Dealflow LatAm #28: Merama becomes unicorn. Axeptio acquires AdOpt. Patria launches $500M VC platform.

- Yoel Rodriguez of Dealflow LatAm <dealflowlatam@substack.com>

- Hidden Recipient <hidden@emailshot.io>

Dealflow LatAm #28: Merama becomes unicorn. Axeptio acquires AdOpt. Patria launches $500M VC platform.Welcome to the 28th edition of the Dealflow LatAm newsletter: a weekly summary of everything that happened in the LatAm startup and investment ecosystem.Hey, it’s Yoel 👋 Back again with the 28th edition of Dealflow LatAm—your go-to source for all the deals, moves, and momentum in the region’s startup scene. A high-energy week in LatAm: the fundraising scene was on fire, including one that turned Merama into a unicorn. We're also rounding up the biggest raises of the past month, plus a wave of new VC and credit funds unlocking fresh growth opportunities across the region. Plenty to break down—so let’s get into it 🚀 This week's newsletter is in collaboration with Finnovista to share the Fintech Radar Colombia 2025, the key report on innovation in Colombia’s Fintech scene. If you're a Fintech operating in the country, don’t miss the chance to be featured. 👇 In our Interesting Reads 💡 section, we’re also featuring an exclusive insight from Jordi Puig, Innovation & Programs Director at Finnosummit, offering a preview of what’s ahead in Colombia’s Fintech landscape. Startup funding news 💸Rounds of $10M+:

Rounds $1M to $10M:

Other rounds of funding:

M&A transactions 🎊🇧🇷🤝🇫🇷 AdOpt is acquired by French CMP platform Axeptio to expand in Brazil. The deal strengthens Axeptio’s global reach and leverages AdOpt’s LGPD expertise and client base of over 50,000 sites. 🇧🇷 Grupo Stefanini acquires 60% of Escala 24x7, AWS’s top consulting partner in LatAm. The deal aims to boost cloud service offerings and drive $100M in revenue for Escala 24x7 by 2025. Investor & accelerator news 🚀🇧🇷 Patria Investimentos merges Kamaroopin and Igah Ventures to launch Patria High Growth, a $500M VC platform focused on larger checks and secondary deals in LatAm. 🇧🇷🇺🇸 Plug and Play launches $50M fund to back early-stage startups in LatAm, prioritizing Brazil. The fund will invest $50K–$2M in pre-seed to Series A rounds across sectors like fintech, agritech, and energytech. 🇧🇷 Audax Capital launches a $34M agro credit fund, aiming to reach $60M by 2025. The FIDC uses AI for risk analysis and backs the sector’s expected rebound. 🇧🇷 Start Growth launches $2.6M fund to invest in growth-stage startups. The round targets HRtechs, Fintechs, Edtechs, Database, and Martechs, offering capital and strategic support. 🇪🇸🌎 Eatable Adventures launches Raíces, a program to accelerate five Spanish-speaking agrifoodtech startups with up to $1M in funding, connecting innovation across Spain and LatAm. 🇧🇷 FIEMG launches FIEMG Anjos to fund industrial tech startups. The program connects investors with scalable industry-focused solutions. 🇬🇹 Fundea joins The Yield Lab Latam as an investor in its Opportunity Fund, supporting agtech and foodtech startups in LatAm. The fund will back 30 companies in Seed to Series B stages. 🇲🇽🤝🇺🇸 Tec de Monterrey’s EBCT joins the Global Accelerator Network (GAN) to support startup growth. The partnership offers founders global resources, perks, and access to over 200 innovation hubs. Opportunities & Deadlines 👀

Startup news 💡🇦🇷 Argentina

🇧🇷 Brazil

🇨🇱 Chile

🇨🇴 Colombia

🇲🇽 Mexico

🇵🇪 Peru

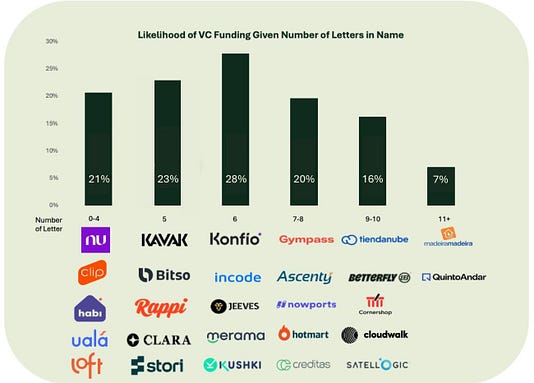

Big company & policy news 💡🇦🇷 Tether to acquire up to 70% of Adecoagro for over $600M, aiming for control with a minimum 51% stake. The move marks Tether’s push into real-economy investments in LatAm. 🇧🇷🤝🇬🇧 Arqia, Brazil’s largest independent IoT firm, is acquired by UK-based Wireless Logic in LatAm’s biggest IoT deal. The move boosts Wireless Logic’s footprint, adding 3M connected devices and clients like BMW and SumUp. 🇨🇳🇧🇷 Meituan, China’s largest delivery platform, will launch in Brazil by early 2026 to rival iFood. The $130B giant, with 30B annual deliveries, is setting up logistics and tax structures to enter the market. 🇧🇷 Vibra Energia cuts inventory by $154M using predictive AI. The system improves demand forecasting and stock efficiency, boosting operational performance across fuel distribution. 🇸🇻 El Salvador’s LEAD law regulates digital assets and tokenization, enabling private offerings with tax benefits and stricter oversight to foster financial innovation. Interesting reads 💡🇧🇷 Alfredo Hahn published “The Digital Real Estate Play: Owning Distribution in the Age of AI”, exploring why acquiring niche media in LatAm can become a powerful go-to-market strategy as AI reshapes customer acquisition. 🇲🇽 Bridge Latam explores a quirky yet intriguing insight: could shorter startup names boost your fundraising odds in LatAm? Their early analysis suggests that startups with names under six letters might have a slight edge in VC success. Coincidence or pattern? They’re digging deeper. 🌎 Jordi Puig shares fresh insights from the latest Fintech Radar Colombia, revealing how the ecosystem is maturing, internationalizing, and embracing new technologies like Open Finance and AI: “Desde Finnosummit mapeamos un ecosistema en Colombia de 394 Fintechs locales en el último Finnovista Fintech Radar Colombia 2024, lo que representa un crecimiento del 5.8% respecto al año anterior. Aunque el ritmo de expansión se ha moderado, esta estabilización refleja una etapa de madurez, con menor tasa de salida y mejores indicadores de sostenibilidad. De hecho, el 45% de las Fintech colombianas superaron los 500 mil dólares en ingresos durante 2023, una cifra significativamente superior al 36.4% de 2021. Pese a una contracción global en el capital de riesgo durante 2023, el primer trimestre de 2024 trajo señales alentadoras: varias Fintechs colombianas cerraron algunas de las rondas de inversión más grandes de la región, lo que reafirma la confianza del mercado en el país. Al mismo tiempo, más del 60% de las Fintech locales han logrado internacionalizarse con éxito, un indicador clave del nivel de sofisticación del talento y la competitividad del ecosistema. La presencia de Fintechs extranjeras también crece, representando ya el 30% del mercado colombiano, especialmente provenientes de México, Chile y Estados Unidos. Esta diversidad impulsa la innovación y eleva los estándares del sector. Por su parte, los segmentos más dinámicos del ecosistema son los de crédito, pagos y remesas, y gestión financiera empresarial, que en conjunto concentran más de la mitad de las startups activas. Colombia también avanza en regulación y adopción tecnológica, con un ecosistema que incorpora con rapidez herramientas como criptomonedas, inteligencia artificial, biometría y, especialmente, Open Finance. Aunque ya se observan avances significativos, el reto está en extender estos marcos regulatorios de manera ágil y equilibrada para no frenar el potencial transformador del sector.“ |

Similar newsletters

There are other similar shared emails that you might be interested in:

- Dealflow LatAm #26: Ualá raises $66M. Nazca and Bridge merge for $320M VC firm. Mercado Libre’s record year.

- Dealflow LatAm #27: Mendel raises $35M. CFOstartup & Legal Ventures merge into Zeta. iFood backs $50M fund for ele…

- Dealflow LatAm #29: Smart Compass raises $17M. Ticketmaster enters Colombia. Mercado Libre announces $8B+ investme…