Dealflow France #11: Germitec raises €28.8M. France commits €109B to AI. France launches LLM leaderboard to benchm…

- Jaime Novoa from Dealflow France <dealflowfrance@substack.com>

- Hidden Recipient <hidden@emailshot.io>

Dealflow France #11: Germitec raises €28.8M. France commits €109B to AI. France launches LLM leaderboard to benchmark AI.Welcome to the 11th edition of the Dealflow France newsletter: a weekly summary of everything that happened in the France startup and investment ecosystem.Welcome to Dealflow France! Dealflow France is the best way to follow the French startup and VC ecosystem. If by any chance you’ve known about Dealflow Spain or Dealflow LatAm, you know what to expect. But just in case: a manually-curated weekly email with the week’s most relevant articles, delivered to your inbox every Monday morning in one single and easy-to-read email. If you have any feedback, please reply to this email or reach out at jaime@dealflow.es Merci beaucoup! This week’s newsletter is brought to you by zenital:

Startup funding news 💸Rounds of €20M+:

Rounds €10M to €20M:

Rounds €5M to €10M:

Rounds €1M to €5M:

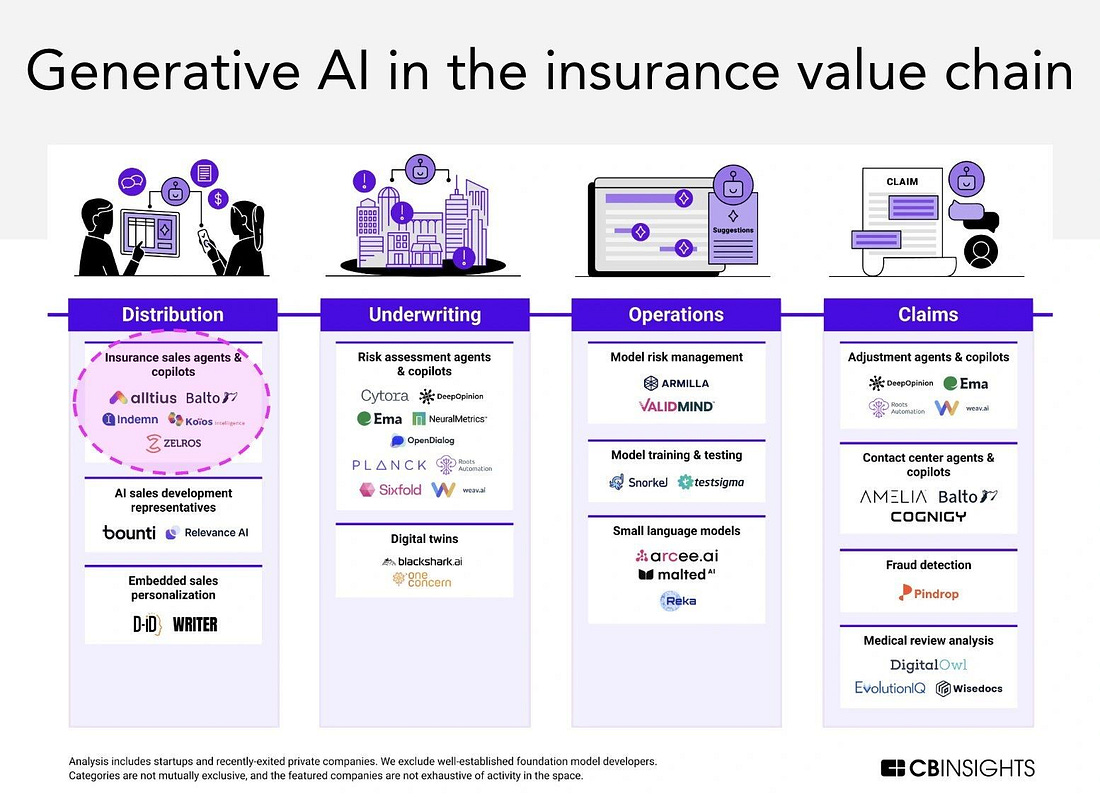

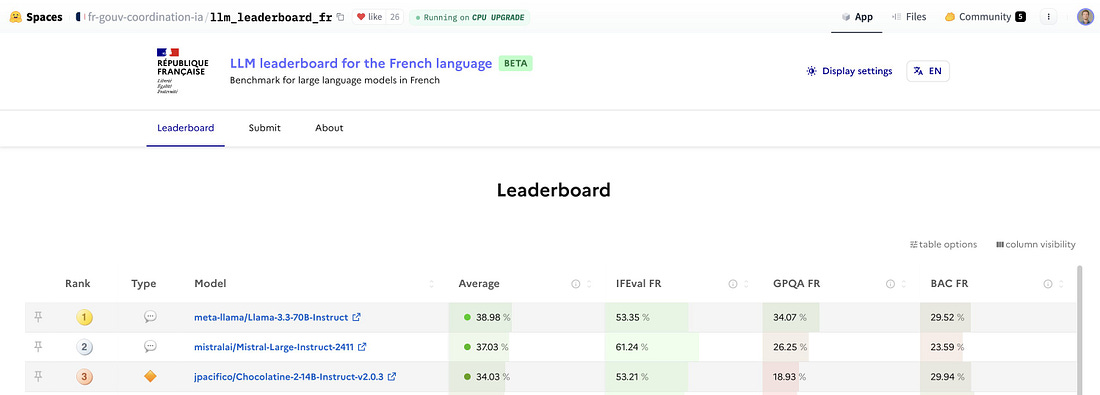

M&A transactions 🎊Axeptio acquires AdOpt to expand its consent management platform in Brazil. This move strengthens its international presence, leveraging AdOpt’s local expertise in compliance with Brazil’s LGPD regulations. Investor & accelerator news 🚀The EU launches InvestAI, a €200B initiative to fund AI and gigafactories, with €50B from the EU and €150B from private investors, boosting Europe's AI capabilities. A HelloSafe study estimates that 5.9 million French people now own cryptocurrency, a 125% increase since 2019. France ranks 19th globally for crypto adoption, with Canada, Germany, and the U.S. seeing the highest growth. Bpifrance injected €60B into the French economy in 2024, including €5.2B for innovation across 5,503 companies. The bank also deployed €9B for industry and €7B for green transition, maintaining strong support for entrepreneurship and economic transformation. PSG closes two new funds totaling $8B, including its $6B North American flagship fund (PSG VI) and a $2B continuation fund (PSG Sequel). Investors include CPP Investments, GIC, StepStone, and Hamilton Lane. The funds will support growth-stage software and tech-enabled services companies. The European Investment Fund (EIF) invests €40M in the Fonds Stratégique des Transitions (FST), managed by ISALT, to support innovative and low-carbon French industries. The fund, set to exceed €300M at final closing, backs SMEs and mid-cap companies in alternative energy, decarbonization, and tech innovation. Opportunities & Deadlines 👀The Eurométropole de Strasbourg will select 20 local startups to showcase at VivaTech 2025 in Paris. This initiative aims to boost their visibility, connect them with investors, and help expand their markets. Applications are open until March 6, 2025. Startup news 💡Mistral updated Le Chat’s privacy policy after a GDPR complaint was filed with CNIL. The complaint alleged free users couldn't opt out of data usage for AI training. Mistral has since added an opt-out option, but differences remain between free and premium users. Market Pay unveils Market Pay Hub, a next-gen centralized payment management platform. The fintech’s new interface enhances transaction monitoring, fraud prevention, and analytics, streamlining payment operations for merchants across Europe. Chouic, a Nantes-based startup specializing in mobile party games, is expanding internationally. Founded in 2015, the company now generates 80% of its revenue abroad, showcasing the global appeal of French creativity in gaming. Big company & policy news 💡France commits €109B to AI development at the Sommet pour l'Action sur l'IA in Paris. The event also saw the launch of the EU AI Champions Initiative, uniting 60 major European companies (Airbus, L’Oréal, Siemens, Spotify, Mistral) to boost Europe’s AI leadership. BNP Paribas and BPCE launch Estreem, a new French payment processing joint venture aiming to become a top-three player in Europe. Estreem will handle 17 billion transactions annually and expand to other banks by 2028. BNP Paribas and the European Investment Bank (EIB) sign an agreement to mobilize up to €8B for wind energy projects across the EU. Backed by InvestEU, the initiative will support new wind farms, supply chains, and grid interconnections. Groupe iliad invests €3B in AI infrastructure, research, and applications. OpCore will allocate €2.5B to expand its data centers, while Scaleway boosts AI computing capacity. A partnership with Mistral AI offers Free Mobile users 12 months of Chat Pro access. Rgreen Invest closes €100M Afrigreen Debt Impact Fund to finance solar projects in Africa, with investments in Nigeria, Morocco, and Botswana. Interesting reads 💡Florian Graillot (astorya.vc) breaks down how AI is revolutionizing the insurance industry with insights from CB Insights, BCG, and Amir Kabir. From game-changing use cases to emerging InsurTech opportunities, he highlights how AI-first startups are already reshaping the sector—and why France is at the forefront! The French government, with Inria, LNE, GENCI, and Hugging Face, launched a leaderboard for LLMs in French to benchmark AI, promote French, and support research. Evaluations on the Jean Zay supercomputer use GPQA, IFEval, and Baccalauréat-based datasets for culturally relevant assessments. Laurent Alexandre predicts that in 10 years, human intelligence will represent only a thousandth of AI’s capacity. Speaking at Cercle Humania, he highlighted AI’s exponential growth, urging businesses, startups, and VCs to adapt or risk obsolescence. |

Similar newsletters

There are other similar shared emails that you might be interested in:

- Dealflow France #7: Loft Orbital raises €170M. EasyPark acquires Flowbird. Société Générale & EIB unlock €8B for w…

- Dealflow France #8: 4elements raises €27M. Clementine acquired by TeamSystem. Shift4Good closes €220M fund.

- Dealflow France #9: Alice & Bob raises €100M. Lita launches a €60M impact fund. Dataiku surpasses $300M ARR but re…