How to Start Angel Investing 💸

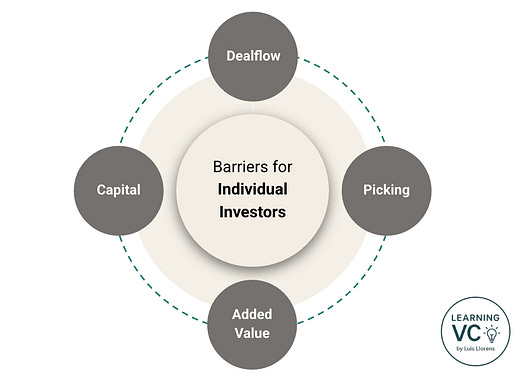

How to Start Angel Investing 💸Creating my Private Community for Family Offices and Individual Investors.Welcome to Learning VC💡! I’m Luis Llorens and I write monthly about VC, fundraising and my personal experiences as an investor. If you want to promote your product or service at Learning VC💡, submit your application here. 👼 Become a Business AngelAngel investing is one of the most exciting ways to participate in the startup ecosystem. It’s also one of the most misunderstood. At its core, angel investing is about backing people before the numbers make sense. You’re investing in vision, execution, and trust. Not traction. Only invest an amount you can afford to lose, as it is a high risk/ high return investment. Decide how much of your net worth you’d like to use to angel invest. Ideally, start only if you can make at least 10 investments to diversify your portfolio. Timing is also important. You’re entering at the very beginning of a company’s journey, and you’ll likely be one of the last to cash out. Occasionally, there might be opportunities to sell part of your stake during later rounds (for example, when new investors join), but expect to be in it for 7-10 years if the company succeeds. Access To The DealsThe main barriers for 1st time angels are capital, access to quality deals, and structure. You can think of the investment process in 4 key pilars:

Traditionally, investing in startups meant dealing with messy paperwork and small ticket sizes that didn’t justify the hassle. Today, that’s changing fast. 💡 How to StartStart by understanding the dynamics and timelines of angel investing. Build your name in the space, or more easily, join a syndicate, angel community, or crowdfunding platform. Start small and diversify. Angel investing is a long game. Expect some write-offs, and 1 or 2 big wins that make it worthwhile. Invest through structured vehicles led by people you trust, with a clear differentiation. Entrepreneurs often set a minimum check size that’s too high for first-time angels, so joining deals through SPVs (Special Purpose Vehicles) with other angels can make more sense. 🚀 Join My CommunityThat’s why I’m creating a private and exclusive community of Family Offices and individuals who want to invest in startups. If you’re interested, apply here, it will take you less than 1 minute: If you’re not premium subscriber yet, you’re missing out! Sign up now to unlock:

That’s all folks👋 — thank you for taking a look! If you liked this post, don’t forget to subscribe and follow me on LinkedIn 🔔 You're currently a free subscriber to Learning VC💡. For the full experience, upgrade your subscription. |

Similar newsletters

There are other similar shared emails that you might be interested in: