The definitive guide to mastering analytical thinking interviews

The definitive guide to mastering analytical thinking interviewsA step-by-step prep playbook to help you ace your PM interviews👋 Welcome to a 🔒 subscriber-only edition 🔒 of my weekly newsletter. Each week I tackle reader questions about building product, driving growth, and accelerating your career. For more: Lenny’s Podcast | How I AI | Lennybot | Lenny’s Reads | Courses | Swag Annual subscribers now get a free year of Bolt, Perplexity Pro, Notion, Superhuman, Linear, Granola, and more. Subscribe now. In my ongoing efforts to help you land your dream job, I’m excited to bring you this truly epic guide by Ben Erez. Below you’ll find everything you need to know to nail your analytical thinking interview—a staple of most product interview loops. I’ve never seen a guide this in-depth, specific, and full of so many real-life examples. I hope this helps them see exactly why you’re the perfect fit for the role. After a decade in product (at Facebook, as the first PM at three different startups, and as a founder), Ben is now a full-time interview coach, helping PMs land their dream roles. He teaches a top-rated course on PM interviewing (use code “LENNYSLIST” to get $100 off), and on July 9th, he’ll be hosting a free 30-minute lightning lesson where he’ll show you how to use AI to practice for your analytical thinking interviews. Ben also co-hosts Supra Insider, a weekly podcast for the product community. Bonus: You can now listen to this post in convenient podcast form: Spotify / Apple / YouTube. In part one of this comprehensive guide—The definitive guide to mastering product sense interviews—I explained why product sense and analytical thinking interviews matter and I walked through my framework for acing the former. Now I’ll walk through my framework for acing analytical thinking interviews. In this post, I’ll cover:

Whether you’re actively preparing for upcoming interviews or you simply want to understand how top tech companies evaluate PMs, this guide will equip you with all the tools and frameworks you need to succeed. We’ll start by exploring exactly what analytical thinking interviews assess and how they’re structured. By understanding the interviewer’s perspective, you’ll be better equipped to provide the signals they’re looking for. Understand the analytical thinking interviewAnalytical thinking (AT) interviews assess a candidate’s ability to understand a product in the context of its broader company and its market, establish metrics to track success, identify team goals, and evaluate tradeoffs in a structured way. Here are some examples of typical AT questions:

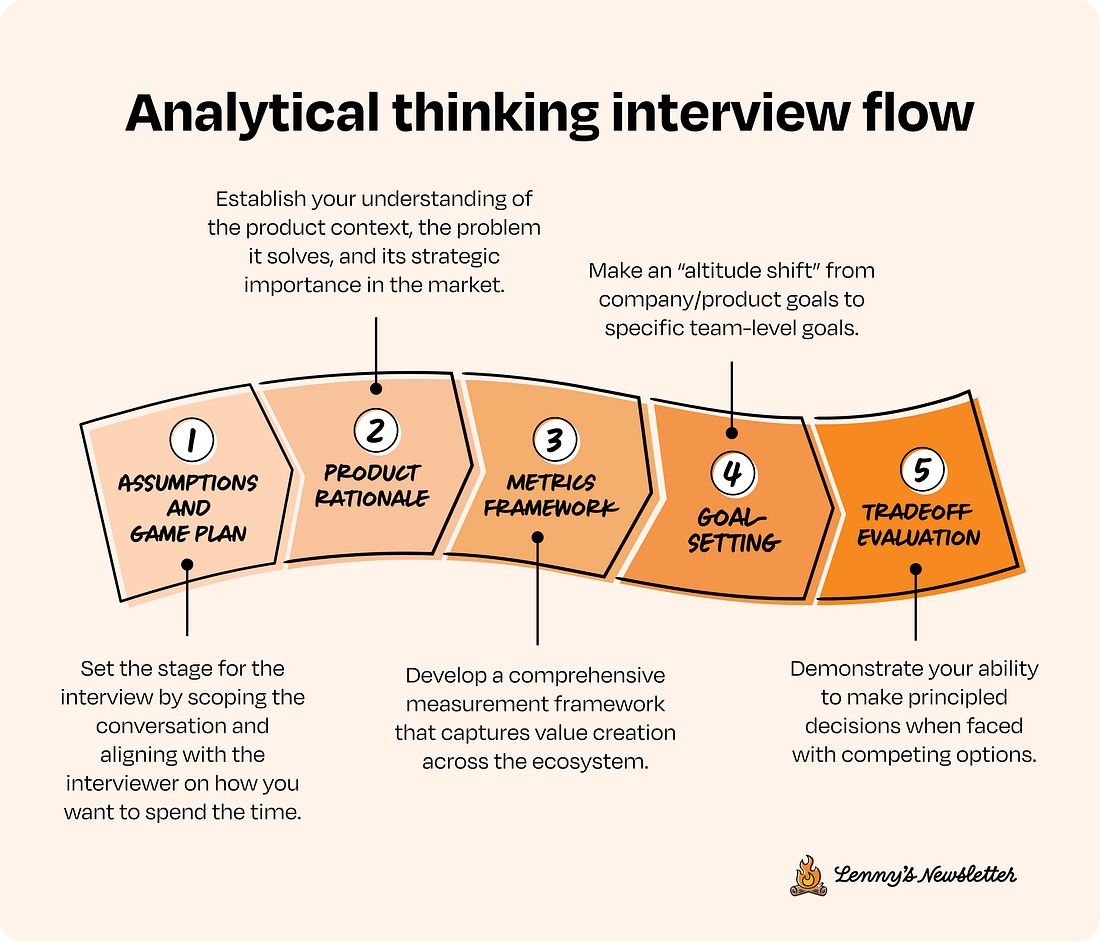

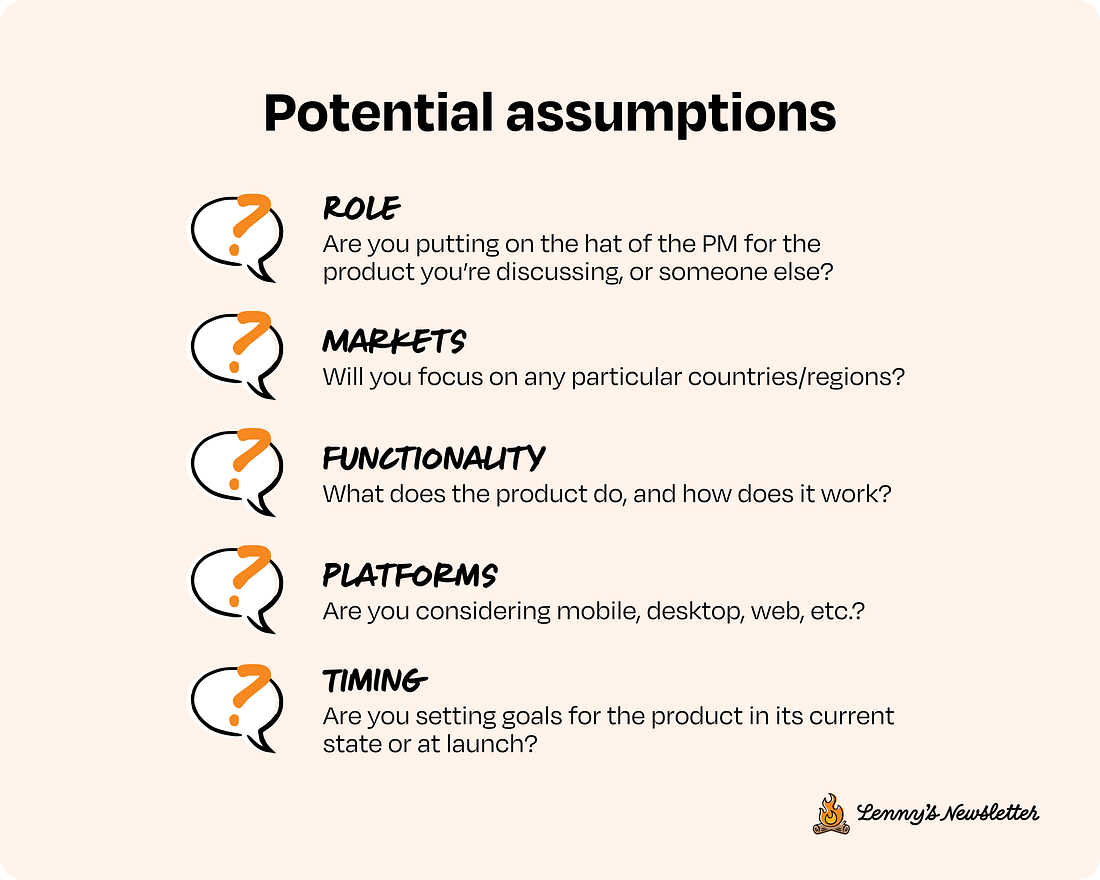

Although an AT interview normally lasts 45 minutes, you’ll have only about 35 minutes of actual working time after accounting for introductions and wrap-up questions. That might seem like plenty of time, but it flies by, so you’ll want to let your inner “time cop” run the show. Since the interviewer won’t be looking for a “correct” answer—rather, they’re evaluating your thought process—I recommend approaching the interview with this linear flow to maximize your chances of providing strong signals for the following dimensions in a structured way: Note: Analytical thinking interviews can sometimes include other question types, such as debugging/root cause analysis questions and estimation questions, but these are becoming less common. I included some thoughts about tackling debugging and estimation questions at the bottom of this post. Step 1: Assumptions and game planThe opening minutes of an analytical thinking interview can make or break your performance. I’ve watched countless candidates struggle because they jumped straight into goals without aligning with the interviewer on the structure. My advice is to approach the interview as a game with clear rules rather than a casual conversation, and spend the first minute making a handful of assumptions at the start of the interview that narrow the scope to a manageable exercise without prematurely limiting the solution space. Then outline your game plan for the interview, showing the interviewer how you want to spend your time together. When transitioning between key sections of the interview structure (e.g. from product rationale to metrics framework), take a pause to think through your content for that section of the interview. Once you’re ready, check in with the interviewer to walk them through your thinking and confirm they’re following before you proceed to the next section. To set yourself up for success, state a few potential assumptions to align on the scope of the exercise. Here are some flavors of assumptions that can be helpful: Let’s now apply our assumptions framework to the first typical AT question I gave above, which we’ll be using as an example throughout this post: How would you measure success for Spotify? (Other potential questions and answers will be available in links at the bottom of each section.) The assumptions below focus on the core consumer-facing music streaming service globally across all platforms, preventing getting lost in niche features or regional specifics. This grants you the freedom to explore meaningful metrics that capture Spotify’s fundamental purpose without being overwhelmed:

Additional examples:

After stating assumptions, share your game plan for the interview to make sure you’re on the same page as the interviewer about how you’ll spend your time together:

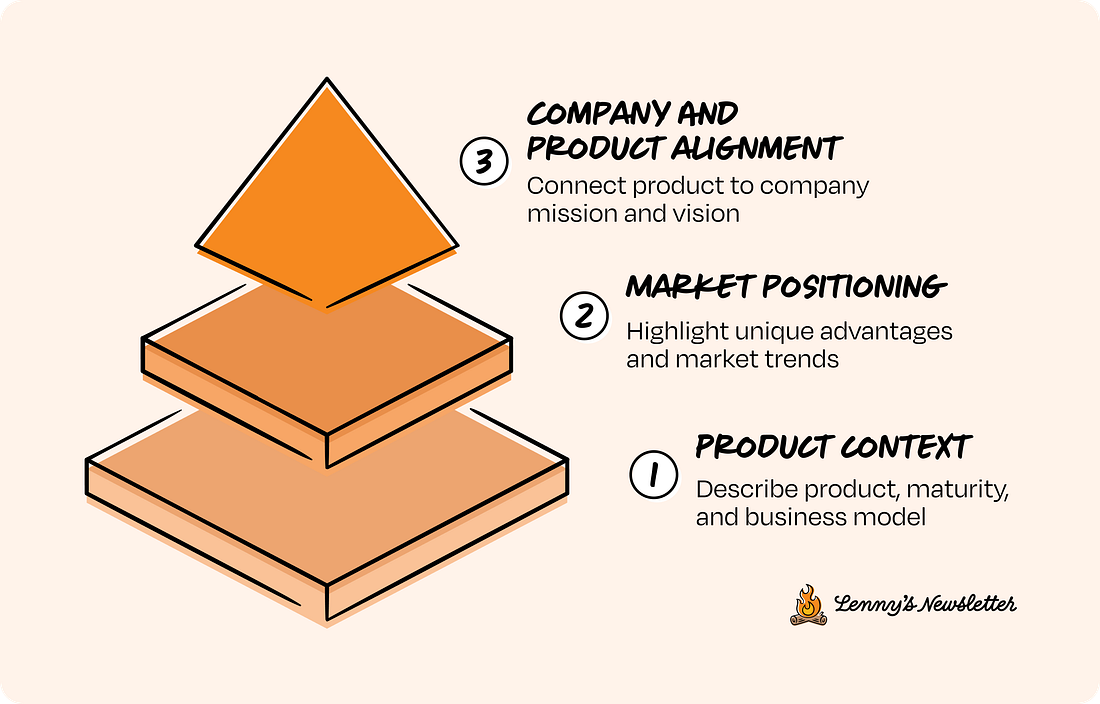

Interviewers love hearing this because it tells them you have a plan to generate the signals they need. To put you in the interviewer’s shoes, this is kind of like sitting down to play a game with someone who knows how to play vs. someone who doesn’t. It’s just better. Outlining your game plan up front also gives the interviewer a chance to redirect you if they want to spend the time differently, preventing you from going in the wrong direction and wasting everybody’s time. Step 2: Product rationaleWith the interviewer on board with your assumptions and game plan, the next step is articulating the product rationale. This is your opportunity to establish your understanding of the product context and its strategic importance to the business before diving into metrics. Without this contextual grounding, your metrics will feel arbitrary rather than aligned with the product’s purpose and the business needs. While most good candidates describe what a product does, you’ll set yourself apart by building a compelling strategic foundation touching on three key areas:

Top candidates don’t just describe a product’s features but establish a compelling case for why it matters to users, the business, and the market. This foundation makes all subsequent metrics and recommendations feel naturally aligned with the product’s core purpose. 💡 Tip: Spend about a minute organizing your thoughts before sharing product rationale with the interviewer. Examples of articulating product rationaleLet’s now apply our metric framework principles to our question: How would you measure success for Spotify? The rationale below articulates the core problem Spotify solved (music piracy and limited access), establishing why the product exists beyond its features. Second, it positions Spotify within its competitive landscape, highlighting specific differentiators like recommendations and platform support. Most importantly, it concludes with a powerful mission statement that will serve as our North Star for all subsequent metrics and decisions.

Additional examples:

How to practice product rationaleGet reps in with an exercise that develops both written and verbal muscles:

Step 3: Metric frameworkNext, you’ll leverage the product rationale to define concrete metrics that track ecosystem health. This section is nuanced and often entails a decent amount of back-and-forth with the interviewer to make sure they follow your thinking. So allocate the largest chunk of time in the interview to your metric framework. While good candidates can identify relevant metrics, what will set you apart is a cohesive story about healthy growth:

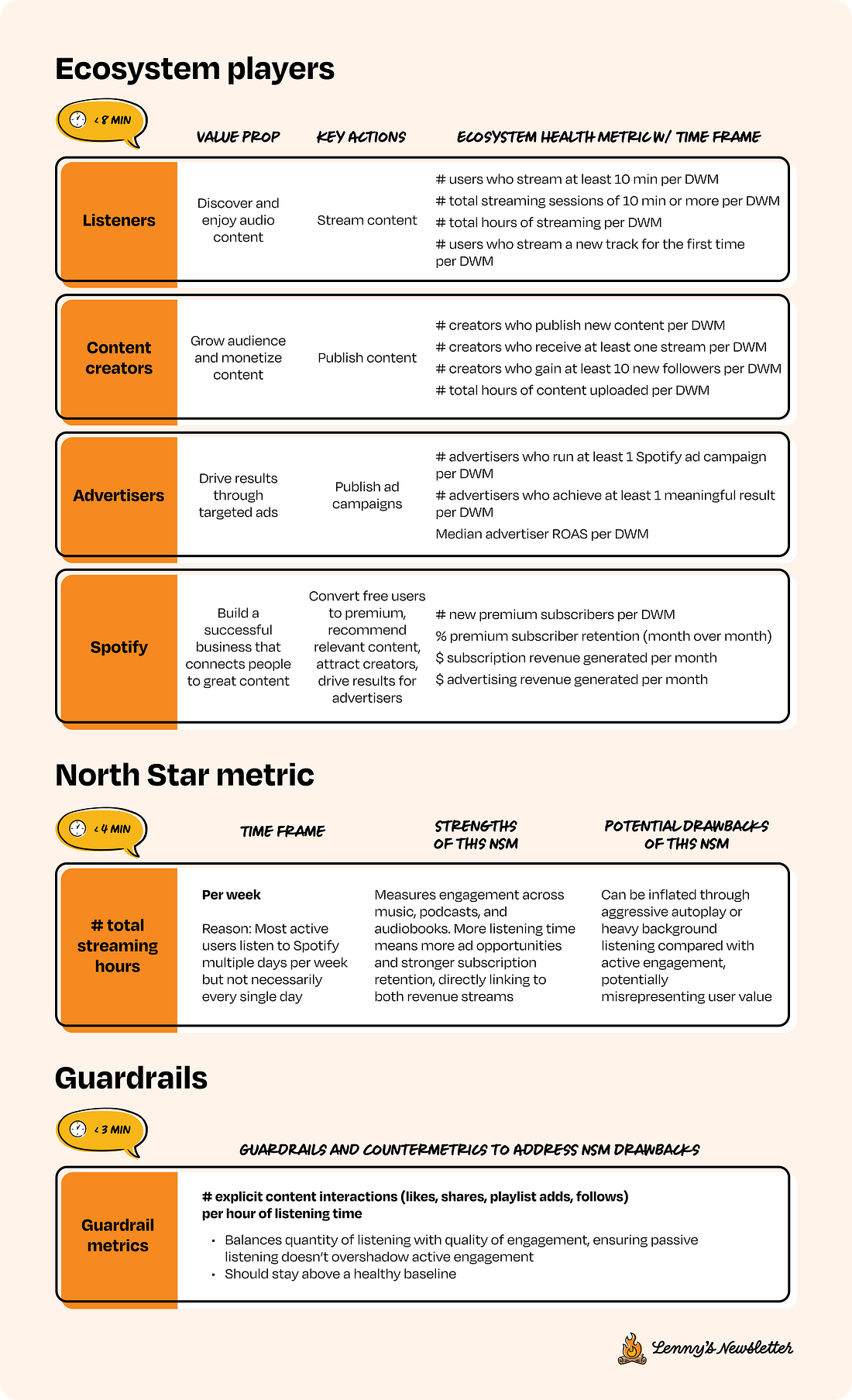

If you can’t describe your metric to a data scientist in a way that they could run a query with, it’s not a useful metric. Always define metrics so specifically that someone could implement them tomorrow, and focus on 3-5 primary metrics per ecosystem player rather than trying to capture everything. Metric selection can also become problematic if you use averages or ratios as North Star metrics. Here’s why this backfires: if your NSM increases while your ecosystem actually shrinks, you’re getting a false positive. I’ve watched candidates confidently present metrics that could look great even as their product dies (not exactly what you want to signal to an interviewer). 💡 Tip: Spend about 2 minutes organizing your thoughts before sharing your metric framework with the interviewer. Examples of metric frameworksLet’s now apply our metric framework principles to our question: How would you measure success for Spotify? The framework below organizes metrics by players (listeners, creators, advertisers, Spotify), tracking value creation across the ecosystem. I like tracking daily, weekly, and monthly (“DWM” in short) in the ecosystem metrics section before narrowing in on one time frame for the NSM. The NSM, “total streaming hours per week,” measures the total volume of our unifying action that benefits all ecosystem players in a way that matches real engagement patterns. The guardrail metric prevents becoming a passive platform. Additional examples:

How to practice metrics frameworksWith the products you chose earlier, spend about 10 minutes doing the following exercise with each:

Step 4: Goal-settingAfter you’ve nailed down a solid metrics framework, here comes the critical transition that trips up a lot of candidates: making an “altitude shift” from company/product-level metrics to specific team-level goals. This is where you show the interviewer you can bridge strategy and execution—a skill they’re evaluating... Subscribe to Lenny's Newsletter to unlock the rest.Become a paying subscriber of Lenny's Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Similar newsletters

There are other similar shared emails that you might be interested in: