The Opportunities in Consumer AI

The Opportunities in Consumer AIMapping Where to Build + Examining Changes in Product Design & Business ModelWeekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities. If you haven’t subscribed, join 70,000+ weekly readers by subscribing here: The Opportunities in Consumer AIThere are a lot of “hot” categories in early-stage venture right now: vertical AI; deep tech; defense. But as we argued in last fall’s Play It Cool: Chasing Heat vs. Being Contrarian in Venture Capital, hot sectors are often not the best places to spend time. Once a space has heat around it, it’s probably too late:

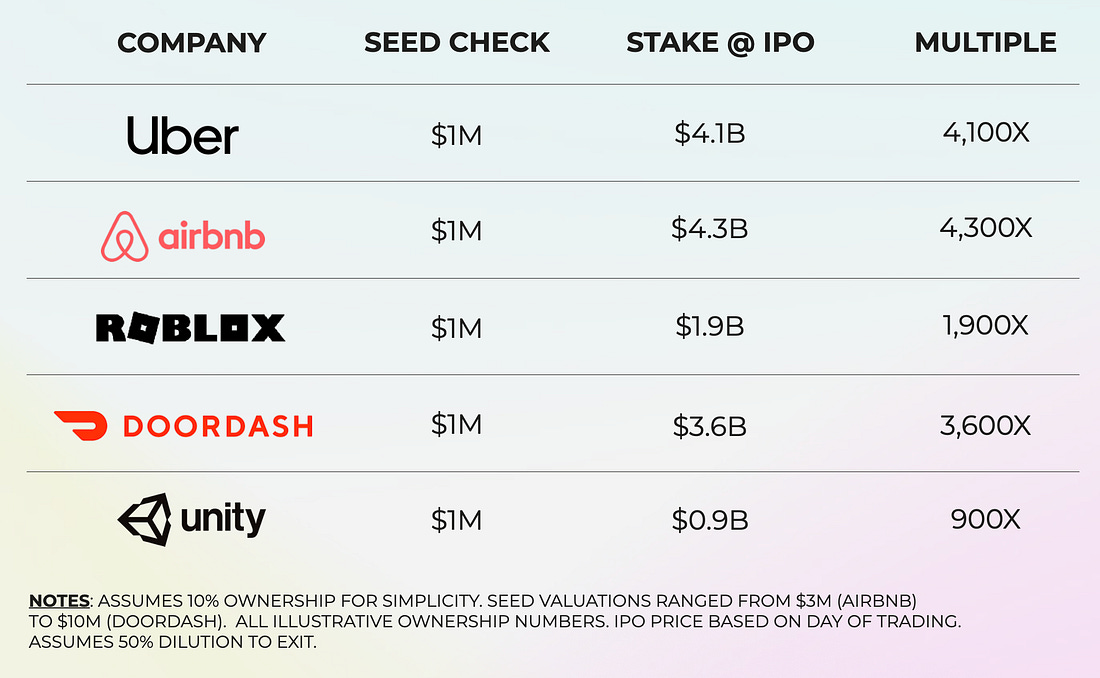

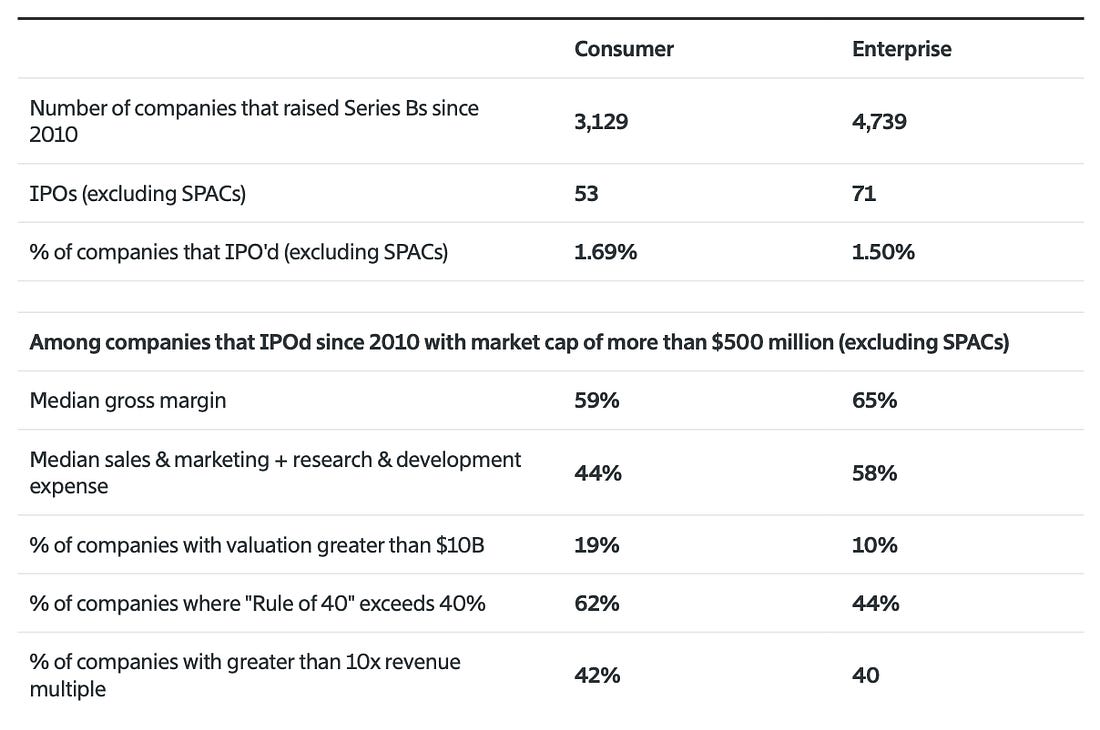

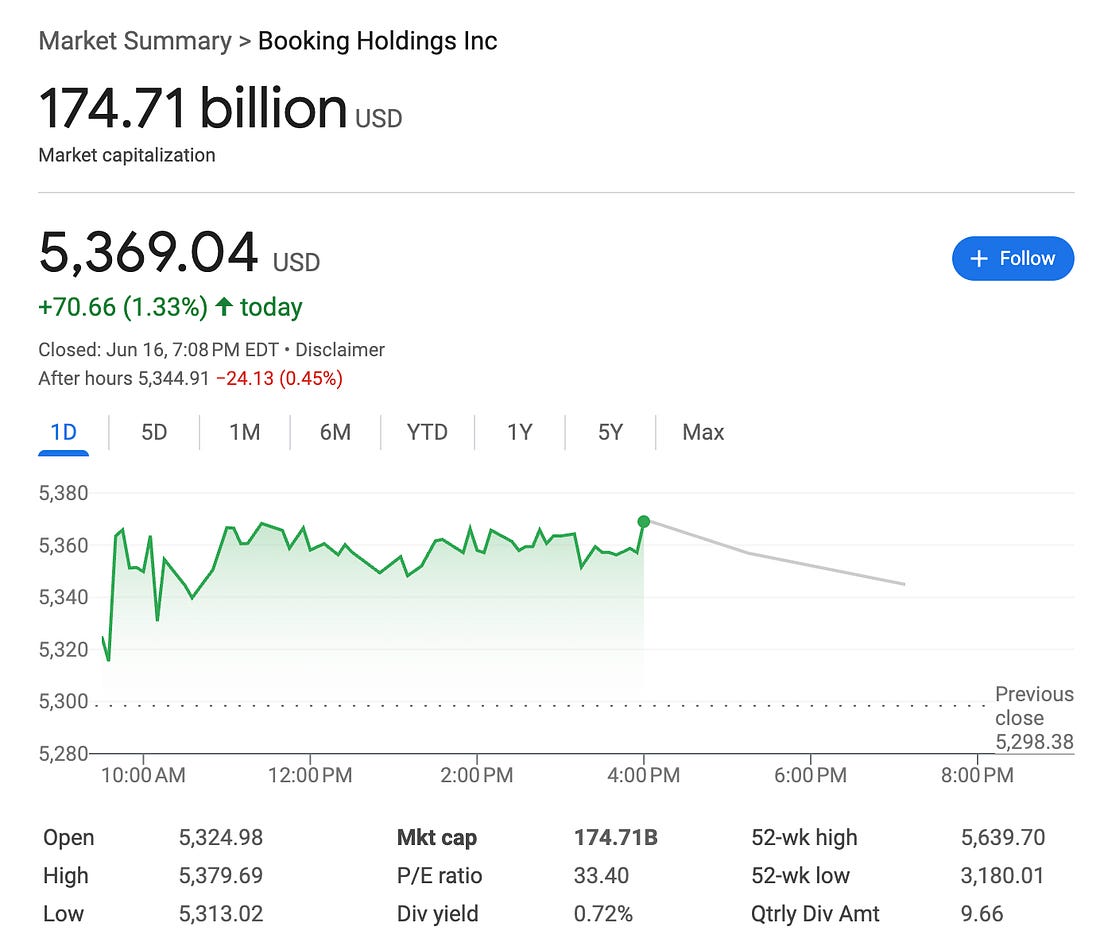

And so on. Success in early-stage venture is about being contrarian; when folks zig, you should probably zag. This is one reason consumer is a great place to spend time right now. Of course, diversification is a good thing: we have plenty of B2B in the Daybreak portfolio (we’re about 50% consumer, 50% enterprise). But any good venture capital firm should actively spend time in consumer; it’s where the wins are biggest, and this is an industry built on outliers. Back in The Consumer Renaissance, we looked at the data: Carta found that just 7.1% of Seed capital raised in 2023 went to consumer startups, less than half the share from 2019 (14.3%). Yet the biggest technology companies in history began in consumer: Apple, Amazon, Google, Meta. Even more puzzling, we’re just a few years removed from blockbuster IPOs: DoorDash ($92B market cap), Uber ($182B), Airbnb ($86B), Roblox ($65B), Coinbase ($65B), Robinhood ($66B). All of those companies are on par with or larger than the biggest enterprise IPO of the past decade, Snowflake ($69B). Here’s how much a $1M investment in the Seed round of five recent consumer IPOs would yield: There are a bunch of footnotes here, but it gets the point across: consumer wins are big. Forerunner analyzed over 12,000 venture-backed startups that have raised a Series B since 2010, categorizing the companies into consumer and enterprise. They found that consumer companies are more likely to go public if they’ve raised a Series B. And of the consumer companies that went public, 18.8% did an IPO at a valuation of more than $10B, nearly double the 9.6% rate for enterprise companies.

Speaking of Forerunner: Daybreak is co-hosting an event next week in San Francisco with our friends there, alongside other co-hosting firms like Sequoia, Greylock, Thrive, Footwork, and Union Square Ventures. The event is called Humans in the Loop and centers around consumer AI; if you’ll be in SF next week, register here and I’d love to see you there. Anyway—I’ll do a piece after the Summit breaking down the demos, fireside chats, and presenting companies. But this week, I want to look at which areas of consumer will be disrupted with AI, then look at how product design and business models are evolving:

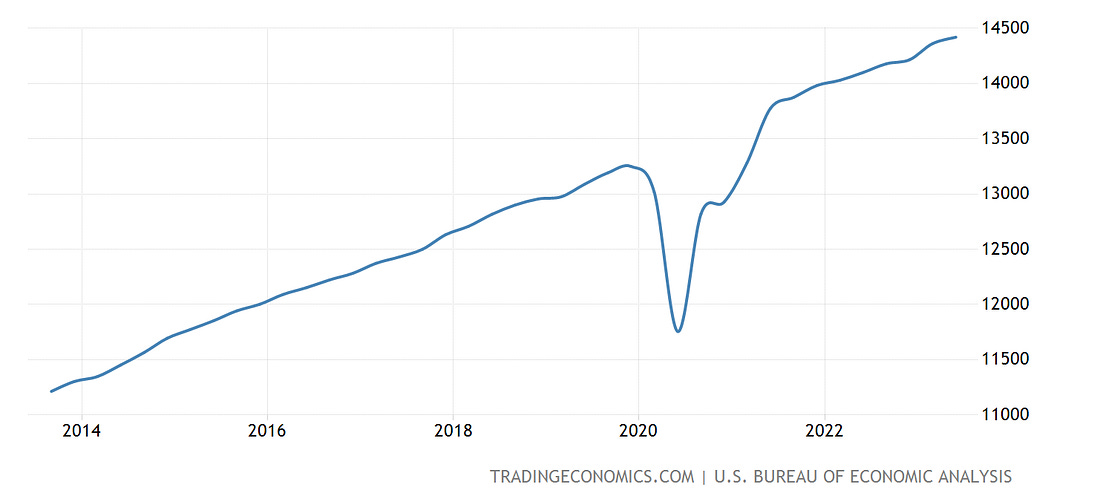

Let’s dive in. Mapping Consumer SpendHere’s a chart of consumer spend. It commits egregious Y-axis crime—starting at 11,000? come on!—but it’s helpful nonetheless. After a COVID dip in 2020, spending rebounded and has been rising steadily the past few years. The Y-axis is in billions here, meaning that the chart ends at around ~$14.5 trillion in U.S. consumer spend. When I think about categories ripe for AI disruption, I think about big categories of consumer spend. Let’s briefly touch on a few. ShoppingLast month’s Agentic Commerce covered what’s happening in shopping: just as the past 20 years was about e-comm’s penetration into retail, the next 20 years are about agents’ penetration into retail. On the infrastructure side, this means companies that will help agents communicate with brands and retailers. On the consumer-facing side, we’ll have platforms that use LLMs for conversational commerce. Everyone gets a personal stylist. Stitch Fix became a public company by marrying human stylists with data science. There’s a much better technology “why now” today, with LLMs able to parse massive catalogs and personalize recommendations. This is a $100B+ idea; what will be the destination where people start serendipitous, curiosity-driven shopping journeys? We’ve seen Daydream amass $50M in Seed funding, and Alta Daily went public with its raise this week. At Daybreak, we have one company building here that’s still in Stealth. TravelThe dotcom boom gave rise to the OTAs—Online Travel Agencies like Booking.com and Expedia. These companies are behemoths, but using them feels like time-traveling back to 2005. Why are we still using OTAs to book travel? AI creates a massive opportunity for disruption. When I think about travel, I think about two segments:

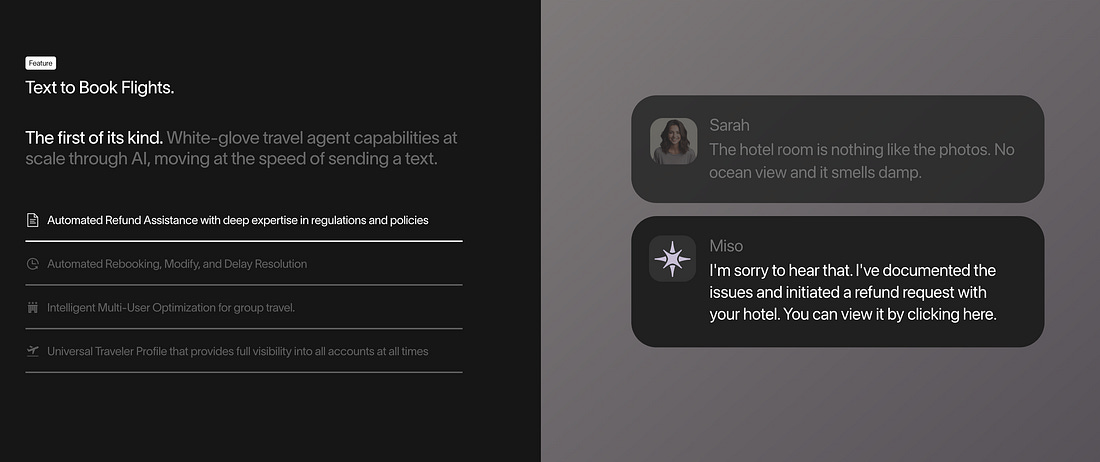

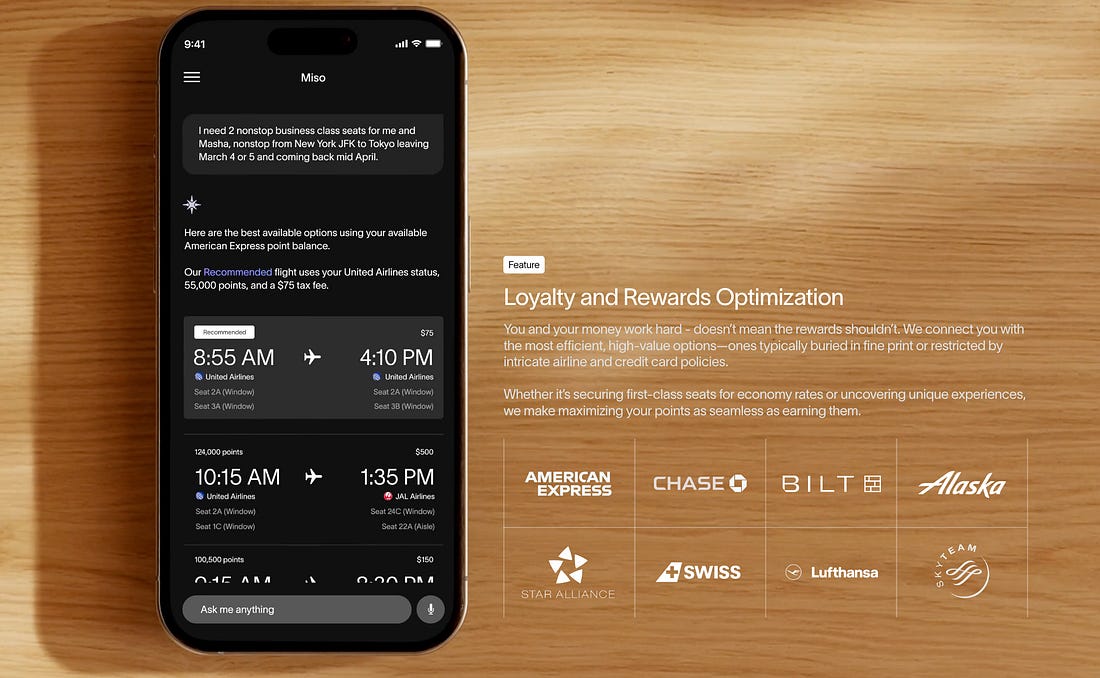

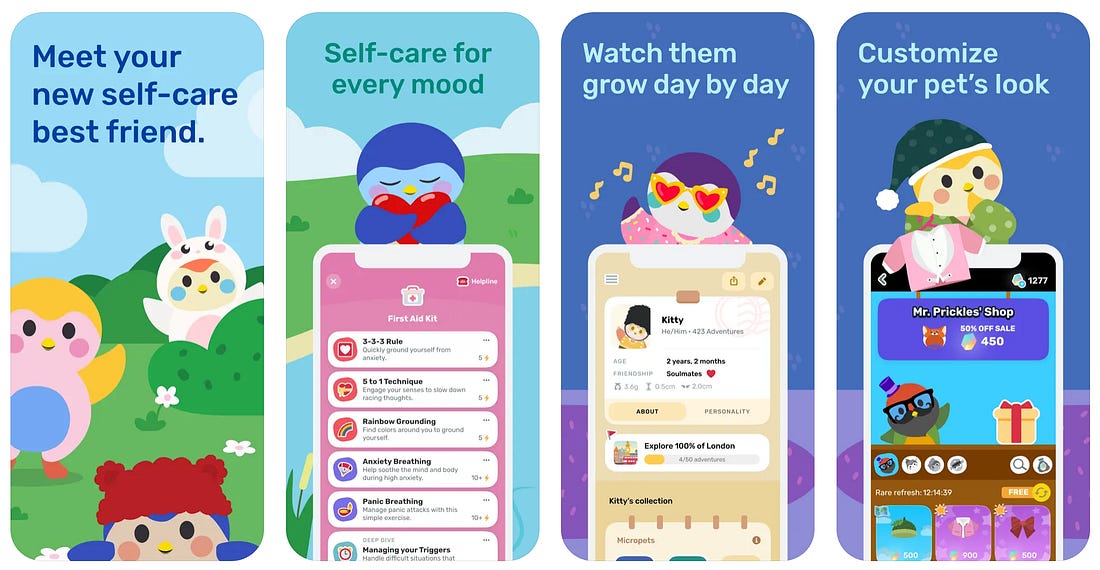

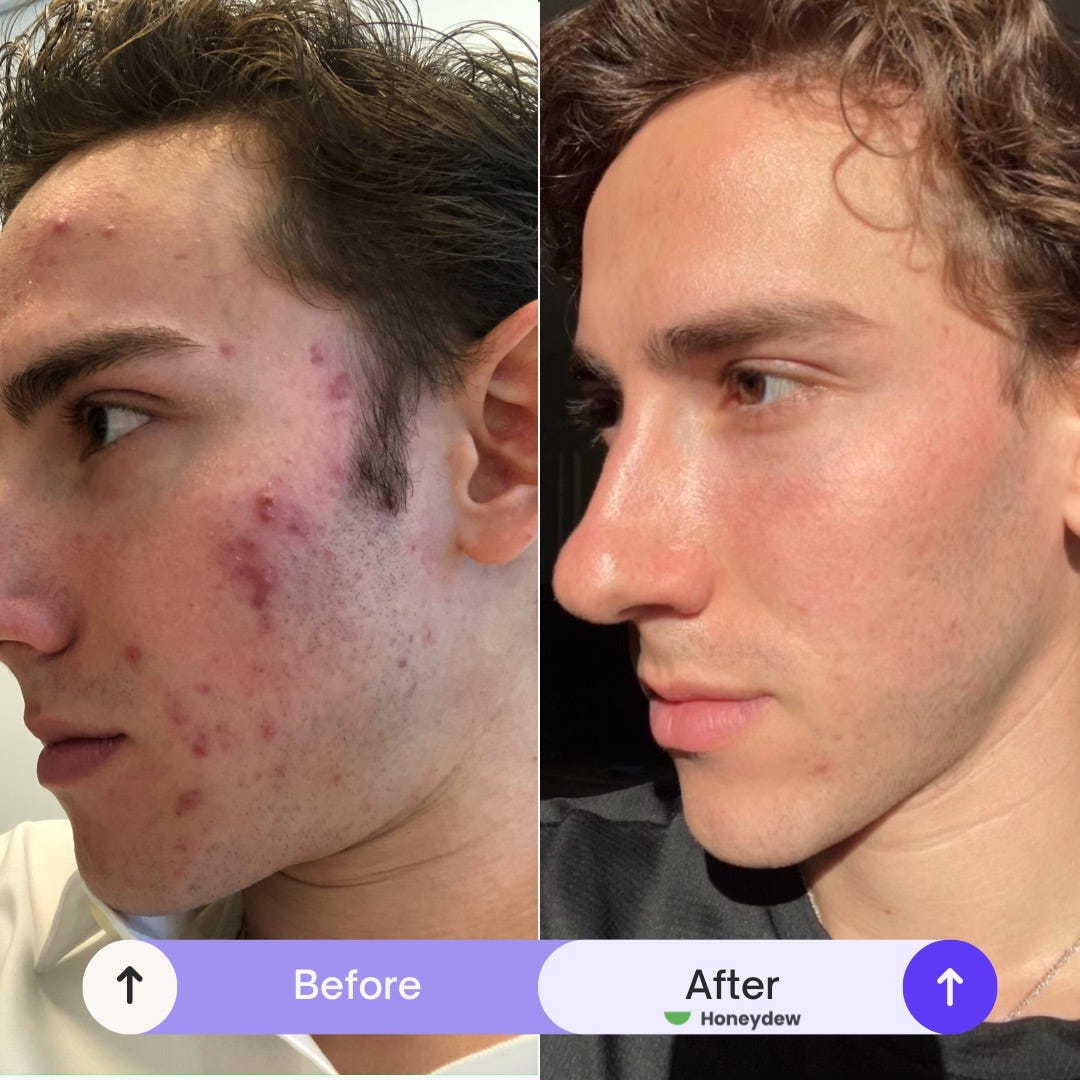

When it comes to startups, I’m more interested in the latter category. The itinerary / planning stage is tricky, and I think consumers will stitch together ChatGPT and TikTok and influencer itineraries. For booking, though, the “job to be done” is a lot clearer: just book me the damn flight. One of my favorite companies in AI + travel is Miso, which focuses on the booking side. Miso operates like a white-glove executive assistant, helping you execute everything from “change my seat to a window seat” to “move me to a different hotel.” Everyone gets an AI assistant to manage their trips. This is the future: we won’t be wading through a sea of links and pop-up ads on OTAs to book travel. We’ll have agents do it for us. KidsWe’ve written in the past about companies like Curio, which embed AI companions into toys. There are a few of these startups, and there’s probably a big business to be built here: I don’t generally believe in AI hardware (I think smartphones will be the AI device, at least for a while), but kids’ toys are the exception. Parents don’t want their kids on screens, and toys are a natural vessel for AI companionship. This week, OpenAI announced a partnership with Mattel. Mattel makes everything from Barbie to Hot Wheels to American Girl dolls. This is OpenAI’s first partnership with a toymaker, and you can envision the eventual IP agreements. It probably won’t be long until your kid is having a full-on conversation with Barbie. CompanionshipAI companionship took center-stage in last month’s AI Friends Are a Good Thing, Actually. Some companion companies focus on kids, a natural extension of what we were just talking about. But many companion companies are broader, and have become popular with adults too. Two examples: Tolan (made by the company Portola) provides “alien friends” for you to chat with, and has caught on with people of all ages. It ranks #1 in Graphic & Design on the App Store today. Finch, meanwhile, gamifies self-care: You can create your self-care pet (I named my little bird “Lollipop”) and then get reminders from your pet to drink water, to do a breathing exercise, and so on. Finch ranks #10 today in the Health & Fitness category on the App Store. HealthWe’re going to see consumer AI companies both for horizontal healthcare, and for specific verticals within healthcare. We have one Stealth company in the Daybreak portfolio tackling the former—personalized healthcare using your own data. This is the eventual vision of diagnostics companies like Function and Superpower, with their current products used to amass data to personalize your health. On the vertical front, we’ll see consumer companies get built within each specialty. One of the fastest-growing companies in the Daybreak portfolio is Honeydew, which offers online dermatology care and has more than 7x’d in the last year, with growth accelerating in recent months. AI features prominently on the Honeydew roadmap: why should someone have to wait for a derm appointment when AI can quickly assess and provide baseline guidance for many skin conditions? By the way, Honeydew is hiring a Provider Ops Lead (job description here) and its first-ever Product hire (job description here) in case anyone wants to join the team. I’m biased, but you’d be hard-pressed to find a faster-growing or more impactful company 😊🍈 Zooming out, I expect AI to seep into every part of healthcare. Consumers now demand more convenient, more affordable, and more personalized treatments. Tech innovation is colliding with that shift in consumer expectations, and large companies will result. LearningI break down learning, like travel, into two categories:

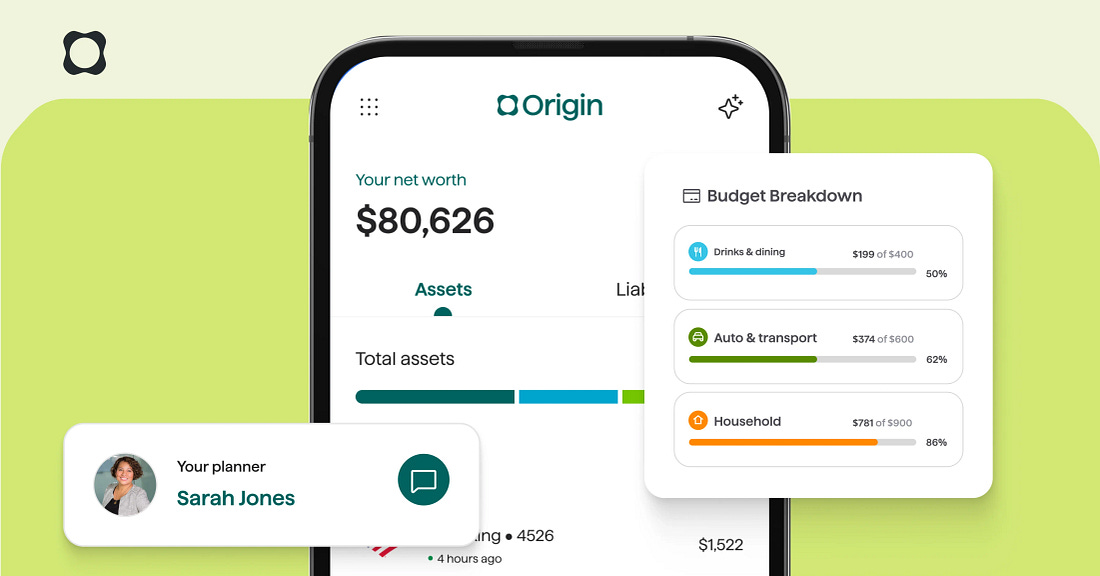

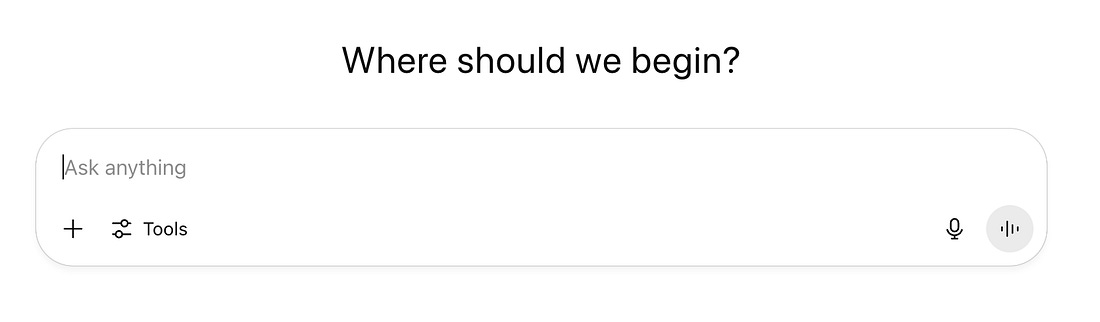

Both can result in large consumer AI businesses. I’ve seen more companies crowd into the latter, but I think the former category is just as interesting. FinanceI haven’t seen much in the intersection of money and AI, not for lack of looking. We’re seeing a resurgence of consumer fintech products: Monarch and Origin, for instance, are both growing well and benefited from Mint shutting down. I think there are several big businesses to be built in this intersection. HousingHousing is the biggest category of consumer spend. I also haven’t seen much here, but it feels ripe for disruption. There are a few companies tackling pieces of the home—mortgages, for instance, or home services bookings. But there’s probably a $10B+ AI company to be built that manages the ‘home life’ experience end to end: from paying rent, to staying on top of utility bills, to running day-to-day house management stuff. Innovations in Product DesignSo far in consumer AI, chat has been the dominant interface. But I liked a piece from Speedinvest that questioned whether chat is the right interface. I’ve also been wondering this. We could assume that because ChatGPT is chat-based, every other consumer AI product should follow suit. But that’s the wrong line of thought. Speedinvest uses an example:

The point here is that a blank chat is intimidating, presenting high cognitive load. This isn’t dissimilar to early computers, which required you to type specific commands. Only with the arrival of the graphical user interface (GUI) did users get more intuitive ways to interact with computers. Users got nudges in the right direction. Speedinvest is right that chat isn’t the best interface for many consumer AI products. In How Consumer Psychology Informs AI Product Design, we wrote about the paradox of choice: too much choice can make a consumer freeze and give up. A blank chat interface like ChatGPT works because it’s replacing the familiar Google Search, but it might not work as well for specialized use cases. For the curiosity-based AI learning example, for instance, we might find chat daunting: there’s so much to learn, how can we ever choose? We might need nudges in the right direction, perhaps based on trending topics (“Learn about the history of the Gulf of Mexico”) or on things personal to us (“Five things you didn’t know about the West Village”). Innovations in Business ModelFor a long time, consumer and enterprise had different metrics. Consumer was all about user growth and engagement (time spent in the product). Monetization? That could come later. Enterprise, meanwhile, was all about revenue revenue revenue. Now, we’re converging to ARR (annual recurring revenue) for both consumer and enterprise. All of a sudden, people are actually spending money on fledgling consumer products. In Came for the AI Tool, Waiting for the AI Network, I wrote about my friend’s PopDaddy AI videos. He told me that it can cost upwards of $200 (!) to make a single 30-second AI music video. This is because many of the AI creative tools are usage-based. ChatGPT, of course, is a subscription business, with 10M paying subscribers. Miso, mentioned above, is also consumer subscription. Finch and Tolan, both still early-stage startups, are both reportedly north of $10M in ARR. Tolan initially wasn’t leaning into monetization, but it found costs rising too quickly. From a RevenueCat blog post:

This is common in consumer AI (costs are still high), and, in my mind, this is a good thing: it’s important to suss out early what people are willing to pay for. Paywalls are becoming more common, and a helluva lot easier. (Helium, the Daybreak company mentioned in last week’s The Personalization of Software, is a pick-and-shovel here, helping apps automate their paywalls.) My friend Sasha had a good tweet about the shift toward paywalls. Apps, he argued, started free. If they were paid, you had to pay to access the entire app (iBeer, for instance, cost $2.99). A classic. Then apps shifted to freemium models. Think Duolingo, Strava, Calm, and so on. Now, we have aggressive paywalls, and Sasha points to a few reasons:

I don’t know about you, but I definitely click my Apple Pay a lot more often these days—and I’m more willing to pay for a high-quality product. This is a major shift in early-stage consumer: revenue is back, and it can help products grow a lot more efficiently with less reliance on outside funding. Final ThoughtsIn a couple weeks, I’ll write about the Humans in the Loop event, breaking down the early-stage companies presenting and which topics get talked about. See you next week! Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: |

Similar newsletters

There are other similar shared emails that you might be interested in: