Grading Our 2025 Predictions 💯

Weekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities. If you haven’t subscribed, join 70,000+ weekly readers by subscribing here: Grading Our 2025 Predictions 💯Back in January, we wrote ‘25 Predictions for 2025’ (Part I here and Part II here). Our predictions were wide-ranging, touching on everything from Waymo to TikTok, humanoid robots to AI clones. Some predictions were spot-on; others were (very) wrong. Some were both at the same time! For instance, we predicted that we’d see a new record set for largest acquisition of a startup, which was right: Wiz broke WhatsApp’s record. But we also predicted that Wiz would IPO—oops—so we get dinged for that. This week we’ll grade our 2025 predictions, before sharing 2026 predictions over the next couple weeks. Let’s dive in 💯 Prediction #1: Taylor Swift will write an open letter about AI that creates a watershed moment for AI art.

Okay, so this is a good time to mention: sometimes our predictions are wildly specific, because those kinds of predictions are more fun. Those kinds of predictions are also more likely to be wrong! This is a good example. Predicting that Swift would pen an open letter about artist rights in the age of AI was more interesting than predicting something broader about artist rights. And it wasn’t too far-fetched, with Swift in the past writing open letters (for instance, her 2014 letter to Apple). I got this one wrong, though; Swift was dead silent on AI this year. But I’m giving myself a D instead of an F, because artist rights were a hot topic. Most recently, Suno settled its lawsuit with Warner Music and announced a joint venture. That partnership comes amidst an interesting backdrop: the No. 1 country song in the US is AI-generated, and there’s a huge AI backlash brewing among music fans. Prediction #2: TikTok will have a deus ex machina and will live on.

Nailed it! From last year: “I think TikTok is going to be saved. Someone will parachute in—maybe Trump, maybe the courts, maybe an 11th-hour buyer—to save TikTok and keep it on our phones. I just don’t think it’s going away.” TikTok is too big to fail. It’s too central to culture, too popular among Americans. A deal to sell TikTok’s U.S. operations is underway, and don’t worry—you’ll be able to doomscroll your FYP for eternity. Prediction #3: The threat of losing TikTok reignites a debate about creators owning their audience, breathing new life into crypto.

This one was less accurate. The threat of a TikTok ban did lead to some interest in owning networks, audiences, content. This is a perennial interest area for crypto. But this wasn’t a noteworthy story of the year. Prediction #4: IP will become even more important—and we’ll see at least one big AI licensing deal.

We were directionally right here. IP is becoming more important, and it’ll be a key differentiator in the age of “AI slop.” As barriers to creation lower, more art and content get made; as more art and content get made, IP becomes more critical. I’m giving us a B+ because the aforementioned Suno x Warner Music deal could qualify. But we’re also seeing a noticeable lack of licensing deals: Disney and Universal are suing Midjourney (that’s the opposite of a deal!) and ChatGPT still won’t generate Pixar characters for me 😪. So this one is a mixed bag.

Prediction #5: A new record will be set for largest VC-backed acquisition, surpassing Meta’s $19B purchase of WhatsApp.

Boom. Another self-congratulatory victory lap. Google bought Wiz for $32B. The acquisition won’t close until 2026, but Google just got regulatory approval, so we should be good to go. This is great news for Wiz’s backers: my old firm, Index, is the largest shareholder with 13%, with Sequoia coming in next at 10%. And this is good news for broader venture markets hoping for a return of M&A. Will 2026 see the record broken yet again? Maybe. I think Apple should’ve bought Anthropic earlier this year (Apple has $150B+ in cash on its balance sheet), but Apple has never been very acquisitive—its largest acquisition was Beats in 2014 for $3B—and now Anthropic is too expensive. I don’t think we’ll see Apple buy its way into the AI race. Time will tell, but I expect Wiz’s record to survive 2026. Prediction #6: Holy distributions, Batman!

This one was wishful thinking. I was hoping the spigot would open a bit more for VC distributions. We got a solid year of distributions, with long-time-coming IPOs for companies like Figma ($18B market cap today), CoreWeave ($39B), and Chime ($8B). We got Meta’s unique acquisition of Scale. But we haven’t really seen the big dollars flow. Here’s hoping 2026 is the year, with potential IPOs for Stripe, Canva, Databricks…and maybe even OpenAI. Prediction #7: Databricks goes public. And so does Wiz, changing the conversation on how fast startups should IPO.

Oops. Wiz instead got acquired, and Databricks instead raised a Series K (not a letter you see too often!) that pushed its valuation over $100B. We’ll see whether Databricks goes public in 2026. If not, it’s a sign that we’re in for a new world order, one in which companies stay private forever (Stripe is another example). This is a bad thing, IMO: most Americans can’t access the private markets, where enormous wealth creation is happening. Staying private forever also, of course, reorients the entire venture landscape: secondaries vehicles will balloon to give early investors, LPs, and employees liquidity. Prediction #8: Waymo will dethrone Uber and Lyft in San Francisco.

I actually don’t have the latest data here to grade the prediction accurately, but I think I was a bit overzealous. I don’t think Waymo has yet dethroned Uber in the Bay Area, though it has certainly surpassed Lyft. The latest data I’ve found is from BOND’s April 2025 Tech Trends report: We’re probably at least getting close to a changing of the guard. And Waymo has now aggressively expanded across the country. Everyone is so excited about gen AI that we’ve forgotten that it’s now normal to drive around in a car without a driver. One reason is that this is still largely a Bay Area phenomenon. I can’t wait for my dad to be able to experience a Waymo. To have grown up with three TV channels and to now ride around in a self-driving car… That’s pretty cool for one lifetime. Prediction #9: Space and defense continue their hot streak.

This was sort of a lay-up. Space and defense remain hot, and I don’t see them cooling next year. I also think Anduril will IPO in 2026, which will keep the party going. One noteworthy remark on this topic: Sequoia’s Roelof Botha recently said that if there’s one Sequoia company most likely to become the world’s most valuable company, it’s not OpenAI—it’s SpaceX. Prediction #10: And manufacturing re-shores to the US.

We wrote this prediction before the tariff mania of 2025. It’s definitely correct: manufacturing is re-shoring to the US. But re-shoring is also happening more slwoly than expected, for two main reasons:

Re-shored manufacturing will be a major story throughout the 2020s. We’re still early in this shift, with new startups solving the dual problems in (1) cost and (2) labor. Prediction #11: Robotics and B2B hardware ride the AI tailwind. But consumer AI hardware continues to sputter.

We’ve seen a lot of buzz in robotics. This buzz is even puncturing mainstream awareness, outside of the Valley. Here’s a billboard: I even had family members at Thanksgiving ask me about NEO, and some had seen the (excellent) launch video for Sunday. Two things I thought were really cool about Sunday: (1) the hat is a very clever way to position a downward-facing camera, and (2) the Skill Capture Glove is a smart way to capture training data. Clearly, robotics is going mainstream. Robotics will have its ChatGPT moment eventually. The examples above are on the consumer side; B2B, meanwhile, is exploding with robots! Every week brings new funding announcements. One cool one this week: USV is leading the Series A in Tutor Intelligence. Tutor’s first robot was in a New Jersey factory packaging cosmetics—at first teleoperated; then, after a few months of real production data, it runs autonomously. Innovations like Tutor should help solve the US re-shoring problems mentioned above. Anyway—robotics had a great year. The other half of this prediction was that we wouldn’t see much new for consumer AI hardware. That was also correct. It feels like we’ll be kept waiting until Jony Ive’s OpenAI device (which Sam Altman just described as like “sitting in the most beautiful cabin by a lake and in the mountains and sort of just enjoying the peace and calm.”) Prediction #12: Digital clones—based on real people—gain traction.

I think we were a bit early with this one. Delphi has solid traction, but hasn’t yet broken through to the mainstream. (Though you can chat with my Delphi here!) Meanwhile, we see new entrants like Sentience, a more comprehensive and ever-evolving AI clone for your mind—but Sentience is pre-launch and still has a waitlist. I still think digital twins are an enormous, horizontal application of AI. But they will probably be a 2026 (or even 2027) breakthrough. Prediction #13: But there’s a big backlash to fully AI creators.

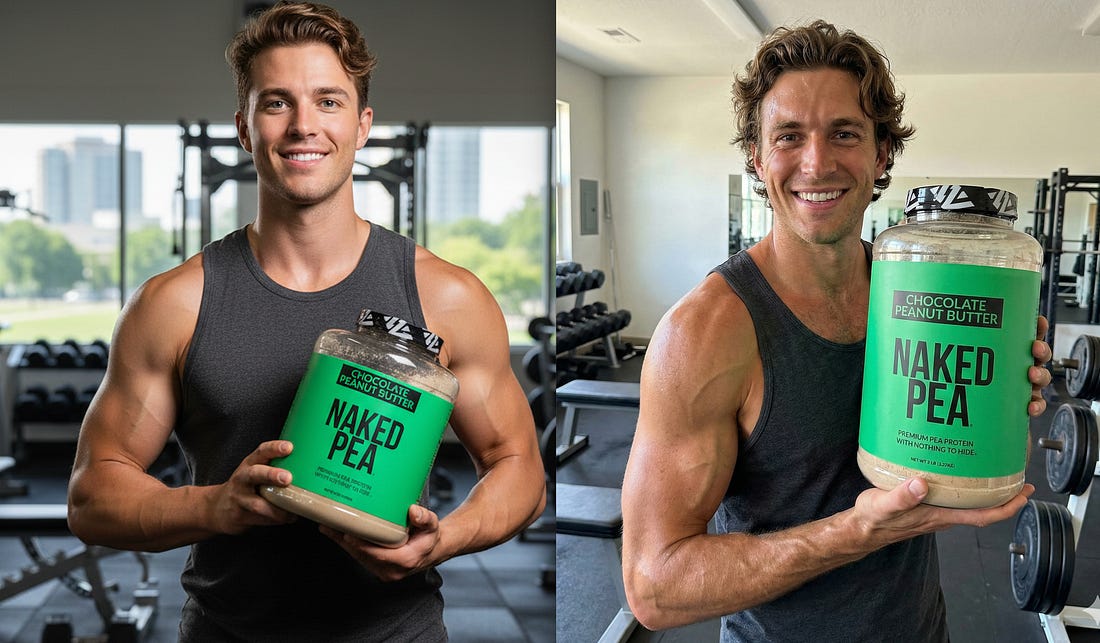

This one feels right. This wasn’t a huge news story, but Meta and Spotify both faced criticism for AI creators on their platforms. Last week’s piece, Going Bananas, ended with these TikTok screenshots I pulled to demonstrate anti-AI sentiment: The problem is: with Nano Banana Pro, you can’t even tell which creators are real vs. fake! Here is a comparison I posted to LinkedIn, showing a Nano Banana influencer (left) and a Nano Banana Pro influencer (right): I saw a tweet that said RIP photography (1839-2025). A lot of people are about to be catfished by attractive (but fake) men and women. Consider yourself warned! Prediction #14: Pixar releases a short film that’s AI-generated.

Another very specific (and fun) prediction that was also flat-out wrong. What I got right here: the technology is just about ready for Pixar to pull something like this off. What I got wrong: even with the technology ready, Pixar wouldn’t do this. There’s tremendous industry scrutiny around AI, and growing public backlash (Exhibit A: the TikTok comments we just showed). More likely, Pixar will use AI to supercharge production. Instead of releasing one film a year, maybe they now do two? James Cameron had a great two-part interview on The Town podcast. Cameron says that 1,000 people work for many years on a single Avatar movie. Asked whether AI will replace some of these workers, he answers:

This is a good response. No one loses a job—instead, everyone is twice as productive, and output doubles. I doubt we see a fully AI Pixar movie, or a fully AI Avatar movie, but we’ll see Prediction #15: Google will launch an AI tutor for K-12.

2025 was the year that Google woke up. ChatGPT caught the tech giant asleep at the wheel, but Google has always had the best AI talent and technology. We’re now seeing that. Gemini 3 proved how good the models are, and we’re also seeing the company flex its distribution and business muscle. This included a move into education: back in August, Google launched ‘Guided Learning’ in Gemini for K-12 students. (This happened a week after OpenAI rolled out Study Mode for ChatGPT.) I expect we’ll see Google do a lot more here; they’ll want to acquire users while they’re young, to keep them locked into the Gemini orbit. Prediction #16: Betting on everything goes mainstream. We see a new unicorn minted around the financialization of everything.

Prediction markets were arguably the story in tech for 2025—at least outside of AI. Kalshi and Polymarket both started the year with valuations sub-$1B. They’re ending the year worth $11B and $9B, respectively. As prediction markets formalize as an asset class (some analysts expect volume to swell 30x by 2030), we’ll see new tools emerge. For example: who will build the Bloomberg for prediction markets? A new asset class means a new infrastructure. In January, we also wrote: “Alongside the rise of new betting platforms, we’ll see increased controversy and attempts at regulation.” Yup, sounds about right. Prediction #17: A major climate disaster forces “climate tech” back into the spotlight.

We wrote this prediction before January’s LA wildfires—yes, that was in 2025; it’s been a long year. But even after that devastating disaster, it feels like climate tech is still out of the limelight. Part of this is because AI is sucking up the oxygen in the room. Climate is still a major category, and there was some renewed interest—but not much, and I wish we saw more. Prediction #18: Healthcare faces a reckoning after the murder of UnitedHealthcare CEO, Brian Thompson.

This one is squishy, so we can score it how we want. I’m going to give us an A. Healthcare is booming in early-stage venture. We have six healthcare companies in our Daybreak portfolio, and a few of them are among our fastest-growing companies. On the B2B side, we see incredible pull from the market, as AI lessens the $1T admin burden in healthcare. On the B2C side, we see consumers clamoring to measure and personalize their health—and willing to pay for it.

An interesting pattern I notice, anecdotally: many of the best young founders, in particular, are building in healthcare x AI. E.g., Stanford, Harvard grads. This aligns with what you’d expect: younger generations care deeply about mission-driven work, and you’d be hard-pressed to find a more impactful sector than healthcare. Prediction #19: We’ll see a breakthrough consumer health AI company. One in hardware, multiple in software.

Mmm, not quite. Well, it depends how you define “breakthrough.” We’ve seen “AI doctors” like Doctronic have rapid growth. More established players like Function Health (not AI-native, though AI is certainly a big part of the vision) are also doing well. But nothing huge has broken through. In hardware, meanwhile, the biggest players remain the familiar ones: Apple Watch, Whoop, Eight Sleep, Oura Ring. I’m giving us a B- here because there were a few fast-growing new entrants, but nothing truly earth-shattering. Prediction #20: AI therapists actually…improve mental health.

In April’s AI Friends Are a Good Thing, Actually, we talked about a landmark study out of Dartmouth. Participants in the study—who had all been diagnosed with depression, anxiety, or an eating disorder—were asked to chat regularly with an AI chatbot called Therabot. The findings:

From the study director: “Our results are comparable to what we would see for people with access to gold-standard cognitive therapy with outpatient providers.” Prediction #21: The number of VC firms drops by 1,000.

Here’s the chart we referenced last year: I don’t have the latest data (PitchBook, ball’s in your court) but I’m pretty sure the trend-line has continued. Many “tourist” venture funds from 2020-2022 over-raised and over-deployed without discipline; few will raise second and third funds. At the same time, capital is consolidating among a handful of names (note: this is a bad thing). Here’s a chart we shared earlier this year in The Taxi Cab Theory of Venture Capital, showing that 74% of LP dollars last year went to the top 30 venture firms: As the saying goes, “No one ever got fired for I expect LP dollars to continue flowing to the mega-funds; this is expected when an asset class institutionalizes. We may see fewer firms created (and fewer LPs allocating to emerging managers), but that’s a mistake; this is where the alpha will come. We’re in the early innings of the biggest technology revolution of our lifetimes (maybe ever); this may be a tough time to raise a venture fund, but it’s the best time in 10+ years to deploy it. Prediction #22: The rebirth of “the lean startup”: a company hits $25M ARR with <10 employees and <$10M in venture capital.

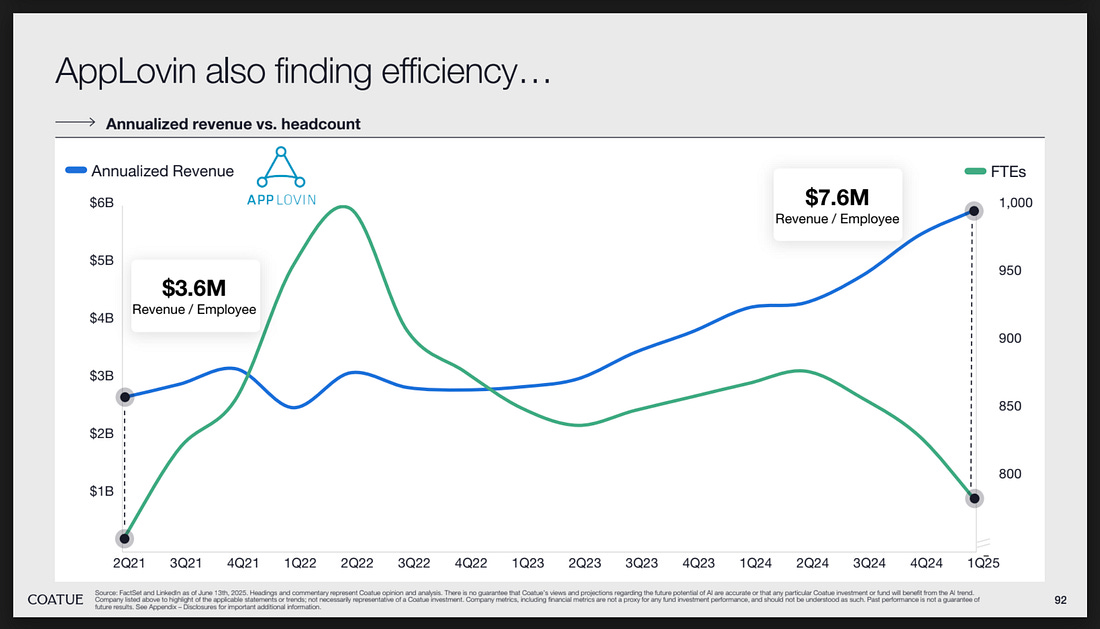

I’m not sure about the exact numbers here (feel free to let me know if you have a specific example), but I feel confident this has happened. And the gist of the prediction is definitely right. You can do a lot more with less, these days. Here’s an example in the public markets: This is the same idea as James Cameron’s comments on AI in filmmaking: you can accomplish more with less. In the private markets, Cursor started 2025 with ~10 employees. Even today, approaching $1B in ARR, the company only has a couple hundred people. Another example: Gamma announced it crossed $100M ARR, with just 50 employees. What’s a second-derivative effect? Founders will end up owning more of their company. Gamma just raised its Series B from Andreessen Horowitz—a $68M round at $2.1B. This means the founders gave away just 3.3% of the company. Not bad for a Series B. Being more capital efficient and maximizing output-per-employee means more leverage in fundraising. This is great for founders, and for early-stage investors who get diluted less. Prediction #23: 2025 brings a Zuckerberg backlash.

Tough one to quantify, but I think this was directionally correct. When we started 2025, Zuck was in full “glow-up” mode, working hard to revamp his image. He grew out his hair. He started wearing a chain. He took up Mixed Martial Arts. He went on Joe Rogan. It’s fair to say he overplayed his hand. Zuck got a lot of ill will this year, whether from poaching researchers with $100M packages or from releasing the “AI slop” Vibes app. I just don’t think Zuck will ever be popular. To Boomers down to Gen Zs, Zuck embodies what people hate and distrust about Big Tech. Don’t feel too bad for him: Meta stock is still up +8% for the year, to $1.7T. Prediction #24: We’ll have our first AI Super Bowl ad.

We wrote back in January: “Now, I’m not sure we’ll see a fully AI-generated Super Bowl ad. But some elements of ads will be generated; it might be tough to tell which. Perennial Super Bowl advertisers have actually been using AI for years. This isn’t always gen AI—sometimes this is old-fashioned personalization. Coke, for instance, used data insights in its ‘Share a Coke’ campaign to localize their ads, changing names, phrases, and emojis by geography.” AI definitely dominated the Super Bowl: we got ads for ChatGPT, for Microsoft Copilot, for Google’s Gemini. What we didn’t get was a fully AI-generated ad, as expected. But AI was definitely used to make Super Bowl commercials—the problem is, which companies would even admit it? Taylor Swift was just criticized for using AI in her promotional videos for Showgirl. Why would any brand invite scrutiny by talking about AI use? Similar to the Pixar prediction, this one was a little misguided. When companies do use AI to trim costs, I think they’ll be quiet about it. And while we might never see a fully AI-generated Super Bowl ad, we’ll certainly see AI used to produce ads more quickly and more cheaply. You could reframe that as augmentation, not automation. Which brings us to our final prediction… Prediction #25: Out: Automation. In: Augmentation.

Last year, we wrote: “Okay, this one is a little broad—but I think this will be the encompassing theme of early-stage tech in 2025. I think, in 2025, we see a decided shift from all-out automation to augmentation.” I feel good about this one. We wrote The Egg Theory of AI Agents back in May 2024 to argue that good AI product design means injecting moments of friction. Full automation is a bridge too far for most people; moments of judgment and approval are necessary to keep the user happy. We see this playing out in our Daybreak portfolio companies: everyday people are augmenting their workflows with AI—from lawyers to restaurant managers, doctors to general contractors. And “augmenting” is the key word, with full-on automation rare. Of course, the lines are blurring here. But I think the best applied AI companies will continue to focus on extending workers (i.e., making existing workers more productive) rather than replacing workers. In labor markets, this means increased productivity with lower head counts and stalled hiring—good news for existing workers, bad news for new entrants to the job market. Next Up: 2026 Predictions! 🔎Back next week with some predictions for 2026! Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: |

Similar newsletters

There are other similar shared emails that you might be interested in: