the right one. I’d be particularly suspicious of so-called Techno-Capitalists who have been at the root of the unreasonable trends we've lived through during the past decade. Instead, you might want to take this inflection point as an opportunity to reconsider your own priorities and figure out what a meaningful life would mean for you, regardless of the latest trends and widespread narratives. That's the whole idea behind Company of One, one that I find very much in line with everything we know so far about living a meaningful and joyful life. Starting your own bootstrapped company is not the only way to internalize these key principles. Let's look at the implications for an engineering leader that operates in the context of a traditional company or startup. 🙏🏼 How will this new reality benefit Engineering Leaders?As the threshold for a VC investment to become profitable has gone up significantly, board members across the industry have shifted their focus toward profitability. Now that profit has taken the place of revenues or growth, your life as a CTO or engineering leader will be very different. And I argue that many of the changes will be an improvement. You will have to learn and hone skills that are critical to build a sustainable business. A business that doesn't only excel in burning through cash while building very elegant solutions in search of a problem. A business that can be profitable and stay profitable for many decades. What are some of these new requirements for the role? I see them broken down into 3 main categories: Technical, Organizational, and Cultural. 👩👩👧 Technical: No more “throwing more people at the problem”We've all been there. Whenever a new problem came up, we often defaulted to creating a new team to deal with it; hiring a few extra engineers, and hiring a bunch of contractors that would stay around indefinitely. Going fast to do "more” usually trumped cost considerations. This new reality will force you to be very ruthless in prioritizing and simplifying.

In other words, you simply will have no money to over-engineer it any longer. Use that to your advantage. 🤏🏼 Organizational: Smaller organizations, less overheadWith a smaller organization, you will reduce the overhead of running it.

Building simpler systems with a simpler organization will generally mean more time invested in building actual value for the customers and the business. You will have to accept some extra tradeoffs, and often the solutions you'll build will be less fancy than the ones you'd build with virtually infinite resources. 🤴🏼 Cultural: Less entitlement, more empathy with the rest of the world.As workers in the tech industry, we've been part of a privileged segment for quite some time. Huge salaries, lavish perks, and substantial equity packages have become the norm, fueled by the frenzies of companies’ valuations. This has caused all sorts of side effects such as ridiculous increases in the cost of living in certain areas of the world. It has also promoted a culture of entitlement and a proliferation of prima donna attitudes where many people have started taking themselves a bit too seriously. In a world dominated by armed conflicts and ravaged by a mounting climate crisis, I hope that this cash shortage will make us all realize how often irrelevant our contribution to humanity is. That building complex machine learning algorithms to optimize the route of a food delivery bike rider will not make the world a better place, to quote a funny episode from the TV Show Silicon Valley., Let's all step down from the pedestal and recognize that even with the recent changes in the market dynamics we're still a very privileged sector of the world population. Instead of feeding our egos, it should infuse a heightened sense of responsibility to a real impact in the lives of people that are not as privileged as we are. 🏁 ConclusionsThe significant shift in financial dynamics with the increase of interest rates is not all doom and gloom, as it brings its own set of opportunities to make the tech industry find new ground. Focus on the bottom line and sustainability will inevitably require that we change the way we operate our teams and build our software. In today's article, I've shared my thoughts on why I believe this is a net positive change for the industry and all the professionals involved with it. As this touches people's job security and incomes, this topic can be very polarising. Whether you resonate with my observations or if you are coming from a very different perspective, I'd love to read your thoughts in the comments section. See you next week! Sudo Make Me a CTO is a free newsletter edited by Sergio Visinoni. If you found this post insightful, please share it with your network using the link below. If you or your company need help with one of the topics I talk about in my newsletter, feel free to visit my website where you can schedule a free 30 minutes discovery call. I'd be delighted to investigate opportunities for collaboration! |

Similar newsletters

There are other similar shared emails that you might be interested in: