Dealflow LatAm #14: Despegar’s $1.7B deal. ISA's new $130M fund. Peru’s fintech freeze.

Dealflow LatAm #14: Despegar’s $1.7B deal. ISA's new $130M fund. Peru’s fintech freeze.Welcome to the 14th edition of the Dealflow LatAm newsletter: a weekly summary of everything that happened in the LatAm startup and investment ecosystem.This is newsletter is put together by Yoel Rodriguez with the help of Jaime Novoa. Yoel has joined us to take Dealflow to the next level. For now, we’ll be once again sending the LatAm version of the newsletter every Monday and we have a few more things in the pipeline. Stay tuned! As this is our final edition of the year, we want to take a moment to thank you for subscribing to Dealflow LatAm. Your support and enthusiasm fuel our mission to bring you the most comprehensive updates on the region's startup and investment ecosystem. Wishing you a happy new year filled with success, growth, and exciting opportunities. See you in 2025! 🎉 This week’s newsletter is brought to you by zenital:

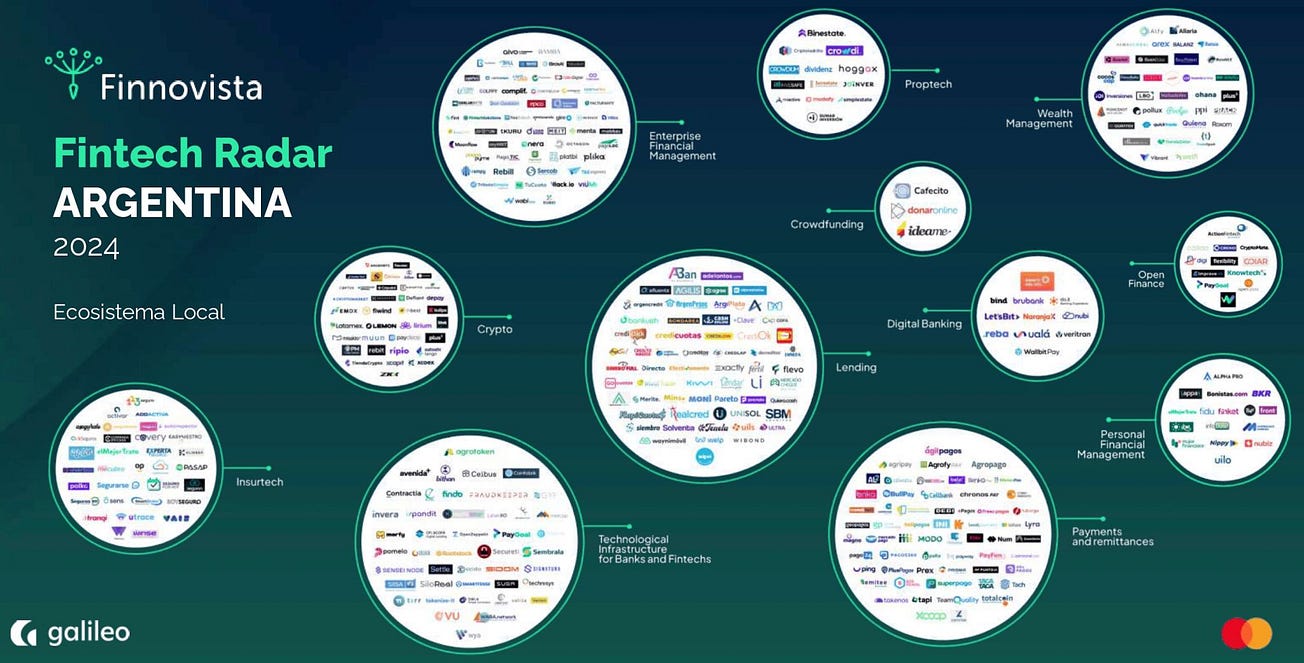

If you’re interested in sponsorship opportunities, send us an email at jaime@dealflow.es Startup funding news 💸🇧🇷 Agibank raises $64.6M from Lumina Capital, valuing the digital bank at $1.5B. Funds will support growth and its hybrid business model. 🇲🇽 Auna raises $57.8M through a private placement of 10.000% Senior Secured Notes due 2029 to redeem its 6.500% Notes due 2025. Funds will support financial structuring and healthcare operations in Mexico, Peru, and Colombia. M&A transactions 🎊🇦🇷🤝🇳🇱 Despegar to be acquired by Prosus for $1.7B, offering shareholders $19.50 per share, a 33% premium. The deal, set to close in Q2 2025, will delist Despegar from the NYSE as Prosus aims to expand its presence and scale in LatAm’s travel market. 🇧🇷🤝🇺🇾 Banco Itaú acquires 100% of Uruguay-based payment platform Plexo to enhance e-commerce solutions and expand its fintech presence. The deal, pending regulatory approval in Uruguay and Brazil, supports Itaú's strategy to drive financial inclusion and digital innovation for businesses. Investor & accelerator news 🚀🇨🇴 ISA launches Inndigo, a $130M corporate venturing fund, to invest in energy transition startups by 2030. Supported by Wayra and Telefónica Movistar, the fund will target Series B and later-stage companies, aiming to accelerate global innovation in the energy sector. 🇪🇨 BuenTrip Ventures has raised over $3.2M for its second fund, set to close in 2025, supporting Ecuadorian and regional startups. With 23 investments so far, it focuses on fintech and e-commerce while fostering growth through its community of 80 founders. 🇦🇷 Kamay Ventures, backed by Coca-Cola, Arcor, and Grupo Bimbo, plans 10 investments in 2025, focusing on agtech and AI. Improved conditions in Argentina attract rising investor interest. 🌎 HF.Capital tackles liquidity issues for LatAm startups by enabling global market access. Partnering with the London Stock Exchange, it offers cost-effective IPOs for startups with $30M+ revenue and plans its first IPO soon. 🇧🇷 Cubo Itaú and Copa Energia launch Cubo Energy, a hub to accelerate Brazil’s energy transition by connecting startups and corporations to drive sustainability and innovation. Startup news 💡🇨🇱🤝🇦🇷 Betterfly and ÜMA Salud AI team up to help Mexican firms comply with NOM-035, offering tools for mental health monitoring and improved HR processes. 🇨🇴🤝🇨🇱 Trepsi partners with Sportlife to provide personalized nutrition plans via its app, supporting Sportlife’s 50,000 users. The platform aims to close 2024 with 35,000 users across LATAM. 🇨🇴 Rappi partners with Avianca to let Pro users earn Lifemiles on app purchases, redeemable for flights or Rappi credits. This expands Rappi's tourism push, following alliances with LATAM, Marriott, and Civitatis. 🇵🇪 Peru's Fintech sector saw no new local startups in 2024, remaining at 193, unchanged from 2023. The stagnation is linked to limited funding and strong competition from foreign Fintechs, which now dominate a growing market of 346 companies. 🇨🇱 Wareclouds will pitch at Davos, selected from 4,500+ startups for its impact-driven storage solution. 🇦🇷 Banco Santa Fe and Agrotoken partner to offer financing using blockchain-backed tokenized grains, boosting liquidity and sustainability in Argentina’s agricultural sector.

🇲🇽 Bitso Retail reached 9M users globally in 2024, tripling its base in three years. Growth highlights include Argentina (+4x), Colombia (+70%), Brazil (+44%), and Mexico (+80%), driven by new crypto products and rising adoption in LatAm. 🇨🇱 Coddi expands to Canada, offering AI-powered mining maintenance solutions. With plans to double clients, reach $1M ARR, and enhance real-time monitoring tools, Coddi aims to grow in the Canadian mining sector. 🇨🇴 Mono, a Colombian fintech, hit $100M in transactions and achieved profitability in 2024. Backed by Y Combinator and others, it supports 1,000+ clients and plans expansion to Mexico and Peru in 2025. 🇦🇷 Patagon AI expands to Colombia, leveraging its AI agents to streamline sales processes and boost efficiency for businesses. The platform, co-founded by Ecuadorian and Argentine entrepreneurs, plans to integrate voice features in 2025 to enhance personalization and scalability. 🇨🇱 Poliglota urged Chile’s Congress to support edtech startups, promote early education in English, programming, and AI, and provide scaling incentives to drive innovation in LatAm. 🇲🇽 VEMO will expand its EV charging network across more Mexican states in 2025, building on 600+ chargers and partnerships with brands like BMW, BYD, and GM to boost sustainable mobility. 🇨🇱 Fraccional.cl launches its first Miami project, allowing Chilean investors to enter U.S. real estate from $300. Expansion plans include LatAm and Europe. 🇦🇷 Rapipago integrates Háblalo to improve accessibility for customers with communication barriers, aiming for 200 inclusive branches by March. 🇲🇽 Xante.mx, Vinte's proptech, grew 196% in Q3 2024 through seminueva home sales, averaging $45,000 USD. Launched in 2022, it operates a tech-driven iBuyer model across key Mexican regions. 🇨🇱 AgendaPro adds AI to its platform for physiotherapy clinics, offering 24/7 chatbot support, predictive analytics, and Google integration to boost efficiency and patient care in LatAm. 🇨🇴 MejorCDT joins Colombia Fintech to boost financial innovation. Led by Carlos Correa, it offers products like CDT-Flexible and CDT-Recargable, benefiting 300,000+ Colombians with $55M in returns and partnerships with eight top banks. 🌎 LemFi launches in Brazil and Mexico, expanding its payment platform to serve LatAm users. The app enables fast, fee-free transfers, boosting financial connectivity across the region. 🇲🇽 Bitso launches RLUSD, a Ripple-backed stablecoin pegged to USD for cross-border payments. Available via RLUSD/MXN on Bitso Alpha, users can transact as Ethereum ERC-20 tokens. 🇨🇱 Recorrido.cl launches Terra, a platform for secure online bus ticket sales, featuring digital tickets, mobile apps, and real-time updates. 🇨🇴 Hubby expands to the U.S. with ghost kitchens in Miami, LA, and SF, targeting $3M in 2024 sales and 10 more locations by 2027. 🇲🇽 Nu, Finsus, Klar, and Stori hold top NICAP ratings, ensuring strong capitalization. Investors are advised to check NICAP and other metrics, as high returns may signal higher risks. 🇨🇱 BUK, Fintoc, and Diio spark viral attention with creative billboard ads on Costanera Norte. BUK’s “BUK Funciona” ad was humorously joined by Fintoc’s “Fintoc también,” followed by Diio’s “y ambas usan Diio, la IA para vender más.” The collaboration highlighted innovation and camaraderie in the Chilean startup ecosystem. Big company & policy news 💡🇨🇱🤝🇦🇷 Mercado Libre and Parque Arauco open a pickup hub at Parque Arauco Mall, processing 16,000+ packages. Expansion to Mall Arauco Maipú and other locations planned for 2025. 🇦🇷 Sturzenegger accuses pharmaceutical groups of pressuring pharmacies selling medication on Mercado Libre. The reform enabling online drug sales aims to improve transparency and access, particularly in rural areas, but faces resistance from traditional sector players. 🇧🇷🇲🇽🇵🇪 Visa reports growing adoption of digital remittances in LatAm, with apps leading in Brazil (80%), Mexico (64%), and Peru (61%). While fees remain a challenge, users value security and ease, expecting increased usage ahead. 🇦🇷 Andreani launches Argentina's most advanced logistics hub in Pacheco, capable of processing 26,000 packages/hour. This AI-powered facility enhances operational efficiency and supports growth in local and international markets. 🇧🇷 Brazil advanced financial regulations in 2024, expanding Open Finance to 39M users and boosting Pix usage by 30% with new features like "Pix Inteligente." Fintechs prioritized sustainable growth and B2B services to adapt to stricter rules. Interesting reads 💡🇲🇽 Paola Villarreal Carvajal explores Mexico's unicorn boom in Creando unicornios, sharing founder insights and startup challenges. A must-read on the rise of tech entrepreneurship in the country. 🇧🇷 Nilio Portella outlines 2025 trends in venture capital and private equity, highlighting a surge in investments in fintech, healthtech, and cleantech. The focus is on AI, blockchain, and ESG initiatives, while private equity targets operational efficiency amid economic pressures. 🌎 Timothy Motte, from The Realistic Optimist, explores the untapped startup potential in the Caribbean. Through an interview with Monique Powell, founder of QuickCart, he highlights the region’s $820M market opportunity and the rise of startups aiming to become "Rappi for the Caribbean." 🌎 Charlie Graham-Brown, GP at Seedstars, recaps 2024 with bold LatAm investments like Silverguard's AI fraud prevention in Brazil and LogShare's logistics revolution. For 2025? Think AI, secured lending, and climate resilience driving the future. |

Similar newsletters

There are other similar shared emails that you might be interested in: