26 Predictions for 2026 (Part II)

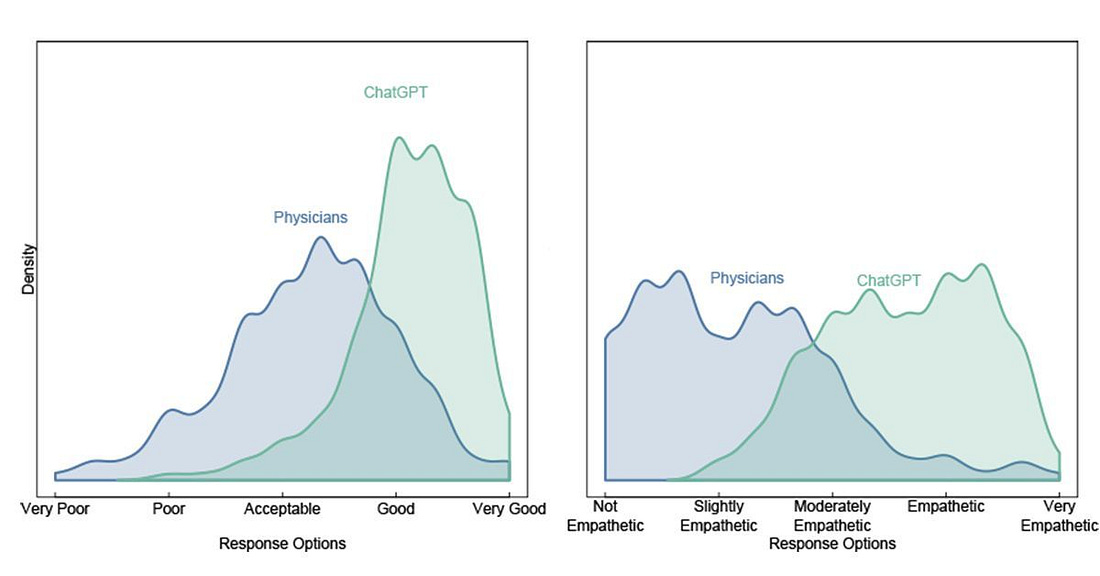

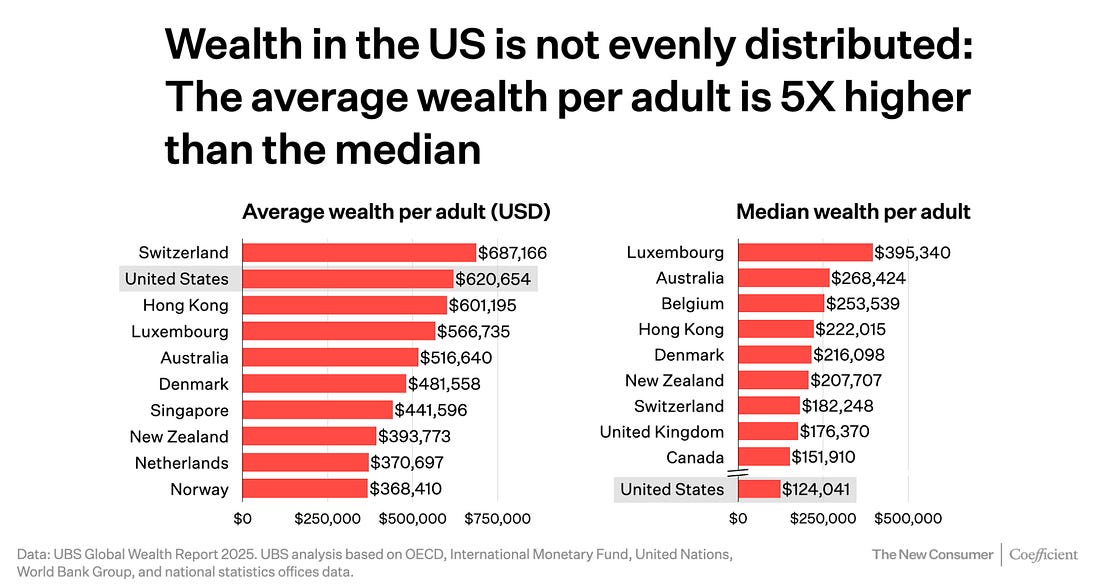

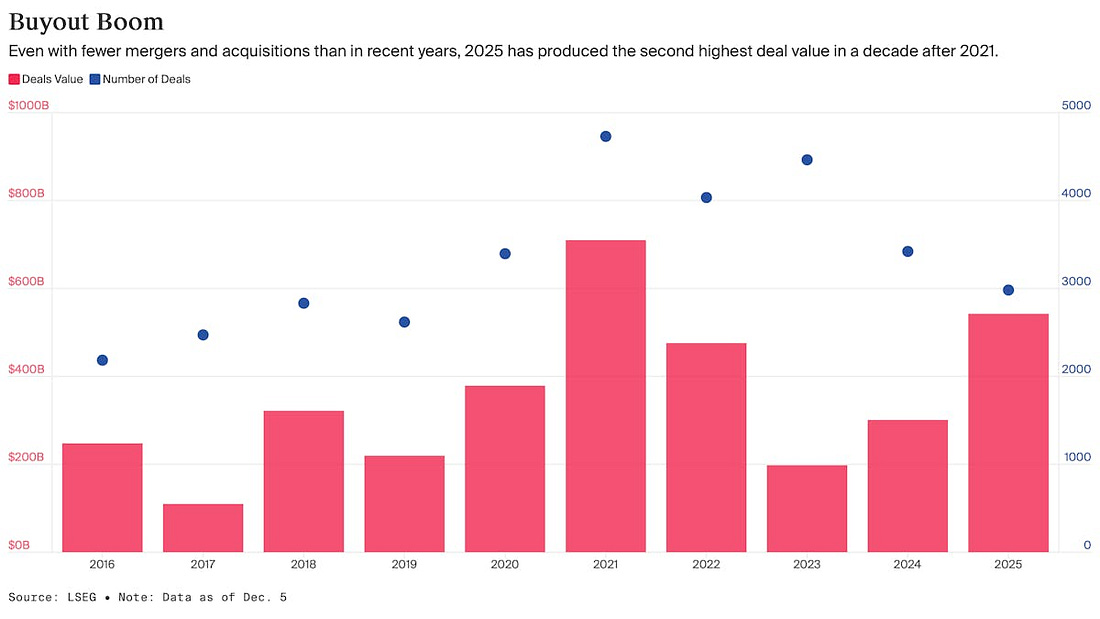

Weekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities. If you haven’t subscribed, join 70,000+ weekly readers by subscribing here: 26 Predictions for 2026 (Part II)Two weeks back we graded our 25 Predictions for 2025. I’m going to amend one of our grades. I’d given us a B+ for Prediction #4: I’ll amend this to an A+ and give myself a little pat on the back. Last week OpenAI and Disney announced a partnership, making the final line of last year’s prediction look pretty damn good: Okay, enough self-congratulations. Before we end up on VCBrags, let’s finish our 2026 predictions. Last week in Part I we covered predictions #1 through #13, which encompassed everything from ChatGPT launching ads, to Anthropic IPO’ing, to social media feeds going synthetic. This week we’ll tackle #14 to #26. Without further ado… Prediction #14: The CFO suite is the new buyer du jour.Here’s a good exercise for any applied AI company: ask your customer for a P&L, then use that P&L to inform your product roadmap. Any good AI product should (1) increase revenue, (2) decrease costs, or (3) do both. The P&L will give you a good idea which levers to pull. Particularly timely are labor costs, which can now be automated by AI. This sounds dystopian, until you realize that technology has a long history of displacing jobs. (A popular job in the early 1900s was “Lamplighter,” with men—yes, they were almost always men—walking an average of 10 miles per night to light a city’s lamps. Were those men mad at Thomas Edison for ruining their jobs, or were they happy to move on to less exhausting work?) Technology also has a long history of creating jobs, and some early studies are showing that AI is currently creating more jobs than it’s taking. Anyway: the CFO is a good buyer for many AI products. Functional heads might be more obvious buyers, because tools are built for their specific workflows. But CFOs are the ones counting the pennies, and they’re the ones looking for P&L-boosting products. Many startup founders will begin directing sales motions to the CFO suite. Prediction #15: Prediction markets mature, meaning we move from exchanges → economies.A 2025 prediction was the explosion of prediction markets (grade = A+) and in 2026, we’ll see an economy form around prediction markets. Kalshi and Polymarket are the duopoly in exchanges, and though they saw their valuations skyrocket in 2025 (starting the year sub-$1B and ending the year at $11B and $9B, respectively), they still have a lot of room to run. Charles Schwab is a $175B company—and, by the way, its eponymous founder is an early investor in Kalshi. We’ll see both Kalshi and Polymarket swell again in 2026. Equally fast-growing will be the tools that form around the exchanges. For our 2025 prediction, we predicted a new unicorn amongst the exchanges (we got two). For 2026, the prediction is a new major player in the picks-and-shovels for prediction markets. If prediction markets are the new trillion-dollar asset class, what infrastructure needs to be built? Who will build the Bloomberg of prediction markets? We probably won’t see a unicorn (yet), but we’ll see a company valued > $100M this year in prediction market tooling. Prediction #16: AI finally gets its memory—and that explodes open use cases in both consumer and enterprise.One of my favorite frameworks for thinking through startup creation comes from Sequoia’s Alfred Lin. During the rise of mobile ~15 years ago, Lin did an exercise: break apart features of the iPhone, then predict which companies each feature could enable. The example Lin points to: the GPS allowed couriers to drive around with Google Maps, delivering food. Sequoia ended up investing in DoorDash. Other examples I can think of:

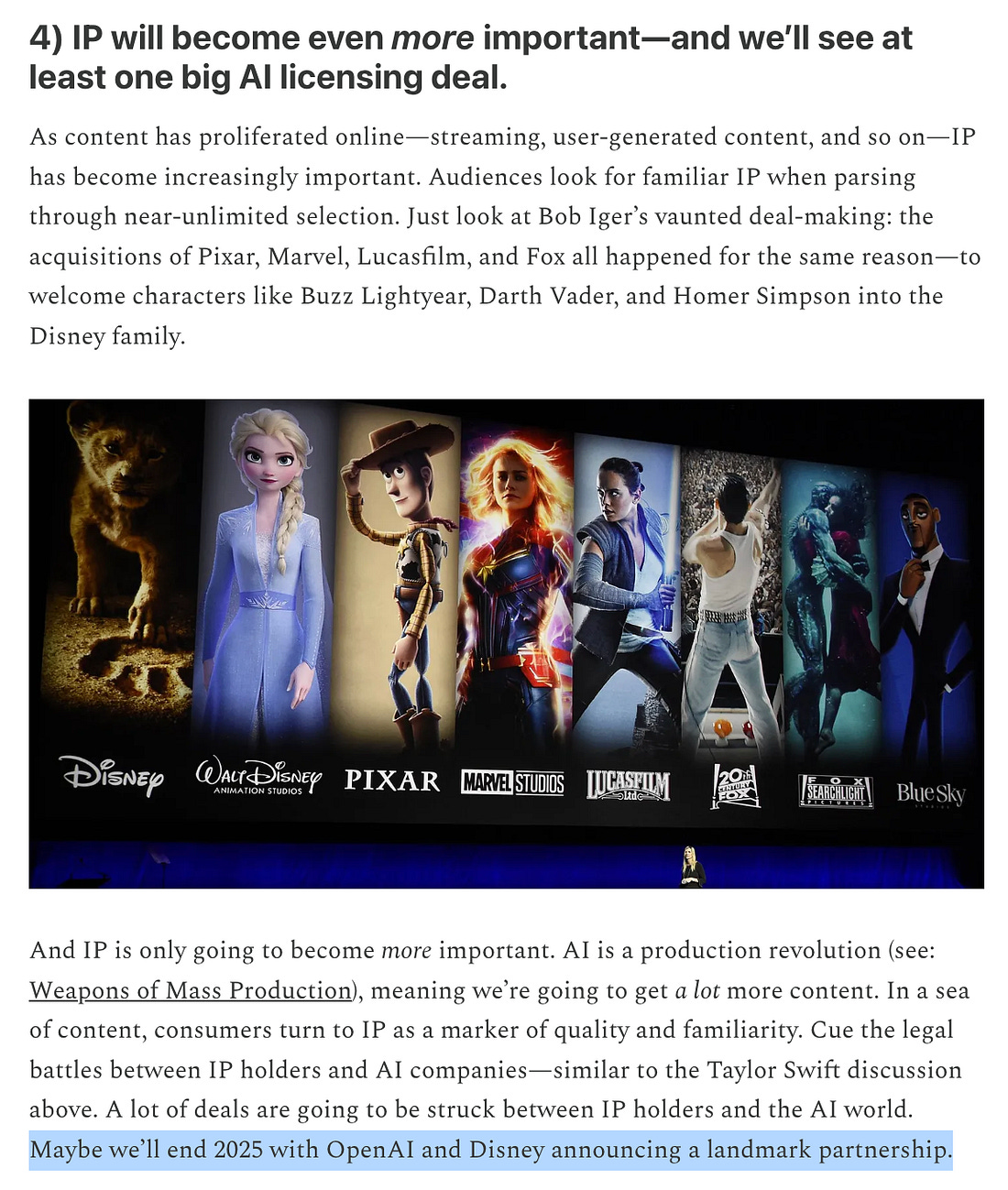

Now apply the same framework to AI. What capabilities exist in the new models, and what companies will they enable? A big capability is memory. Right now, most AI interactions are ephemeral, meaning the model forgets between sessions. This is hugely limiting for AI applications. But models are getting better at memory (rapidly) meaning we’ll see new applications born from these improvements. You can make the GPS analogy with mobile. What’s an example here? Last year we predicted a breakthrough year for digital clones—essentially persistent AI models personalized to an individual. This didn’t happen (I think we were a year or two early), but you can see how memory will accelerate the capabilities of digital clones. Prediction #17: Death of the CRM.CRMs exist because humans are pretty terrible at remembering stuff: we need to log contacts, notes, communications. CRMs are sort of externalized human memories residing within a company. Another reason that CRMs exist is because software couldn’t understand messy, unstructured data. Emails, calls, meetings, Slack messages, docs. They were tough to ingest and understand. AI changes the game. Agents are smart, and unstructured data doesn’t present as much of a problem. We no longer need clean fields, because AI systems can read and interpret our communications. This means we see the death of the CRM, or at least the CRM traditionally defined. Last week we wrote about Salesforce (maybe) changing its name to Agentforce, which is indicative of the shift. How we organize and pull information within orgs will change dramatically in 2025, and everyone who has ever mind-numbingly filled in a CRM will breathe a sigh of relief. Prediction #18: We see the first AI doctor visit get reimbursed by insurance.This is something I’ve been excited about for a long time. If AI is outperforming physicians across benchmarks, why isn’t care delivery being reinvented by AI? Well, because AIs don’t get paid by insurance.

This will change; it’s a question of when, not if. And this is the Holy Grail for AI x healthcare. I like how Chemistry put it in their 2026 predictions:

They’re right: startup innovation will explode once we have a new methodology. I’m not convinced 2026 will be the year, but there are some major events on the horizon. CMS is expanding its AI-enabled service reimbursement through specific codes and rule updates for 2026. And bills like the Health Tech Investment Act, introduced back in April, hope to create a Medicare reimbursement category for algorithm-based medical services. We’ll see how that legislation progresses in 2026. Prediction #19: And that isn’t the only policy shift. The U.S. government moves aggressively to protect and accelerate the AI race.Today’s technology landscape is the result of government policies set in place during the internet boom. Liability shield policies in 1996, for instance, protected online services from liability from user-posted content, paving the way for social and content networks to emerge. Copyright safe harbors set forth in 1998, meanwhile, basically paved the way for YouTube’s entire business model: online service providers would be protected as long as they followed notice-and-takedown requirements. And, of course, we saw landmark antitrust cases like U.S. v. Microsoft, which targeted bundling behavior tied to Internet Explorer. We’re about to see a slew of AI policies that lay the groundwork for the next few decades. I expect we see policies in two major forms: (1) deregulation, with the government working hard to remove regulations that hinder AI development, typically packaged with the talking points of emboldening the U.S. against China; and (2) encouraging competition, with support for open-source models that prevent incumbents from dominating AI. Prediction #20: But government fails to prevent AI driving up the Gini Coefficient.The Gini Coefficient measures income inequality, and it’s been trending up in America for a long time: This chart only goes through 2018, but recent 2023 / 2024 data shows that the Gini Coefficient is hovering around 0.49 right now. The below visual, showing average vs. median wealth in America, stood out to me in Dan Frommer’s recent report. It’s… not great. In 2026, I unfortunately think the Gini Coefficient gets worse. AI will continue supercharging capital markets, which are disproportionately accessed by the wealthy (the wealthiest 10% of Americans own 93% of the stocks). Meanwhile, hourly and salaried workers will see wages stagnate, which will worsen a deep and growing anti-AI populist sentiment. I don’t have confidence that the government can create policy changes in time to offset this disparity (and the Gini Coefficient is heavily dependent on policy). One timely example of growing inequality represented in culture: Neon, the film distribution company behind recent Best Picture winners Parasite and Anora, has a new film coming out called No Other Choice. The film tells the story of a South Korean worker who, after being abruptly laid off by his company, begins to eliminate his competition for an open job in increasingly brutal companies. As part of the marketing for the movie, Neon cordially invited “all Fortune 500 CEOs” to a free screening. If that ain’t a sign of the times, I don’t know what is. Prediction #21: Roomba gets an upgrade.When I hear “I Robot” I think Will Smith fighting robots. That’s because I’m a movie-loving Millennial, who definitely saw this in theaters when I was 11: But “I Robot” also refers to a company (spelled iRobot, to be specific), and it’s the company that owns Roomba. iRobot had a rough year. Amazon was supposed to buy iRobot for $1.7B in cash, but regulators said nope, not gonna happen. Lina Khan’s FTC and the UK’s Competition and Market Authority launched investigations, and the acquisition ultimately got blocked. iRobot instead filed for bankruptcy, and the bankrupt company will now be swept up by Shenzhen-based Picea Robotics. This is a pretty rough story. In an effort to protect American and British interests, Roomba will now be owned by… a Chinese company? Not great. More on tech M&A in the next section, but related to Roomba: I think 2026 brings a major upgrade on household robotics. NEO billboards are plastered everyone, and the (excellent) launch video for Sunday seemed to pierce the news even outside the Valley. By the end of 2026, Roomba will look quaint. Consumer robotics are in for a hell of a year. Prediction #22: With a new FTC, acquisitions galore! The next Roomba is safe.I don’t think we see many more failed acquisitions like Roomba. Instead, we’re about to see the floodgates open on M&A. Last year we predicted a new record set for the largest venture-backed startup acquisition. We got that, with Google / Wiz ($32B) handily beating Meta / WhatsApp ($19B). I don’t think we see that record broken in 2026, but I do think we get a new overall record. The current record for tech M&A in a single year is ~$700B in 2021; 2025 is second-highest on record. I’m going to go out on a limb and say we clear $800B in 2026, and maybe we approach $1T. Prediction #23: Get ready to hear a lot about world models.Heading into 2026, most people outside of tech circles haven’t heard of world models. Large Language Models are now a household term, but world models? Still new. That’ll change this year. While LLMs focus on text, world models focus on the physical world around us. I like how the WSJ put it: “Today’s AIs are book smart. Everything they know they learned from available language, images and videos. To evolve further, they have to get street smart. That requires world models.” In 2026, AI gets street smart. Godmothers and godfathers of AI like Fei-Fei Lin and Yann LeCun have already started companies in the space, and we’re only getting started. “World Model” is my submittal for 2026 “Tech Term of the Year.” Prediction #24: We see the bubble pop in |

Similar newsletters

There are other similar shared emails that you might be interested in: